Question: An investor is comparing three mutually exlcusive alternative projects A, B, and C. He plotted the following graph of the net present worth (NPV) of

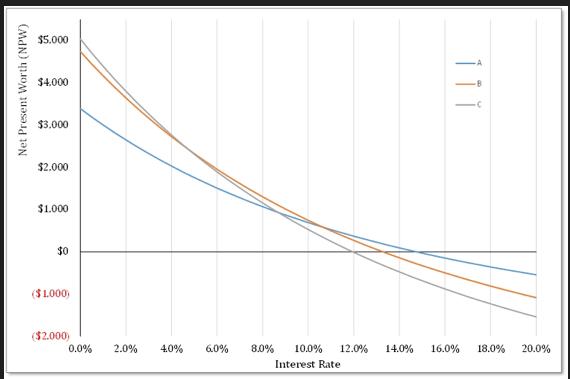

An investor is comparing three mutually exlcusive alternative projects A, B, and C. He plotted the following graph of the net present worth (NPV) of each alternative for interest rates ranging from 0% to 20%. Which project should the investor choose?

a) If the minimum accepted rate of return (MARR) is 2.0%.

b) If the minimum accepted rate of return (MARR) is 8.0%.

c) If the minimum accepted rate of return (MARR) is 13.0%.

d) If the minimum accepted rate of return (MARR) is 18.0%.

Net Present Worth (NPW) $5.000 $4.000 $3.000 $2.000 $1.000 $0 ($1.000) ($2.000) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Interest Rate 14.0% 16.0% 18.0% 20.0%

Step by Step Solution

3.44 Rating (141 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To determine which project the investor ... View full answer

Get step-by-step solutions from verified subject matter experts