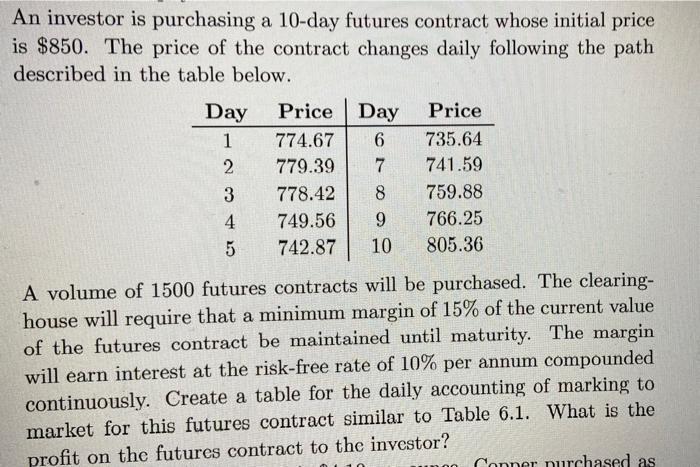

Question: An investor is purchasing a 10-day futures contract whose initial price is $850. The price of the contract changes daily following the path described

An investor is purchasing a 10-day futures contract whose initial price is $850. The price of the contract changes daily following the path described in the table below. Day 1 2 3 4 5 Price Day Price 774.67 6 735.64 779.39 7 741.59 759.88 766.25 805.36 778.42 8 749.56 9 742.87 10 A volume of 1500 futures contracts will be purchased. The clearing- house will require that a minimum margin of 15% of the current value of the futures contract be maintained until maturity. The margin will earn interest at the risk-free rate of 10% per annum compounded continuously. Create a table for the daily accounting of marking to market for this futures contract similar to Table 6.1. What is the profit on the futures contract to the investor? Copper purchased as

Step by Step Solution

There are 3 Steps involved in it

Maintenance margin Day 1MTML Maintenance margin brought in Balance as on day 1 Day 2MTML Balance as ... View full answer

Get step-by-step solutions from verified subject matter experts