Question: An investor received a term sheet from a venture capitalist, the key terms of which are summarized in the following table: Amount and Securities: 4,000,000

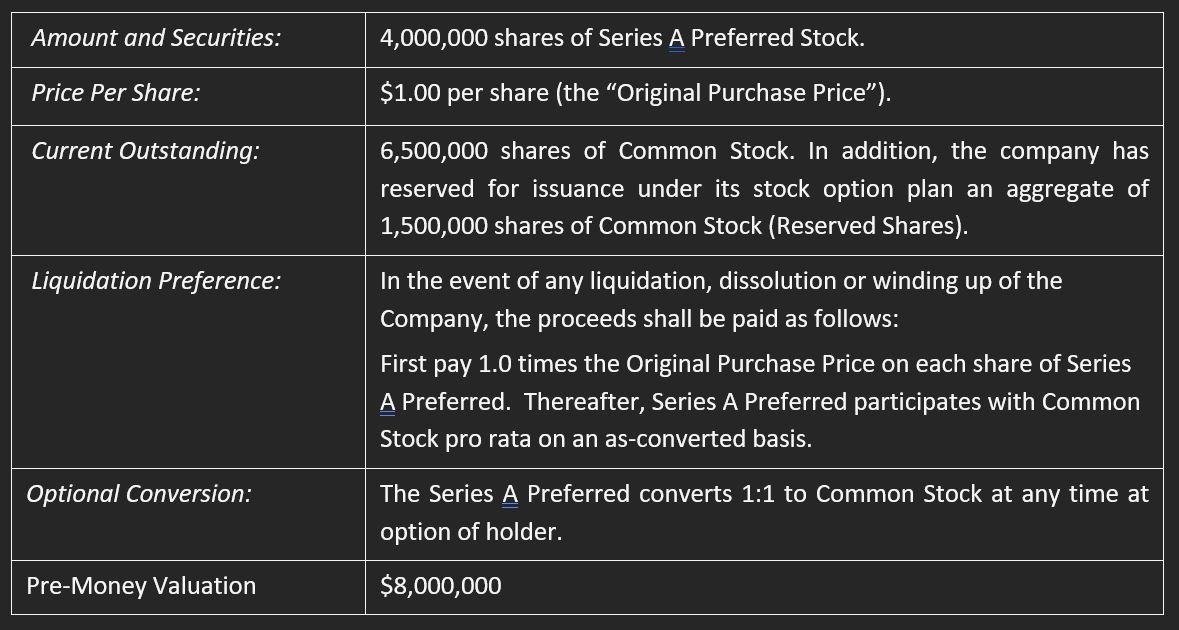

An investor received a term sheet from a venture capitalist, the key terms of which are summarized in the following table: Amount and Securities: 4,000,000 shares of Series A Preferred Stock. Price Per Share: $1.00 per share (the Original Purchase Price). Current Outstanding: 6,500,000 shares of Common Stock. In addition, the company has reserved for issuance under its stock option plan an aggregate of 1,500,000 shares of Common Stock (Reserved Shares). Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows: First pay 1.0 times the Original Purchase Price on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis. Optional Conversion: The Series A Preferred converts 1:1 to Common Stock at any time at the option of the holder. Pre-Money Valuation $8,000,000

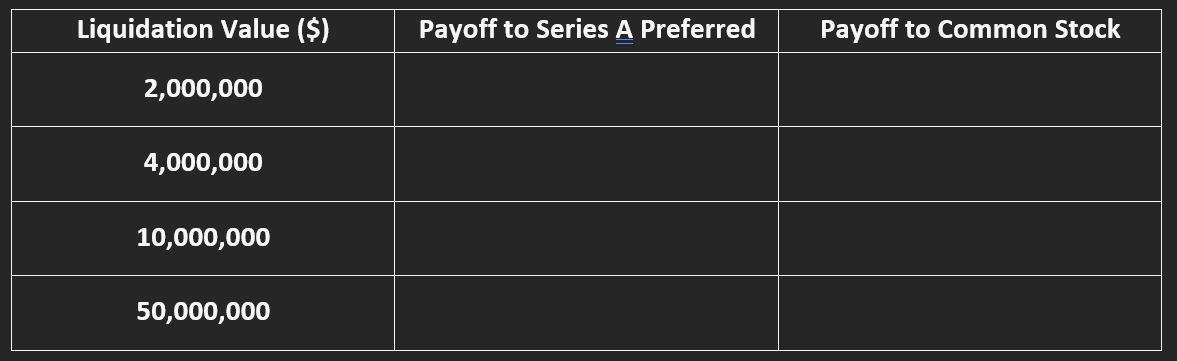

a) Calculate the payoff at maturity to Series A Preferred Stock as well as Common Stock as a function of liquidation value. Complete the table below that summarizes the allocation of the liquidation value between preferred stock and common stock:

Amount and Securities: 4,000,000 shares of Series A Preferred Stock. Price Per Share: $1.00 per share (the "Original Purchase Price"). Current Outstanding: 6,500,000 shares of Common Stock. In addition, the company has reserved for issuance under its stock option plan an aggregate of 1,500,000 shares of Common Stock (Reserved Shares). Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows: First pay 1.0 times the Original Purchase Price on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis. The Series A Preferred converts 1:1 to Common Stock at any time at option of holder. Optional Conversion: Pre-Money Valuation $8,000,000 Liquidation Value ($) Payoff to Series A Preferred Payoff to Common Stock 2,000,000 4,000,000 10,000,000 50,000,000 Amount and Securities: 4,000,000 shares of Series A Preferred Stock. Price Per Share: $1.00 per share (the "Original Purchase Price"). Current Outstanding: 6,500,000 shares of Common Stock. In addition, the company has reserved for issuance under its stock option plan an aggregate of 1,500,000 shares of Common Stock (Reserved Shares). Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows: First pay 1.0 times the Original Purchase Price on each share of Series A Preferred. Thereafter, Series A Preferred participates with Common Stock pro rata on an as-converted basis. The Series A Preferred converts 1:1 to Common Stock at any time at option of holder. Optional Conversion: Pre-Money Valuation $8,000,000 Liquidation Value ($) Payoff to Series A Preferred Payoff to Common Stock 2,000,000 4,000,000 10,000,000 50,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts