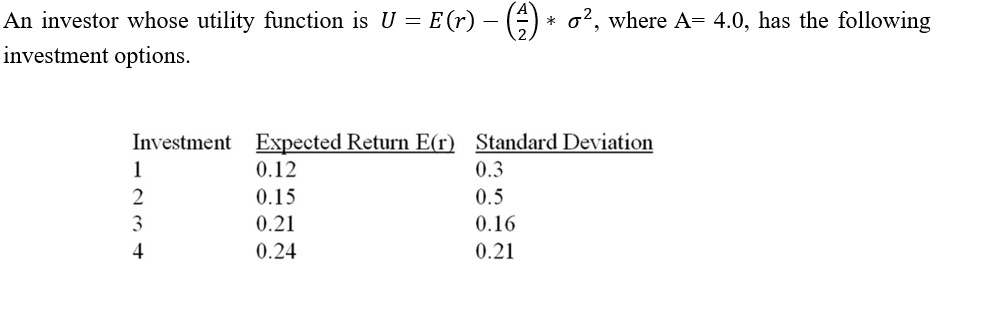

Question: An investor whose utility function is U = E(r) () * o, where A= 4.0, has the following investment options. Investment Expected Return E(r) Standard

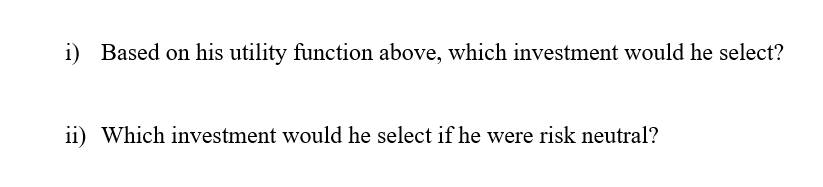

An investor whose utility function is U = E(r) () * o, where A= 4.0, has the following investment options. Investment Expected Return E(r) Standard Deviation 1 0.12 0.3 2 0.15 0.5 3 0.21 0.16 4 0.24 0.21 i) Based on his utility function above, which investment would he select? ii) Which investment would he select if he were risk neutral? iii) The variable (A) in the utility function represents the 1. Investor's return requirement. 2. Investor's aversion to risk. 3. Certainty-equivalent rate of the portfolio. 4. Minimum required utility of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts