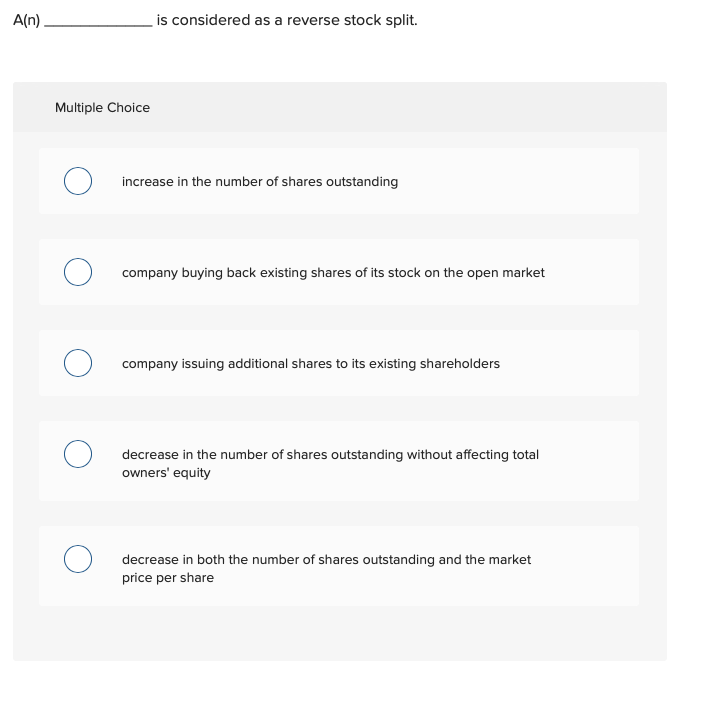

Question: A(n). _ is considered as a reverse stock split. Multiple Choice 0 increase in the number of shares outstanding 0 company buying back existing shares

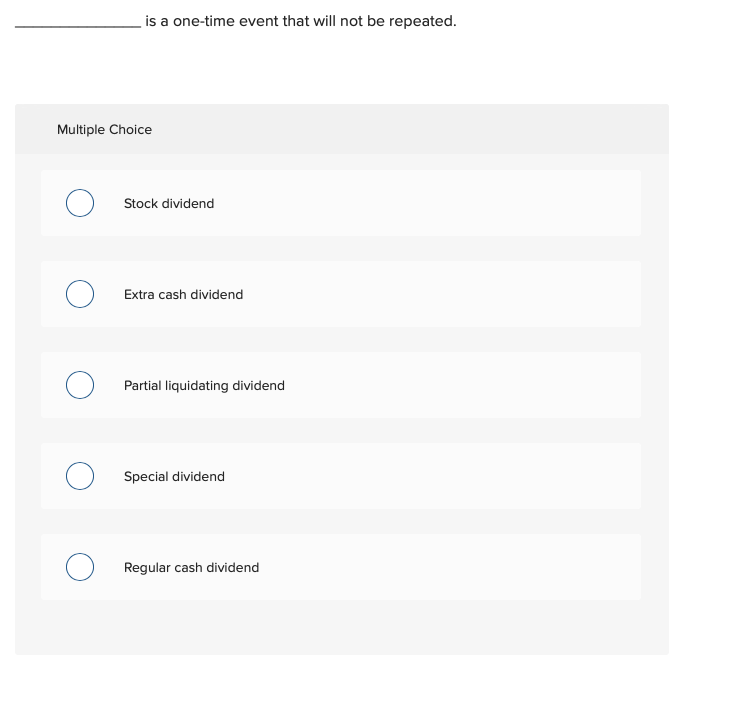

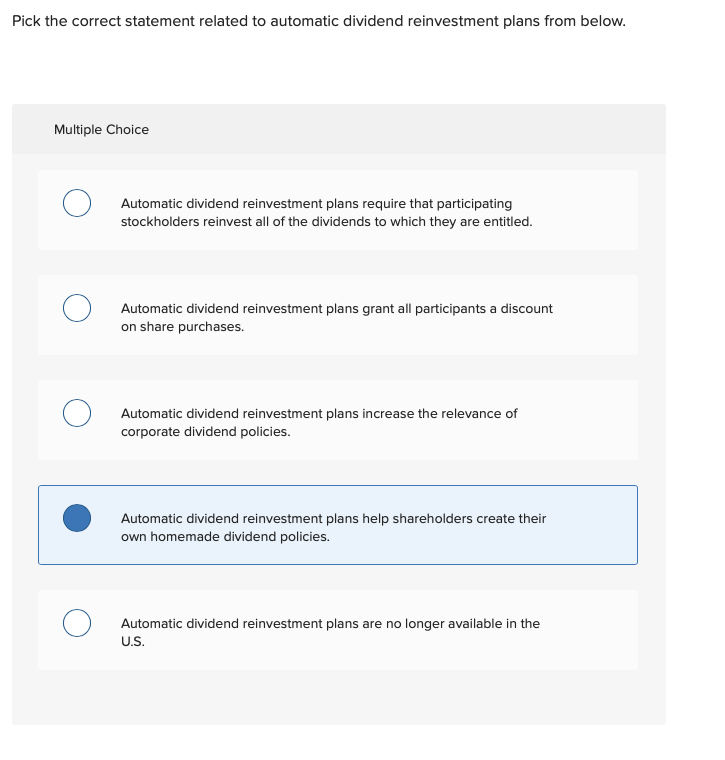

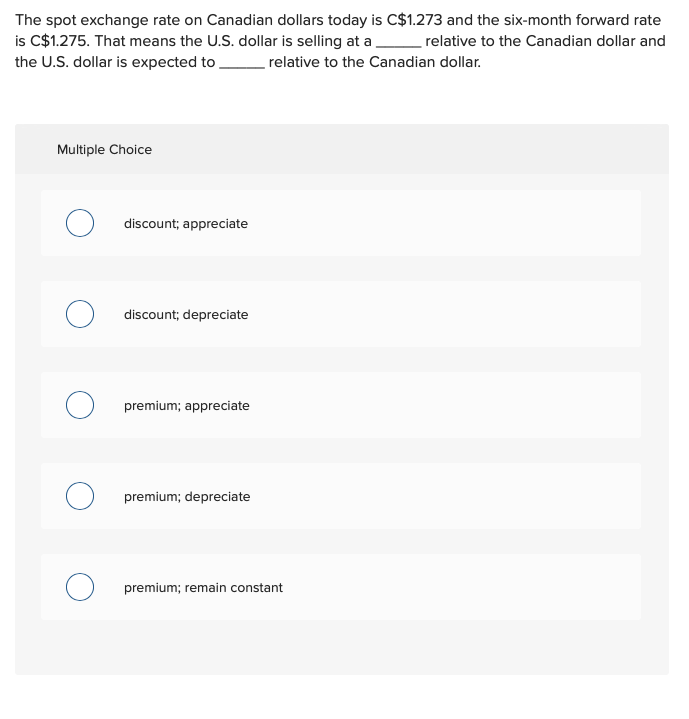

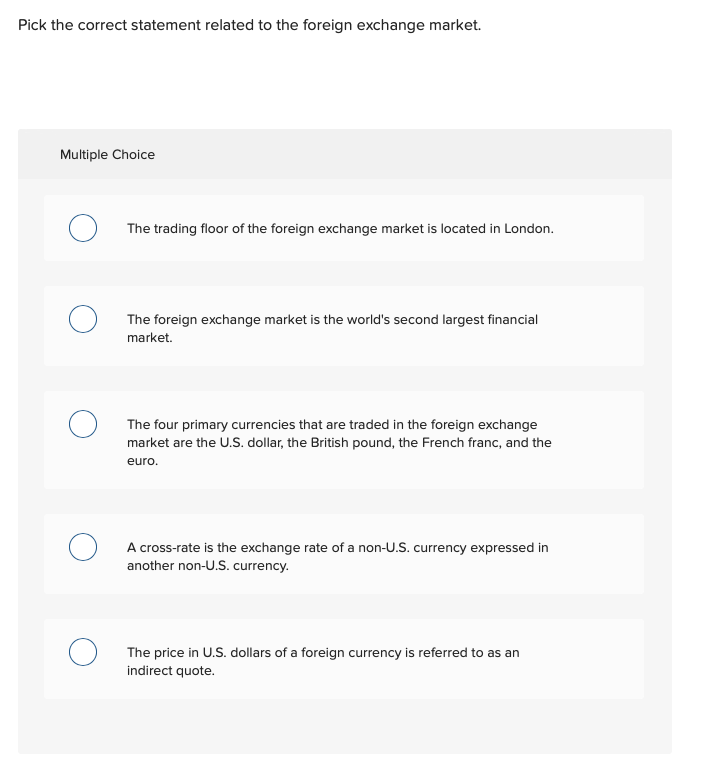

A(n). _ is considered as a reverse stock split. Multiple Choice 0 increase in the number of shares outstanding 0 company buying back existing shares of its stock on the open market 0 company issuing additional shares to its existing shareholders 0 decrease in the number of shares outstanding without affecting total owners' equity 0 decrease in both the number of shares outstanding and the market price per share _ is a one-time event that will not be repeated. Multiple Choice Stock dividend Extra cash dividend Partial liquidating dividend Special dividend Regular cash dividend Pick the correct statement related to automatic dividend reinvestment plans from below. Multiple Choice Automatic dividend reinvestment plans require that participating stockholders reinvest all of the dividends to which they are entitled. Automatic dividend reinvestment plans grant all participants a discount on share purchases. o Automatic dividend reinvestment plans increase the relevance of corporate dividend policies. Automatic dividend reinvestment plans help shareholders create their own homemade dividend policies. Automatic dividend reinvestment plans are no longer available in the U.S. The spot exchange rate on Canadian dollars today is C$1.273 and the six-month forward rate is C$1.275. That means the U.S. dollar is selling at a __ relative to the Canadian dollar and the U.S. dollar is expected to relative to the Canadian dollar. Multiple Choice discount; appreciate discount; depreciate premium; appreciate premium; depreciate premium; remain constant Pick the correct statement related to the foreign exchange market. Multiple Choice O The trading floor of the foreign exchange market is located in London. The foreign exchange market is the world's second largest financial market. o The four primary currencies that are traded in the foreign exchange market are the U.S. dollar, the British pound, the French franc, and the euro. o A cross-rate is the exchange rate of a non-U.S. currency expressed in another non-U.S. currency. o o The price in U.S. dollars of a foreign currency is referred to as an indirect quote

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts