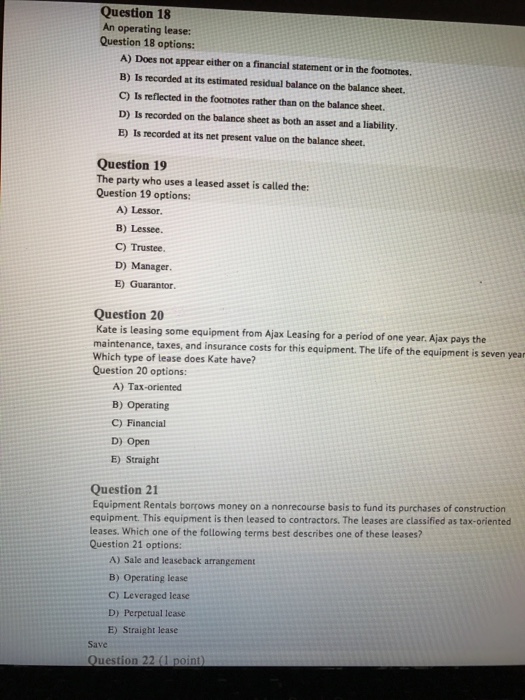

Question: An operating lease: A) Does not appear either on a financial statement or in the footnotes. B) Is recorded at its estimated residual balance on

An operating lease: A) Does not appear either on a financial statement or in the footnotes. B) Is recorded at its estimated residual balance on the balance sheet. C) Is reflected in the footnotes rather than on the balance sheet. D) Is recorded on the balance sheet as both an asset and a liability. E) Is recorded at its net present value on the balance sheet. The party who uses a leased asset is called the: A) Lessor. B) Lessee. C) Trustee. D) Manager. E) Guarantor. Kate is leasing some equipment from Ajax Leasing for a period of one year. Ajax pays the maintenance, taxes, and insurance costs for this equipment. The life of the equipment is seven year Which type of lease does Kate have? A) Tax-oriented B) Operating C) Financial D) Open E) Straight Equipment Rentals borrows money on a nonrecourse basis to fund its purchase of construction equipment. This equipment is then leased to contractors. The leases are classified as tax-oriented leases. Which one of the following terms best describes one of these leases? A) Sale and leaseback arrangement B) Operating lease C) Leveraged lease D) Perpetual lease E) Straight lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts