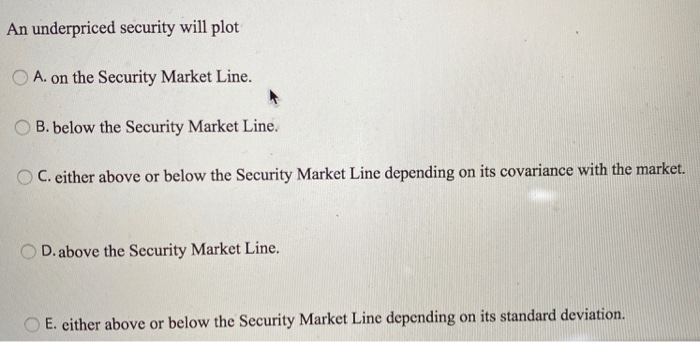

Question: An underpriced security will plot A. on the Security Market Line. OB. below the Security Market Line. OC. either above or below the Security Market

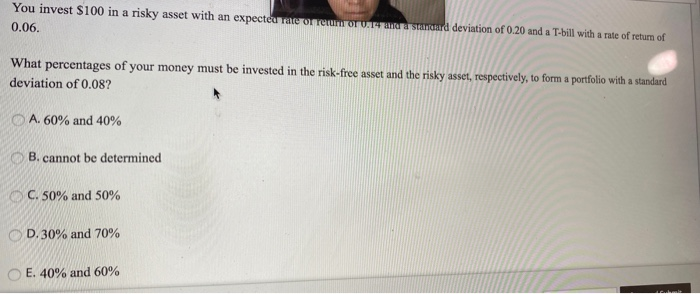

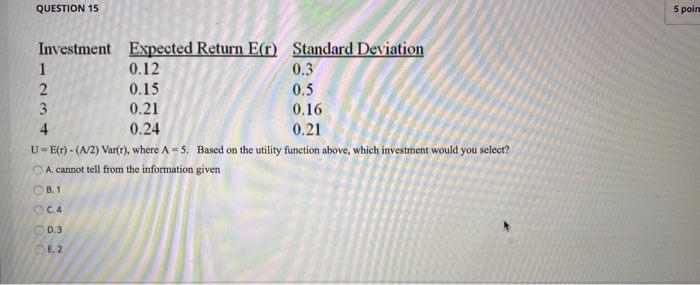

An underpriced security will plot A. on the Security Market Line. OB. below the Security Market Line. OC. either above or below the Security Market Line depending on its covariance with the market. OD. above the Security Market Line. O E. either above or below the Security Market Line depending on its standard deviation. You invest $100 in a risky asset with an expectorate or rem OT UNIRII Stard deviation of 0.20 and a T-bill with a rate of return of 0.06. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.08? A. 60% and 40% B. cannot be determined C. 50% and 50% D. 30% and 70% E. 40% and 60% QUESTION 15 5 poin Investment Expected Return E() Standard Deviation 0.12 0.3 0.15 0.5 0.21 0.16 0.24 0.21 U-E() - (A/2) Var(r), where A = 5. Based on the utility function above, which investment would you select? A. cannot tell from the information given B. 1 C.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts