Question: an upvote will be given please to show all working out ASAP On 1 January 201 Swish entered into a contract to lease a crane

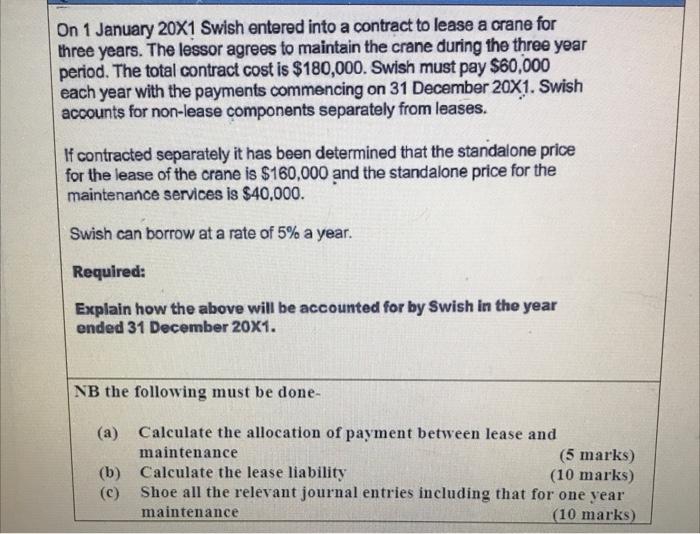

On 1 January 201 Swish entered into a contract to lease a crane for three years. The lessor agrees to maintain the crane during the three year period. The total contract cost is $180,000. Swish must pay $60,000 each year with the payments commencing on 31 December 201. Swish accounts for non-lease components separately from leases. If contracted separately it has been determined that the standalone price for the lease of the crane is $160,000 and the standalone price for the maintenance services is $40,000. Swish can borrow at a rate of 5% a year. Required: Explain how the above will be accounted for by Swish in the year ended 31 December 201. NB the following must be done- (a) Calculate the allocation of payment between lease and maintenance (5 marks) (b) Calculate the lease liability (10 marks) (c) Shoe all the relevant journal entries including that for one year maintenance (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts