Question: Anadarko Petroleum must choose between two mutually exclusive oil-driling projects, which each have a cost of $12 milion. Under Plan A all oil would be

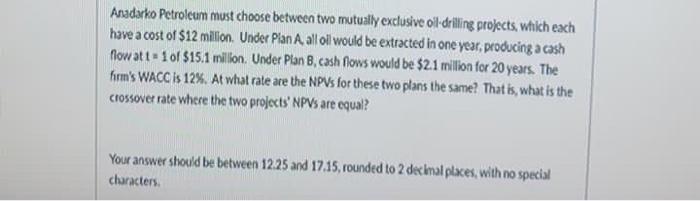

Anadarko Petroleum must choose between two mutually exclusive oil-driling projects, which each have a cost of $12 milion. Under Plan A all oil would be extracted in one year, producing a cash Nowatt - 1 of $15,1 millon. Under Plan B, cash flows would be $2.1 million for 20 years. The firm's WACC IS 12%. At what rate are the NPVs for these two plans the same? That is what is the Crossover rate where the two projects' NPVs are equal? Your answer should be between 12.25 and 17.15, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock