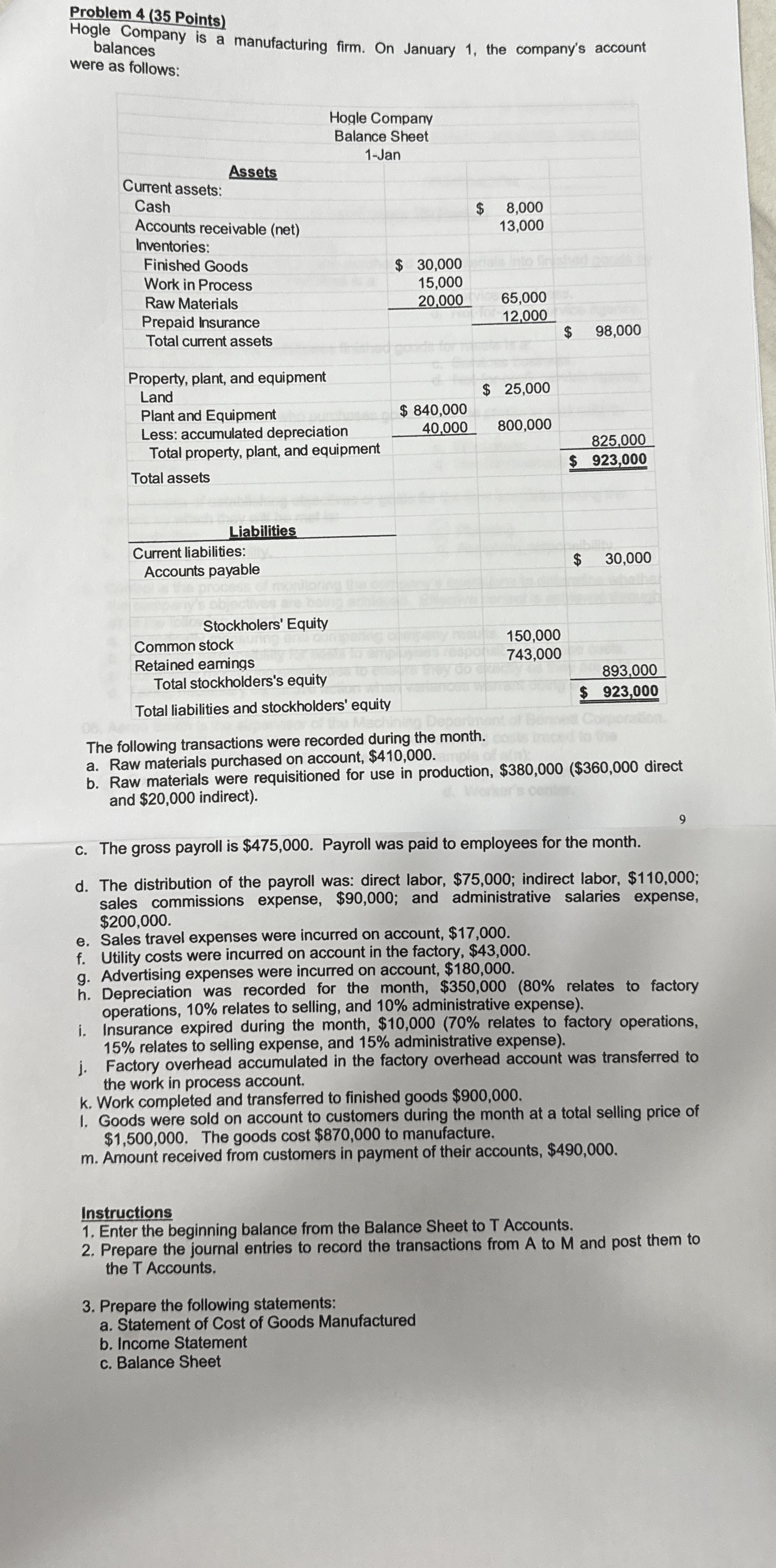

Question: ANAG.M Problem 4 ( 3 5 Points ) Hogle Company is a manufacturing firm. On January 1 , the company's account balances were as follows:

ANAG.M

Problem Points

Hogle Company is a manufacturing firm. On January the company's account

balances were as follows:

The following transactions were recorded during the month.

a Raw materials purchased on account, $

b Raw materials were requisitioned for use in production, $ $ direct and $ indirect

c The gross payroll is $ Payroll was paid to employees for the month.

d The distribution of the payroll was: direct labor, $; indirect labor, $; sales commissions expense, $; and administrative salaries expense, $

e Sales travel expenses were incurred on account, $

f Utility costs were incurred on account in the factory, $

g Advertising expenses were incurred on account, $

h Depreciation was recorded for the month, $ relates to factory operations, relates to selling, and administrative expense

i Insurance expired during the month, relates to factory operations, relates to selling expense, and administrative expense

j Factory overhead accumulated in the factory overhead account was transferred to the work in process account.

k Work completed and transferred to finished goods $

I. Goods were sold on account to customers during the month at a total selling price of $ The goods cost $ to manufacture.

m Amount received from customers in payment of their accounts, $

Instructions

Enter the beginning balance from the Balance Sheet to Accounts.

Prepare the journal entries to record the transactions from to and post them to the T Accounts.

Prepare the following statements:

a Statement of Cost of Goods Manufactured

b Income Statement

c Balance Sheet

Problem Points

Hogle Company is a manufacturing firm. On January the company's account balances

were as follows:

The following transactions were recorded during the month.

a Raw materials purchased on account, $

b Raw materials were requisitioned for use in production, $ $ direct and $ indirect

c The gross payroll is $ Payroll was paid to employees for the month.

d The distribution of the payroll was: direct labor, $; indirect labor, $; sales commissions expense, $; and administrative salaries expense, $

e Sales travel expenses were incurred on account, $

f Utility costs were incurred on account in the factory, $

g Advertising expenses were incurred on account, $

h Depreciation was recorded for the month, $ relates to factory operations, relates to selling, and administrative expense

i Insurance expired during the month, relates to factory operations, relates to selling expense, and administrative expense

j Factory overhead accumulated in the factory overhead account was transferred to the work in process account.

k Work completed and transferred to finished goods $

I. Goods were sold on account to customers during the month at a total selling price of $ The goods cost $ to manufacture.

m Amount received from customers in payment of their accounts, $

Instructions

Enter the beginning balance from the Balance Sheet to T Accounts.

Prepare the journal entries to record the transactions from to and post them to the T Accounts.

Prepare the following statements:

a Statement of Cost of Goods Manufactured

b Income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock