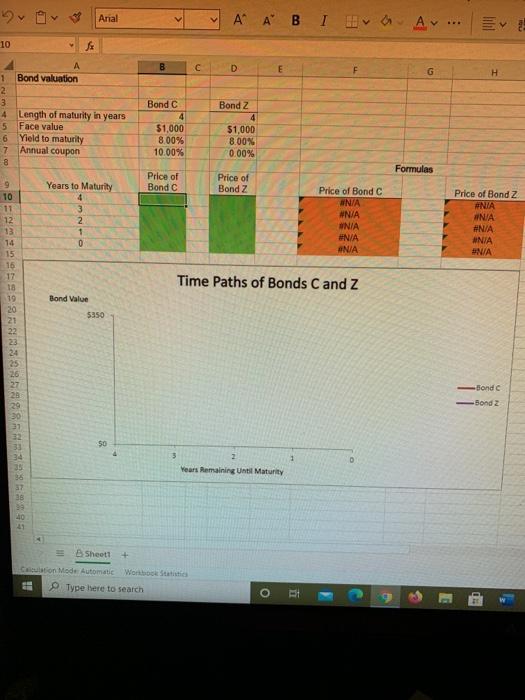

Question: Anal A BI uva Av 10 B E G A 1 Bond valuation 2 3 4 Length of maturity in years 5 Face value Bond

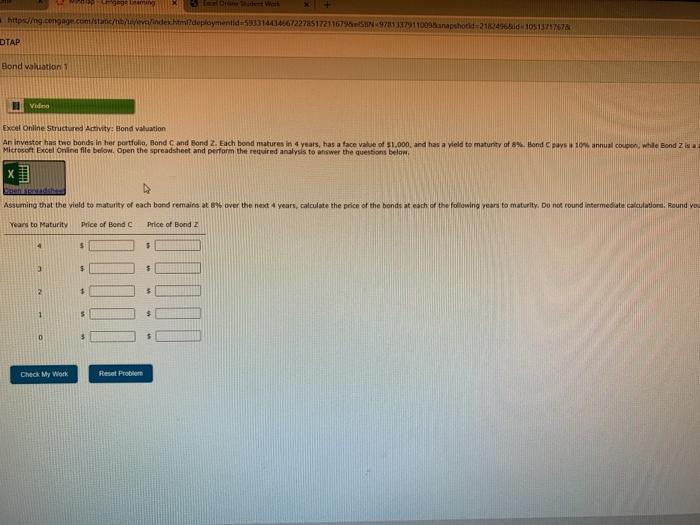

Anal A BI uva Av 10 B E G A 1 Bond valuation 2 3 4 Length of maturity in years 5 Face value Bond C 4 $1,000 8.00% 10.00% Bond Z 4 $1,000 8.00% 0.00% Yield to maturity Annual coupon 7 8 Formulas Years to Maturity Price of Bond C Price of Bond Z 9 10 11 12 13 14 15 15 17 3 2 1 0 Price of Bond C ANA #N/A UNIA #N/A ANA Price of Band Z #N/A NA #N/A . MNIA #N/A Time Paths of Bonds C and Z Bond Value 5350 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Bond Bond 2 50 4 3 1 Years Remaining Until Maturity 38 29 40 Sheet1 + Calculation Mode Automatic Wortbook State Type here to search O i TG mi Welt https://g.congage.com/static/b/indexhtml?deploymentid533314414472278517211679783117911003anapshotid=210246.10513717678 DTAP Bond valuation Video Excel Online Structured Activity: Bond valuation An investor has two bonds in her portfolio, Bond Cand Bond 2. Each bond matures in 4 years, has a face value of 51.000, and has a yield to maturity of 8 Honda 10 annual coupon, while Bond 2 Microsoft Excel Online fille below. Open the spreadsheet and perform the required analysis to answer the question below x] Assuming that the vield to maturity of each bond remains at 8% over the next years, calculate the price of the bonds at each of the following years to maturity. Do not found intermediate calculation. Round you Years to Maturity Price of Blond Price of Bond 2 4 5 3 $ $ 2 + 5 5 O 3 Check My Work Reset Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts