Question: Analyse financial statement 2020: Income Statement Balance Sheet Make use of ratio analysis, DuPont analysis, etc. The 2020 financial statements of Outdoor Waterworks Inc. follow:

Analyse financial statement 2020: Income Statement Balance Sheet Make use of ratio analysis, DuPont analysis, etc.

Analyse financial statement 2020: Income Statement Balance Sheet Make use of ratio analysis, DuPont analysis, etc.

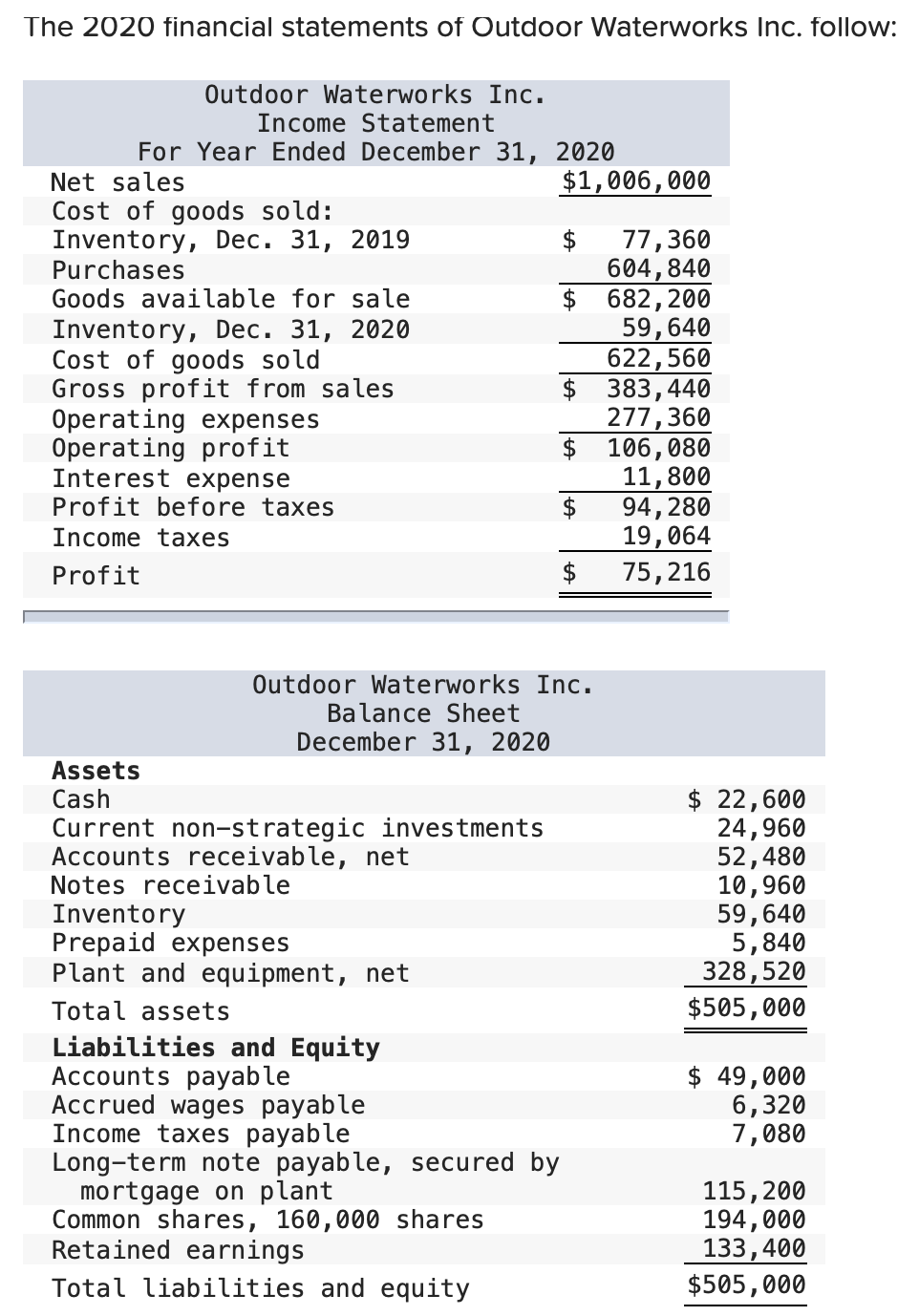

The 2020 financial statements of Outdoor Waterworks Inc. follow: Outdoor Waterworks Inc. Income Statement For Year Ended December 31, 2020 Net sales $1,006,000 Cost of goods sold: Inventory, Dec. 31, 2019 $ 77,360 Purchases 604,840 Goods available for sale 682,200 Inventory, Dec. 31, 2020 59,640 Cost of goods sold 622,560 Gross profit from sales $ 383,440 Operating expenses 277,360 Operating profit 106,080 Interest expense 11,800 Profit before taxes $ 94,280 Income taxes 19,064 Profit 75,216 Outdoor Waterworks Inc. Balance Sheet December 31, 2020 Assets Cash Current non-strategic investments Accounts receivable, net Notes receivable Inventory Prepaid expenses Plant and equipment, net Total assets Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Long-term note payable, secured by mortgage on plant Common shares, 160,000 shares Retained earnings Total liabilities and equity $ 22,600 24,960 52,480 10,960 59,640 5,840 328,520 $505,000 $ 49,000 6,320 7,080 115,200 194,000 133,400 $505,000 The 2020 financial statements of Outdoor Waterworks Inc. follow: Outdoor Waterworks Inc. Income Statement For Year Ended December 31, 2020 Net sales $1,006,000 Cost of goods sold: Inventory, Dec. 31, 2019 $ 77,360 Purchases 604,840 Goods available for sale 682,200 Inventory, Dec. 31, 2020 59,640 Cost of goods sold 622,560 Gross profit from sales $ 383,440 Operating expenses 277,360 Operating profit 106,080 Interest expense 11,800 Profit before taxes $ 94,280 Income taxes 19,064 Profit 75,216 Outdoor Waterworks Inc. Balance Sheet December 31, 2020 Assets Cash Current non-strategic investments Accounts receivable, net Notes receivable Inventory Prepaid expenses Plant and equipment, net Total assets Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Long-term note payable, secured by mortgage on plant Common shares, 160,000 shares Retained earnings Total liabilities and equity $ 22,600 24,960 52,480 10,960 59,640 5,840 328,520 $505,000 $ 49,000 6,320 7,080 115,200 194,000 133,400 $505,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts