Question: Analyse the financial statement, what are your expectations about the industrys profitability in the short run (1 or 2 years) and the long run (5

Analyse the financial statement, what are your expectations about the industrys profitability in the short run (1 or 2 years) and the long run (5 to 10 years)?

If you have RM 1 Millions to invest, would you invest in this company. Perform a further analysis analysis in a structured way to help you make better investment decision.

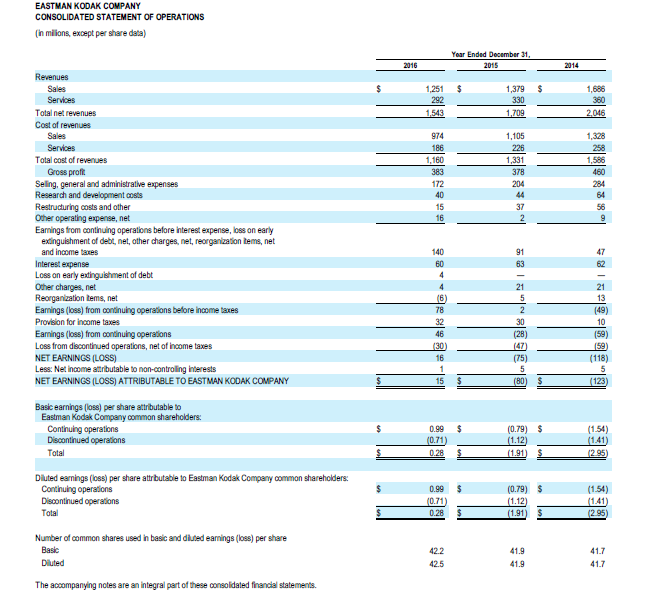

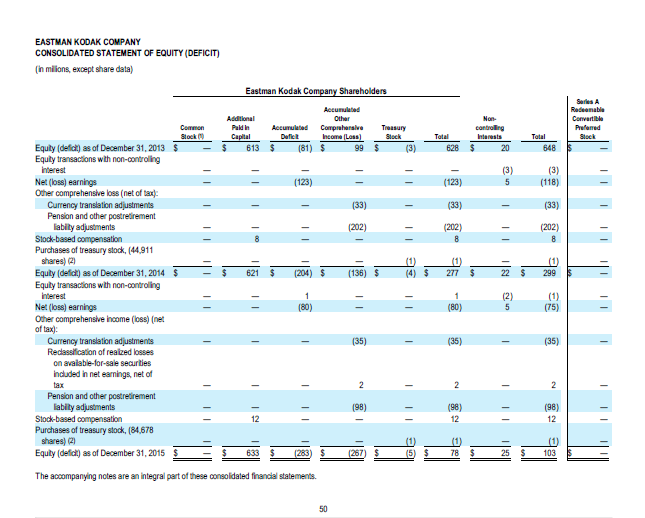

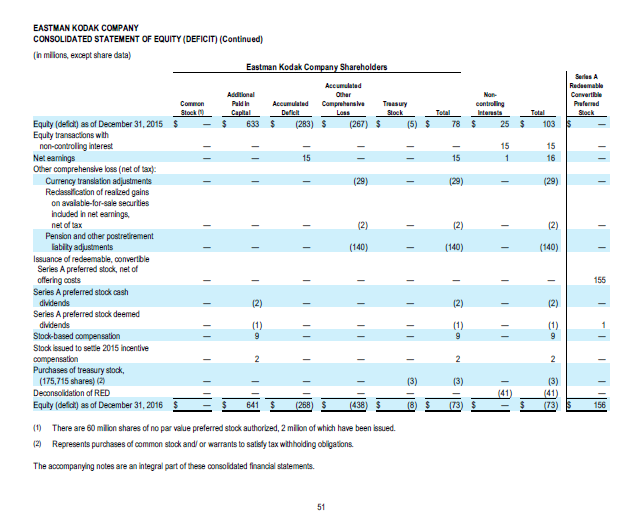

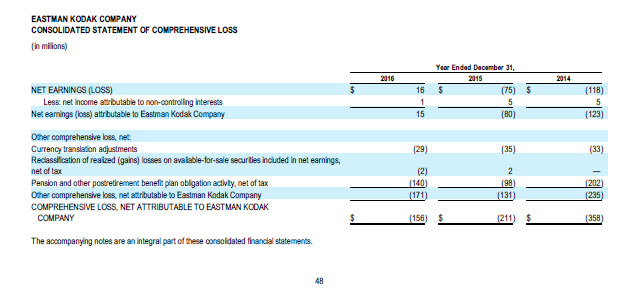

EASTMAN KODAK COMPANY CONSOLIDATED STATEMENT OF OPERATIONS (in milions, except per share data) Yoar Ended December 31 1,251 1,379 1,686 Total net revenues Cost of revenues 1,105 1,328 186 1,160 Total cost of revenues Gross proft. Seling, genera Research and development costs Restructuring costs and other Oher operating expense, net Eamings from continuing operations before interest expense, loss on early al and administrative expenses extinguishment of debt, net, ather charges, net, reorganization tems, net and income taxes Interest expense Loss on early extinguishment of debt Oher charges, net Reorganization tems, net Eamings (loss) fram condinuing operations before income taxes Provision for income taxes Eamings (loss) fram condnuing operations L088 from decontrued operations, net of ncome taxes NET EARNINGS (LOSS) Less: Net income atibutable to non-controling interests NET EARNINGS (LOSS) ATTRIBUTABLE TO EASTMAN KODAK COMPANY (49) (59) (118) (28) (80) S Basic earnings (loss) per share atributable to Eastman Kodak Company common shareholders 0.99 $ 1.54 1.41 Continuing operations (0.79) $ Total Diluted eamings (loss) per share attr butable to Eastman Kodak Company common shareholders: 0.99 $ 154) 1.41 Continuing operations (0.79) S Total Number of common shares used in basic and diuted eamings (loss) per share 1.9 1.9 1.7 The accompanying notes are an integral part of these consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts