Question: Analysis Analysis Bal Sheet Inc Stmt Prepare a horizontal analysis of the balance sheet. (Negative answers should be indicated by a minus sign. Round your

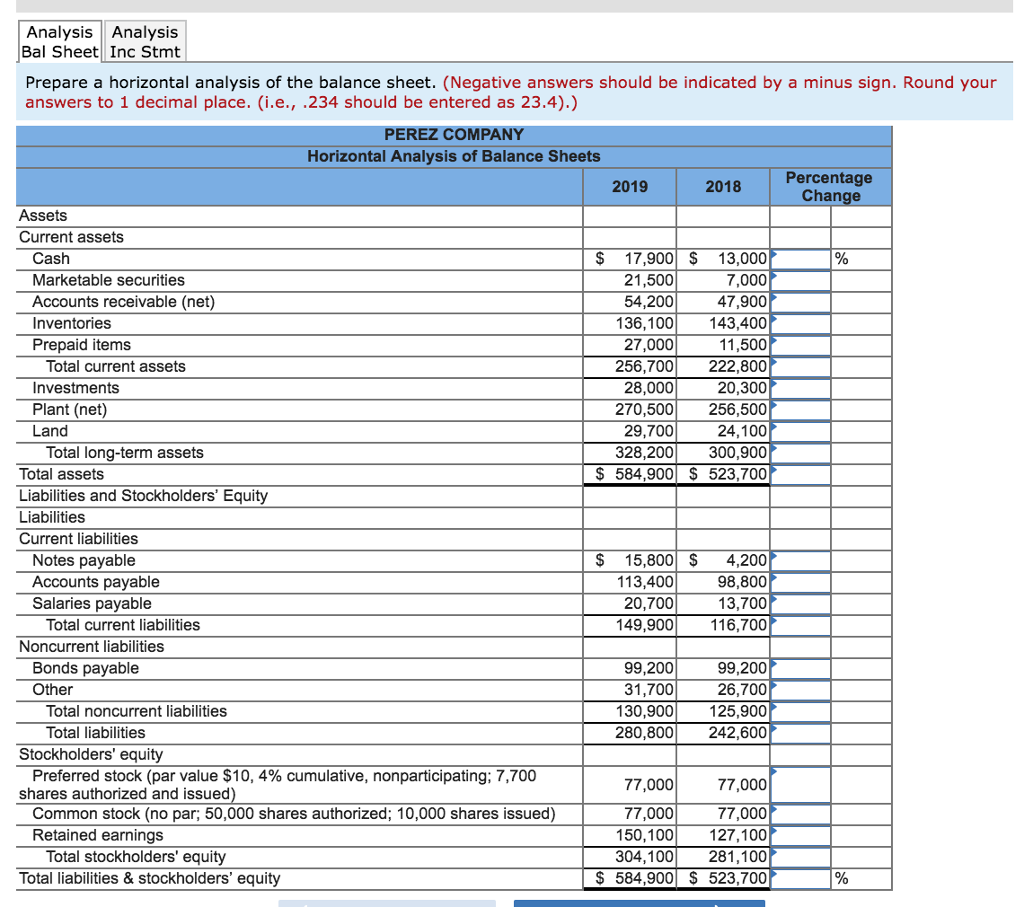

Analysis Analysis Bal Sheet Inc Stmt Prepare a horizontal analysis of the balance sheet. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4).) PEREZ COMPANY Horizontal Analysis of Balance Sheets Percentage Change 2019 2018 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items $ 17,900$ 13,000 7,000 47,900 143,400 11,500 256,700 222,800 20,300 270,500 256,500 24,100 328,200300,900 $ 584,900 523,700 21,500 54,200 136,100 27,000 Total current assets Investments Plant (net) Land 28,000 29,700 Total long-term assets Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable $ 15,800$ 4,200 98,800 13,700 116,700 113,400 20,700 149,900 Total current liabilities Noncurrent liabilities 99,200 26,700 130,900 125,900 280,800 242,600 Bonds payable Other 99,200 31,700 Total noncurrent liabilities Total liabilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating: 7700 77,000 77,000 77,000 77,000 150,100 127,100 304,100 281,100 $ 584,900S 523,700 shares authorized and issued Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities & stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts