Question: Analysis and Decision - Making Case Consider this conversation between two work colleagues: Carole: Hey Fong, what did you say you needed these other selling

Analysis and DecisionMaking Case

Consider this conversation between two work colleagues:

Carole: Hey Fong, what did you say you needed these other selling prices for again?

Fong: Im trying to figure out if my potential customers will be willing to pay what I want to charge for my clever upgrade to plastic storage containers.

Carole: Oh wow, that sounds super exciting; thanks for including me in this analysis.

Fong: You just wait, Carole. Im going to make a dent in this market, and then we'll see who retires at age

Carole gathered the following selling price information about other plastic storage containers on the market.

Competitor times Plastic Containers with Lid

$ lid fits tightly but is not spillproof

$ lid is spillproof but snaps on loudly

$ lid just rests on top so is not tightfitting

However, without access to competitors' internal records, she could not determine their costs.

Meanwhile, Fong made note of his production costs and secretly smiled to himself as he thought about what a great idea he had. He wants to make plastic storage containers that have a locking lid. More than that, the lid locks quietly, so no one knows you're sneaking a treat from the container yes Fong got busted stealing Carole's famous chocolate cookies, and he vowed to fix this problem permanently Here's his estimated costs to produce and sell one plastic container with quiet, spillproof lid:

tableDM$Required

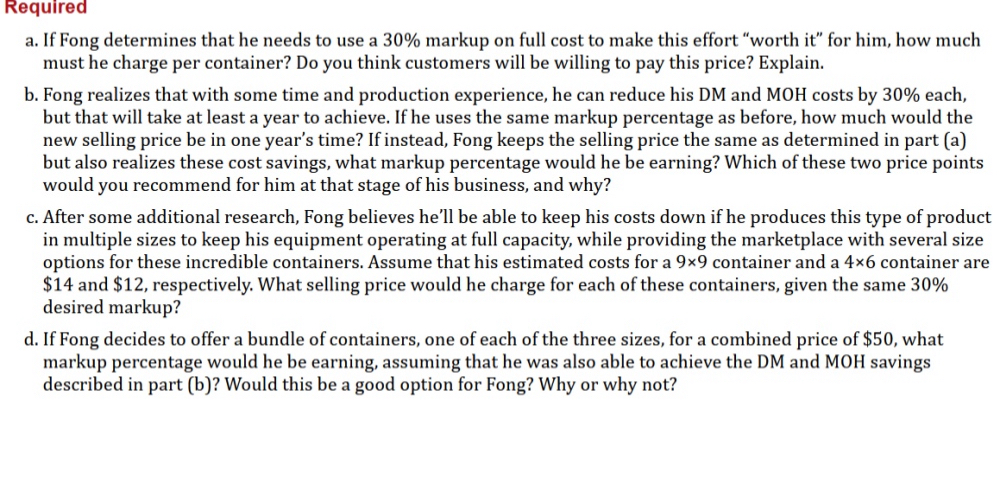

a If Fong determines that he needs to use a markup on full cost to make this effort "worth it for him, how much must he charge per container? Do you think customers will be willing to pay this price? Explain.

b Fong realizes that with some time and production experience, he can reduce his DM and MOH costs by each, but that will take at least a year to achieve. If he uses the same markup percentage as before, how much would the new selling price be in one year's time? If instead, Fong keeps the selling price the same as determined in part a but also realizes these cost savings, what markup percentage would he be earning? Which of these two price points would you recommend for him at that stage of his business, and why?

c After some additional research, Fong believes he'll be able to keep his costs down if he produces this type of product in multiple sizes to keep his equipment operating at full capacity, while providing the marketplace with several size options for these incredible containers. Assume that his estimated costs for a container and a container are $ and $ respectively. What selling price would he charge for each of these containers, given the same desired markup?

d If Fong decides to offer a bundle of containers, one of each of the three sizes, for a combined price of $ what markup percentage would he be earning, assuming that he was also able to achieve the DM and MOH savings described in part b Would this be a good option for Fong? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock