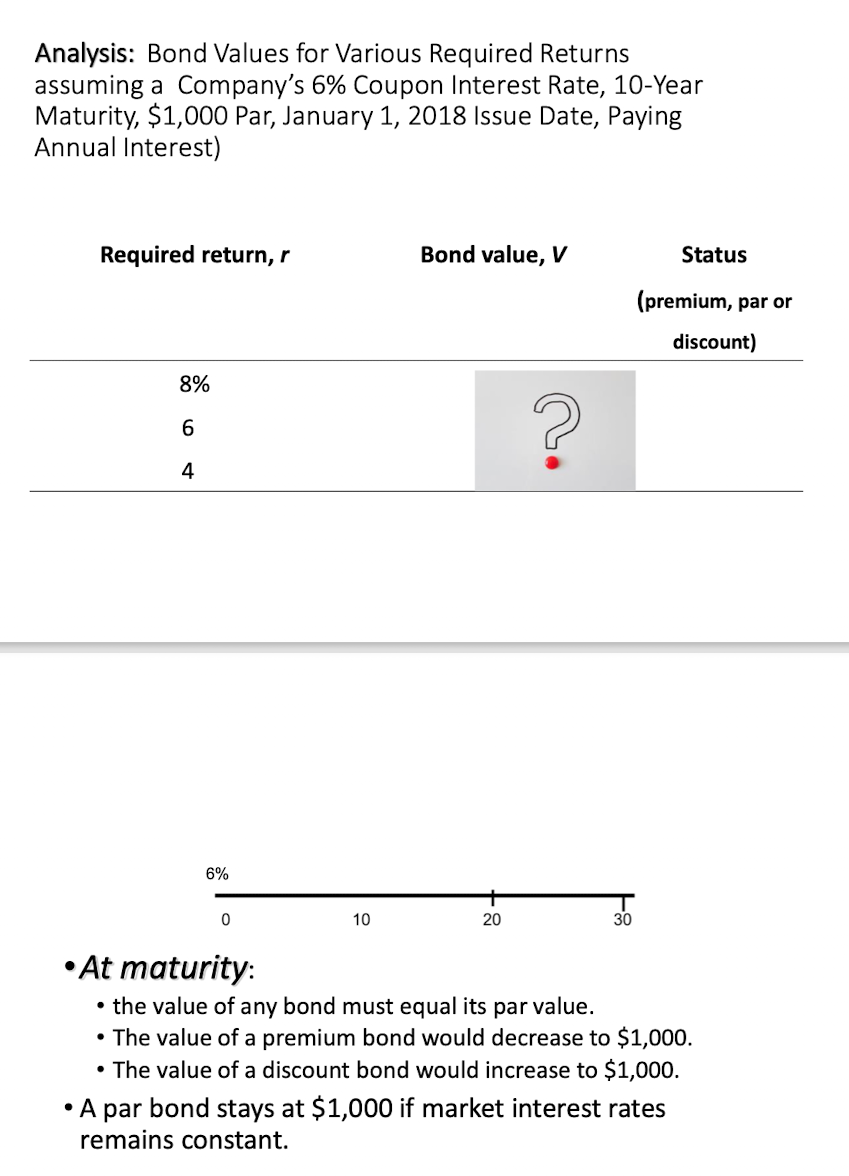

Question: Analysis: Bond Values for Various Required Returns assuming a Company's 6% Coupon Interest Rate, 10-Year Maturity, $1,000 Par, January 1, 2018 Issue Date, Paying Annual

Analysis: Bond Values for Various Required Returns assuming a Company's 6% Coupon Interest Rate, 10-Year Maturity, $1,000 Par, January 1, 2018 Issue Date, Paying Annual Interest) Required return, r Bond value, V Status (premium, par or discount) 8% 6 2 4 6% 0 10 20 30 At maturity: the value of any bond must equal its par value. The value of a premium bond would decrease to $1,000. The value of a discount bond would increase to $1,000. A par bond stays at $1,000 if market interest rates remains constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts