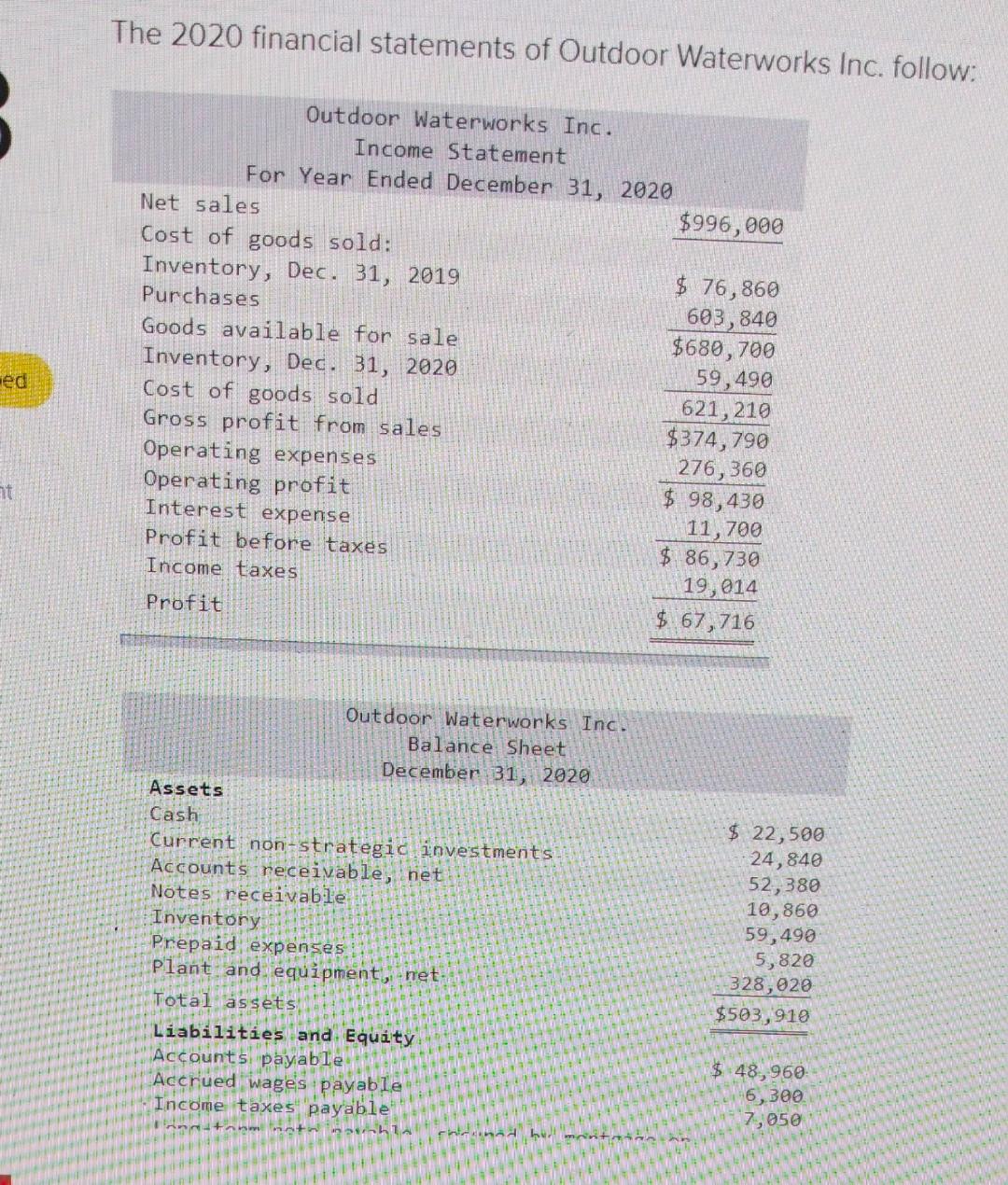

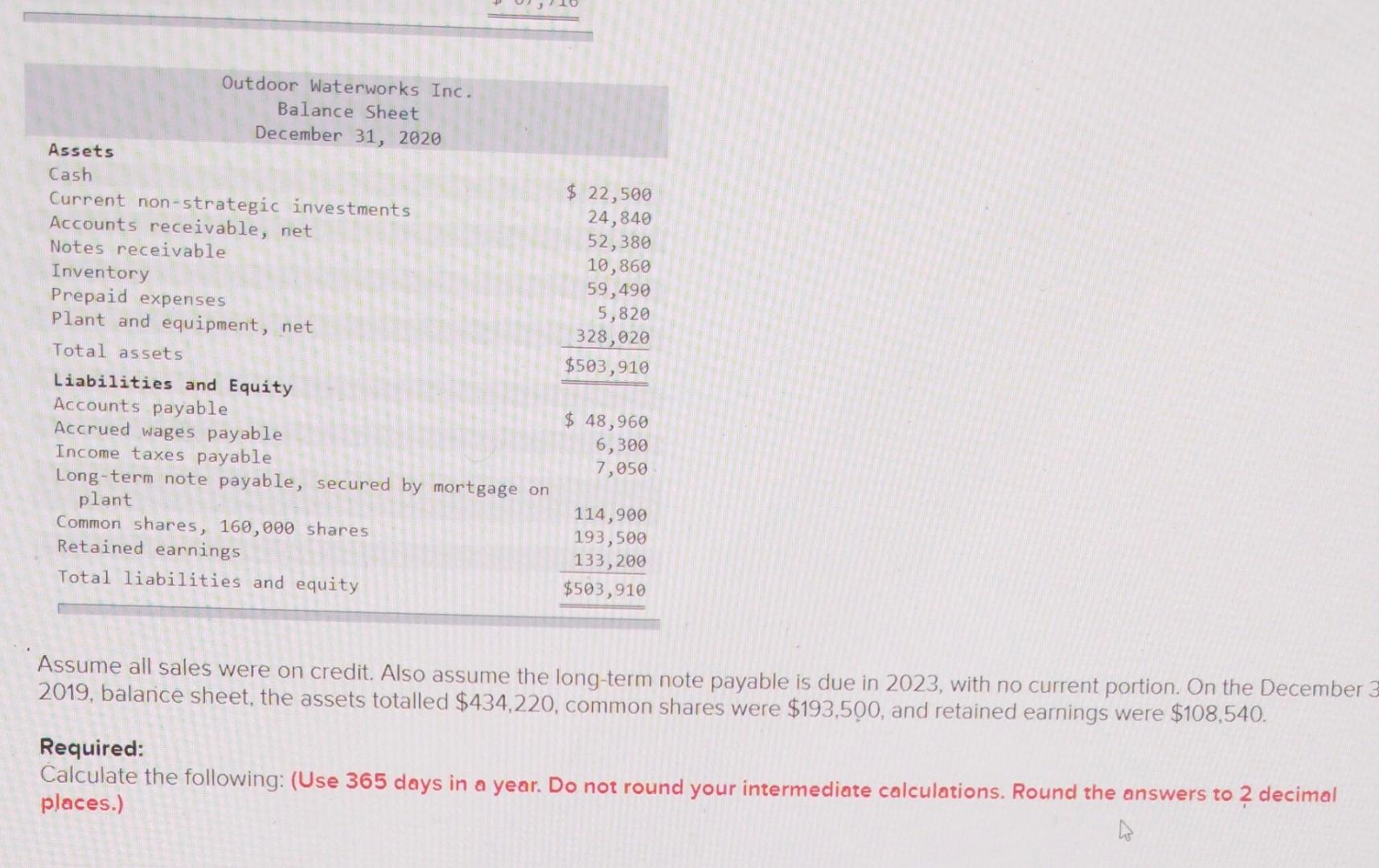

Question: analysis component: identify whether the ratio calculated above are favourable or unfavourable to the industry average. The 2020 financial statements of Outdoor Waterworks Inc. follow:

analysis component: identify whether the ratio calculated above are favourable or unfavourable to the industry average.

The 2020 financial statements of Outdoor Waterworks Inc. follow: Assume all sales were on credit. Also assume the long-term note payable is due in 2023 , with no current portion. On the December 2019 , balarice sheet, the assets totalled $434,220, common shares were $193,500, and retained earnings were $108,540. Required: Calculate the following: (Use 365 days in a year. Do not round your intermediate calculations. Round the answers to 2 decimal places.) The 2020 financial statements of Outdoor Waterworks Inc. follow: Assume all sales were on credit. Also assume the long-term note payable is due in 2023 , with no current portion. On the December 2019 , balarice sheet, the assets totalled $434,220, common shares were $193,500, and retained earnings were $108,540. Required: Calculate the following: (Use 365 days in a year. Do not round your intermediate calculations. Round the answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts