Question: analysis for Walmart company, section c. data found on SEC.gov 9:02 1 Done FSA project a. Explanation of the context and rationale Throughout the semester

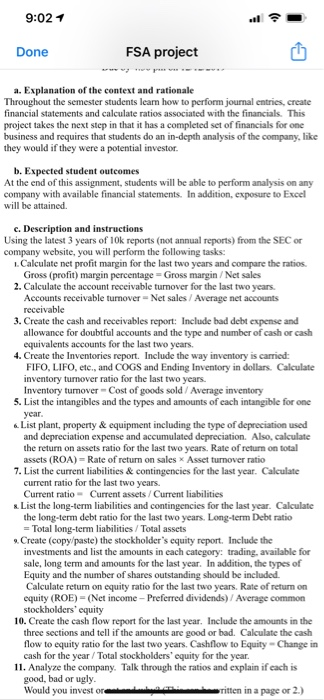

9:02 1 Done FSA project a. Explanation of the context and rationale Throughout the semester students learn how to perform journal entries, create financial statements and calculate ratios associated with the financials. This project takes the next step in that it has a completed set of financials for one business and requires that students do an in-depth analysis of the company, like they would if they were a potential investor. b. Expected student outcomes At the end of this assignment, students will be able to perform analysis on any company with available financial statements. In addition, exposure to Excel will be attained. c. Description and instructions Using the latest 3 years of 10k reports (not annual reports) from the SEC or company website, you will perform the following tasks: 1. Calculate net profit margin for the last two years and compare the ratios. Gross (profit) margin percentage=Gross margin/Net sales 2. Calculate the account receivable turnover for the last two years. Accounts receivable turnover - Net sales/ Average net accounts receivable 3. Create the cash and receivables report: Include bad debt expense and allowance for doubtful accounts and the type and number of cash or cash equivalents accounts for the last two years. 4. Create the Inventories report. Include the way inventory is carried FIFO, LIFO, etc., and COGS and Ending Inventory in dollars. Calculate inventory turnover ratio for the last two years. Inventory tumover - Cost of goods sold / Average inventory 5. List the intangibles and the types and amounts of each intangible for one year. 6.List plant, property & equipment including the type of depreciation used and depreciation expense and accumulated depreciation. Also, calculate the return on assets ratio for the last two years. Rate of return on total assets (ROA) Rate of return on sales x Asset turnover ratio 7. List the current liabilities & contingencies for the last year. Calculate current ratio for the last two years. Current ratio - Current assets / Current liabilities & List the long-term liabilities and contingencies for the last year. Calculate the long-term debt ratio for the last two years. Long-term Debt ratio = Total long-term liabilities/ Total assets Create (copy/paste) the stockholder's equity report. Include the investments and list the amounts in each category: trading, available for sale, long term and amounts for the last year. In addition, the types of Equity and the number of shares outstanding should be included Calculate retum on equity ratio for the last two years. Rate of return on equity (ROE) = (Net income - Preferred dividends) / Average common stockholders' equity 10. Create the cash flow report for the last year. Include the amounts in the three sections and tell if the amounts are good or bad. Calculate the cash flow to equity ratio for the last two years, Cashflow to Equity - Change in cash for the year / Total stockholders' equity for the year. 11. Analyze the company. Talk through the ratios and explain if each is good, bad or ugly. Would you investore r itten in a page or 2.) 9:02 1 Done FSA project a. Explanation of the context and rationale Throughout the semester students learn how to perform journal entries, create financial statements and calculate ratios associated with the financials. This project takes the next step in that it has a completed set of financials for one business and requires that students do an in-depth analysis of the company, like they would if they were a potential investor. b. Expected student outcomes At the end of this assignment, students will be able to perform analysis on any company with available financial statements. In addition, exposure to Excel will be attained. c. Description and instructions Using the latest 3 years of 10k reports (not annual reports) from the SEC or company website, you will perform the following tasks: 1. Calculate net profit margin for the last two years and compare the ratios. Gross (profit) margin percentage=Gross margin/Net sales 2. Calculate the account receivable turnover for the last two years. Accounts receivable turnover - Net sales/ Average net accounts receivable 3. Create the cash and receivables report: Include bad debt expense and allowance for doubtful accounts and the type and number of cash or cash equivalents accounts for the last two years. 4. Create the Inventories report. Include the way inventory is carried FIFO, LIFO, etc., and COGS and Ending Inventory in dollars. Calculate inventory turnover ratio for the last two years. Inventory tumover - Cost of goods sold / Average inventory 5. List the intangibles and the types and amounts of each intangible for one year. 6.List plant, property & equipment including the type of depreciation used and depreciation expense and accumulated depreciation. Also, calculate the return on assets ratio for the last two years. Rate of return on total assets (ROA) Rate of return on sales x Asset turnover ratio 7. List the current liabilities & contingencies for the last year. Calculate current ratio for the last two years. Current ratio - Current assets / Current liabilities & List the long-term liabilities and contingencies for the last year. Calculate the long-term debt ratio for the last two years. Long-term Debt ratio = Total long-term liabilities/ Total assets Create (copy/paste) the stockholder's equity report. Include the investments and list the amounts in each category: trading, available for sale, long term and amounts for the last year. In addition, the types of Equity and the number of shares outstanding should be included Calculate retum on equity ratio for the last two years. Rate of return on equity (ROE) = (Net income - Preferred dividends) / Average common stockholders' equity 10. Create the cash flow report for the last year. Include the amounts in the three sections and tell if the amounts are good or bad. Calculate the cash flow to equity ratio for the last two years, Cashflow to Equity - Change in cash for the year / Total stockholders' equity for the year. 11. Analyze the company. Talk through the ratios and explain if each is good, bad or ugly. Would you investore r itten in a page or 2.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts