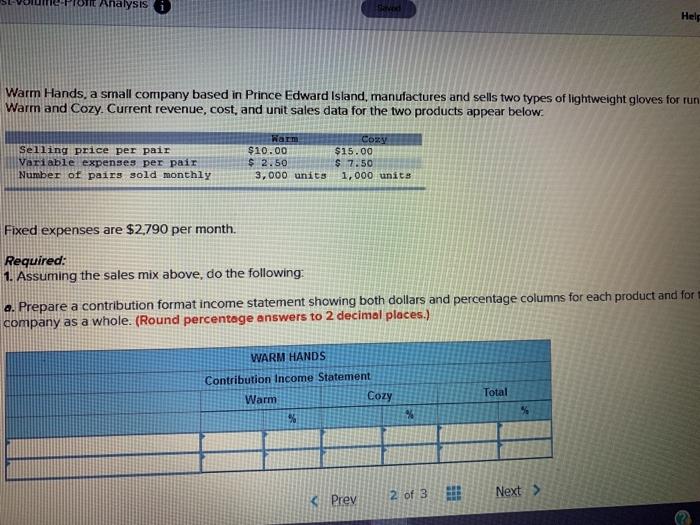

Question: Analysis i Hels Warm Hands, a small company based in Prince Edward Island, manufactures and sells two types of lightweight gloves for run Warm and

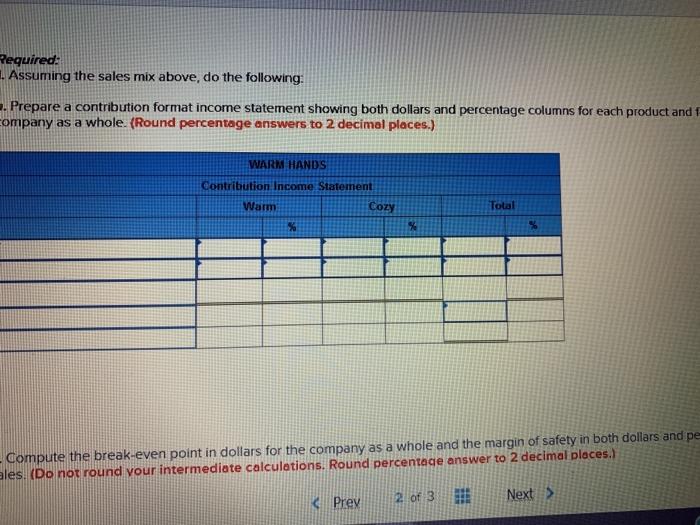

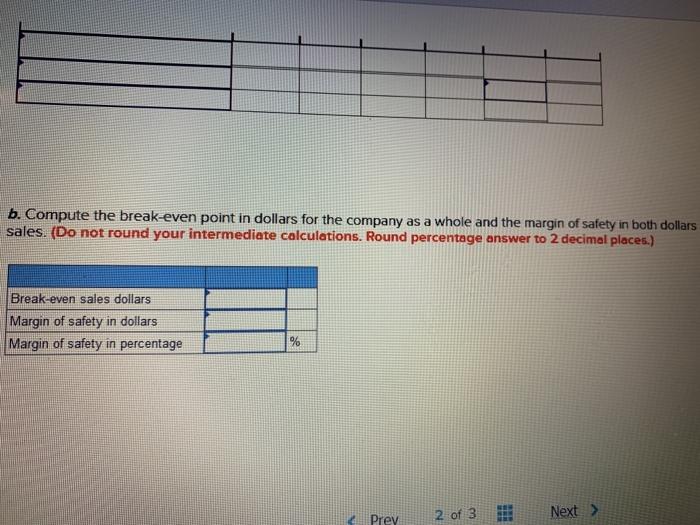

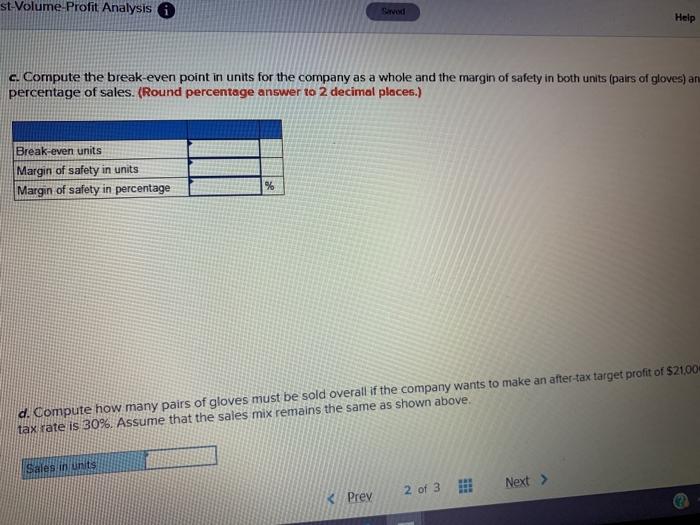

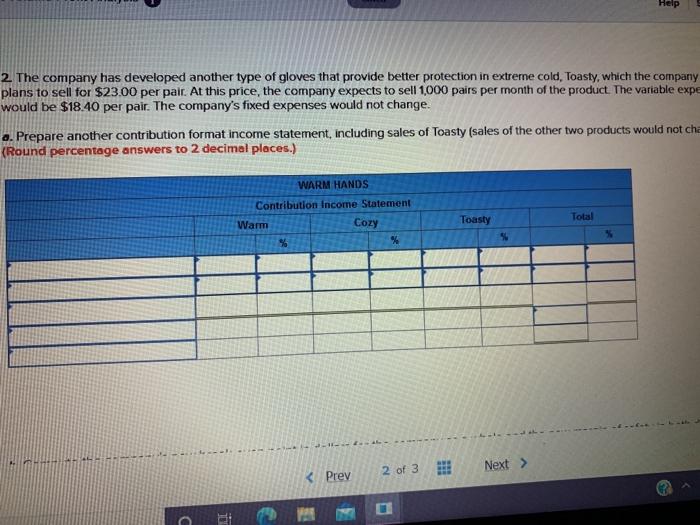

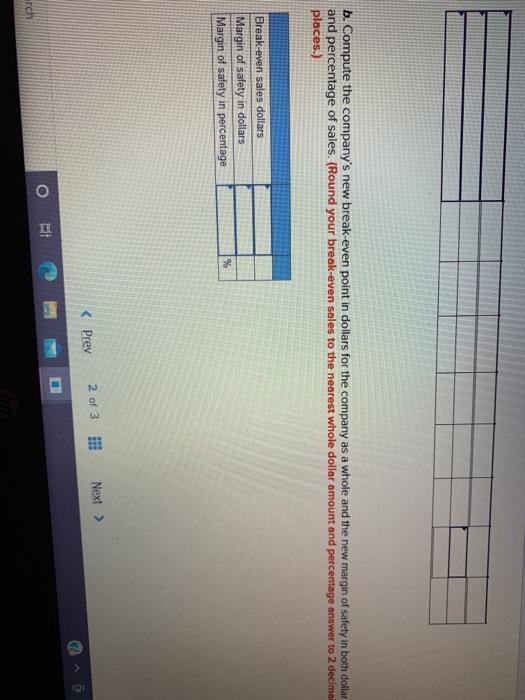

Analysis i Hels Warm Hands, a small company based in Prince Edward Island, manufactures and sells two types of lightweight gloves for run Warm and Cozy. Current revenue, cost, and unit sales data for the two products appear below. Selling price per pair Variable expenses per pair Number of pairs sold monthly Warm $10.00 $ 2.50 3,000 units Cony $15.00 $ 7.50 1,000 units Fixed expenses are $2,790 per month. Required: 1. Assuming the sales mix above, do the following: a. Prepare a contribution format income statement showing both dollars and percentage columns for each product and for company as a whole. (Round percentage answers to 2 decimal places.) WARM HANDS Contribution Income Statement Warm Cozy Total 5 % 2 of 3 FH Prev Next > Required: 1. Assuming the sales mix above, do the following: . Prepare a contribution format income statement showing both dollars and percentage columns for each product and company as a whole. (Round percentage answers to 2 decimal places.) WARM HANDS Contribution Income Statement Warm Cozy Total % % - Compute the break-even point in dollars for the company as a whole and the margin of safety in both dollars and pe ales. (Do not round your intermediate calculations. Round percentage answer to 2 decimal places.) Prey 2 of 3 TB Next > b. Compute the break-even point in dollars for the company as a whole and the margin of safety in both dollars sales. (Do not round your intermediate calculations. Round percentage answer to 2 decimal places.) Break-even sales dollars Margin of safety in dollars Margin of safety in percentage % Prey 2 of 3 Next > st-Volume-Profit Analysis i Saved Help c. Compute the break-even point in units for the company as a whole and the margin of safety in both units (pairs of gloves) an percentage of sales. (Round percentage answer to 2 decimal places.) Break-even units Margin of safety in units Margin of safety in percentage % d. Compute how many pairs of gloves must be sold overall if the company wants to make an after-tax target profit of $21,00 tax rate is 30%. Assume that the sales mix remains the same as shown above. Sales in units Next > 2 of 3 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts