Question: ANALYSIS Include your Expected Value Analysis and Decision Tree Analysis that was completed in the M 4 . 2 . 4 Practice Scenario: Expected Value

ANALYSIS

Include your Expected Value Analysis and Decision Tree Analysis that was completed in the M Practice Scenario: Expected Value and Decision Tree.

Expected Value EV analysis helps in evaluating the potential outcomes of different decisions by considering the probabilities and payoffs of each outcome. For the Smart Farm Pro System, we can analyze different pricing strategies and market scenarios to determine the expected value for each strategy.

Scenario Assumptions:

High Market Acceptance: probability

Revenue: $ millionCosts: $ millionProfit: $ million

Moderate Market Acceptance: probability

Revenue: $ millionCosts: $ millionProfit: $ million

Low Market Acceptance: probability

Revenue: $ millionCosts: $ millionProfit: $ million Loss

Expected Value Calculation: textEVtextProbability of High Acceptancetimes textProfit in High AcceptancetextProbability of Moderate Acceptancetimes textProfit in Moderate AcceptancetextProbability of Low Acceptancetimes textProfitLoss in Low Acceptance

textEVtimes Mtimes Mtimes M

textEVM M M

textEVM

The expected value of the pricing strategy for the Smart Farm Pro System is $ million.

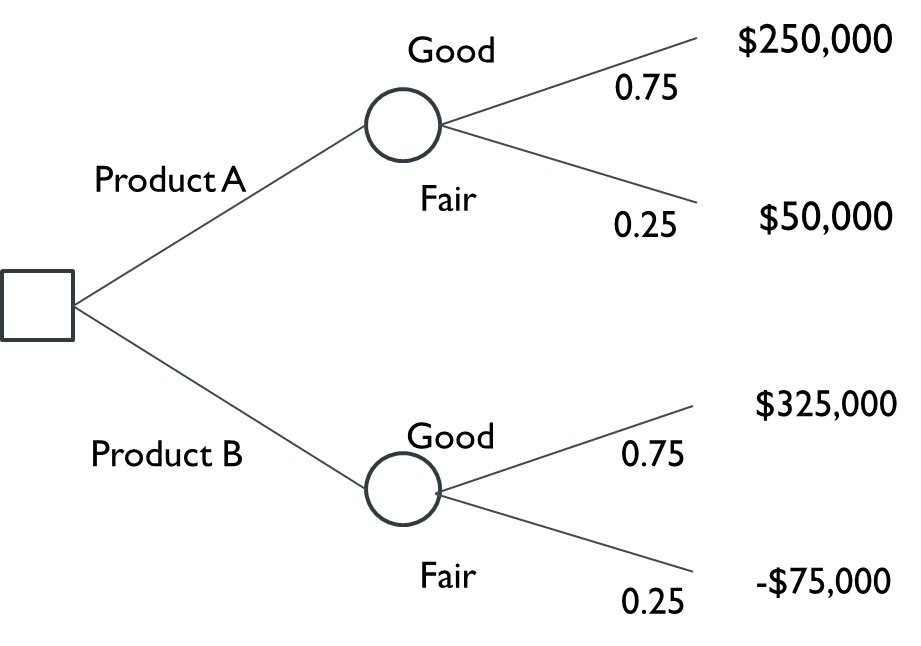

Decision Tree Analysis

A decision tree helps visualize the different decisions and their potential outcomes, incorporating probabilities and payoffs. Below is a simplified decision tree for the Smart Farm Pro System pricing strategy:

Decision Node: Pricing Strategy

Option : Base Price $ with Subscription TiersOption : Lower Base Price $Assume lower costs attract more customers but reduce perunit profit

Option : Base Price $ with Subscription Tiers

High Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Moderate Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Low Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Expected Value for Option : $ million as calculated above

Option : Lower Base Price $ with Subscription Tiers

High Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Moderate Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Low Market Acceptance

Revenue: $ millionCosts: $ millionProfit: $ million

Expected Value for Option :

textEVtimes Mtimes Mtimes M

textEVM M M

textEVM

Decision Tree Visualization

Pricing Strategy Base Price $ Lower Base Price $ High Mod Low High Mod Low Profit: $M $M $M $M $M $M

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock