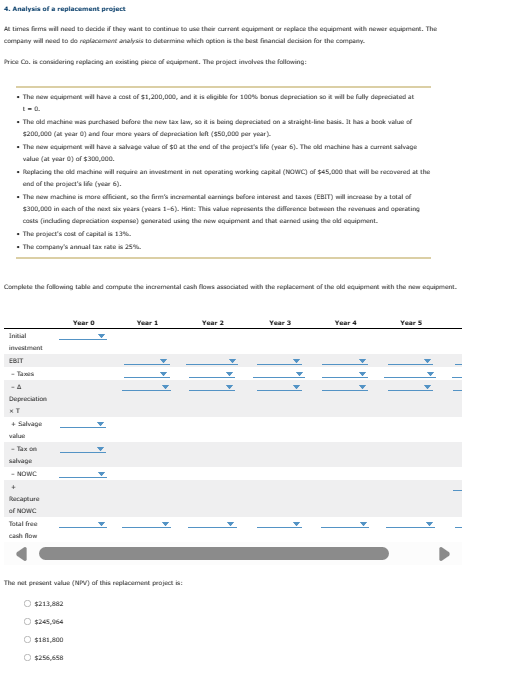

Question: Analysis of a replackment project t = 0 . The old machine maid purchased before the niw tax law, so it is being dopreciated on

Analysis of a replackment project

The old machine maid purchased before the niw tax law, so it is being dopreciated on a siraightline basis. It has a book value of

$at year and four more years of depreciation left $ perr yiar

value at year o of $

Poplacing, the old mactine will require an invistment in net opearating workinc, capital NOWC of $ that will be rectivred at the

end of the projoct's lifo year

costs incluting depreciation esponse quenarated using the new equipment and that earrod using the old equipmant.

The projoct's cost of capital is

The compariy's annual tax rate is

Year

Year

Year

Year

Year

Year

The fout prisent value NF of this riplatoment projert is:

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock