Question: Analysis on whether the US deal should be accepted. Sales Cost of sales Gross profit Appendix I Atlantic Watercraft Ltd. Statement of profit or loss

Analysis on whether the US deal should be accepted.

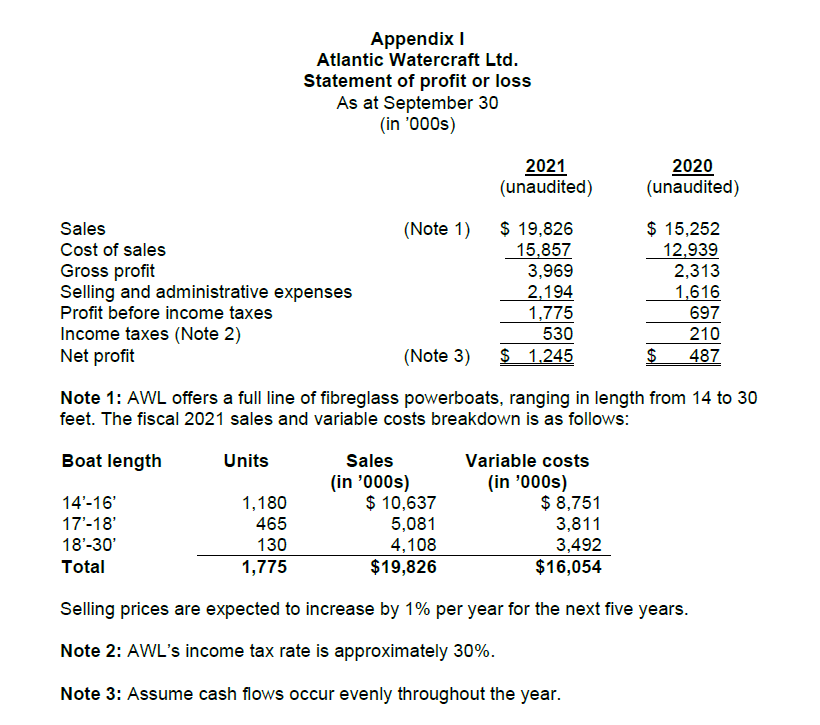

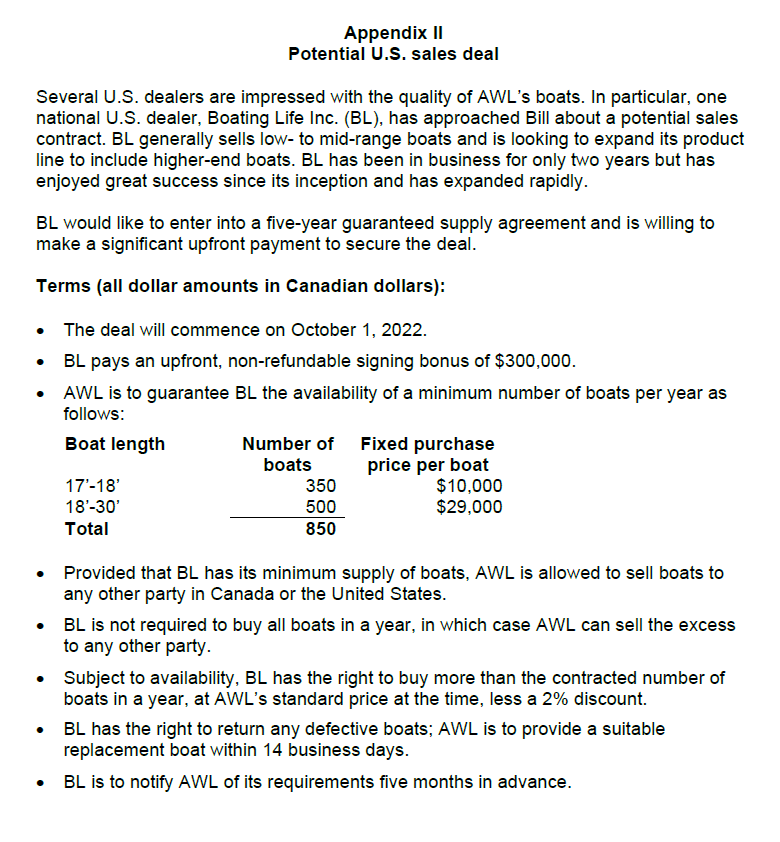

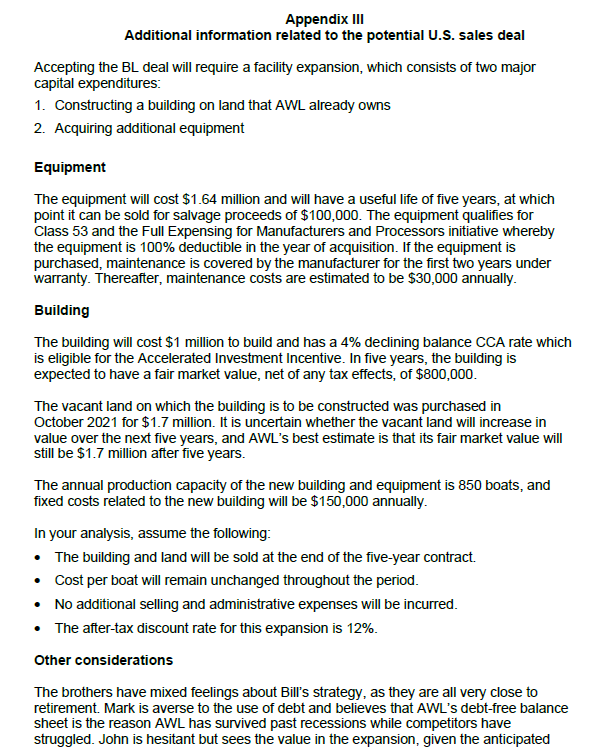

Sales Cost of sales Gross profit Appendix I Atlantic Watercraft Ltd. Statement of profit or loss As at September 30 (in '000s) Selling and administrative expenses Profit before income taxes Income taxes (Note 2) Net profit (Note 1) $ 19,826 15,857 2021 (unaudited) 2020 (unaudited) $ 15,252 12,939 3,969 2,313 2,194 1,616 1,775 697 530 210 (Note 3) $ 1.245 $ 487 Note 1: AWL offers a full line of fibreglass powerboats, ranging in length from 14 to 30 feet. The fiscal 2021 sales and variable costs breakdown is as follows: Boat length 14'-16' 17'-18' 18'-30' Total Units Sales (in '000s) Variable costs (in '000s) 1,180 465 $ 10,637 5,081 $ 8,751 3,811 130 4,108 3,492 1,775 $19,826 $16,054 Selling prices are expected to increase by 1% per year for the next five years. Note 2: AWL's income tax rate is approximately 30%. Note 3: Assume cash flows occur evenly throughout the year.

Step by Step Solution

There are 3 Steps involved in it

To answer all parts of the question with detailed calculations lets walk through each element of the analysis including calculating revenue costs depreciation taxes and the net present value NPV of ca... View full answer

Get step-by-step solutions from verified subject matter experts