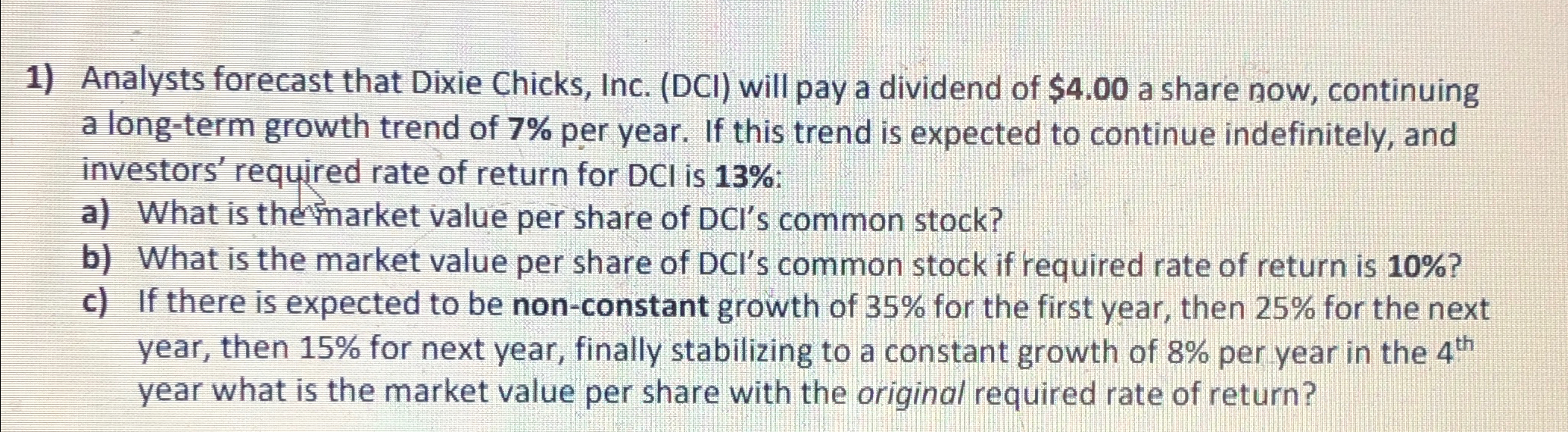

Question: Analysts forecast that Dixie Chicks, Inc. ( DCI ) will pay a dividend of $ 4 . 0 0 a share now, continuing a long

Analysts forecast that Dixie Chicks, Inc. DCI will pay a dividend of $ a share now, continuing a longterm growth trend of per year. If this trend is expected to continue indefinitely, and investors' required rate of return for DCI is :

a What is themarket value per share of DCI's common stock?

b What is the market value per share of DCI's common stock if required rate of return is

c If there is expected to be nonconstant growth of for the first year, then for the next year, then for next year, finally stabilizing to a constant growth of per year in the year what is the market value per share with the original required rate of return?

SHOW WORK IN EXCEL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock