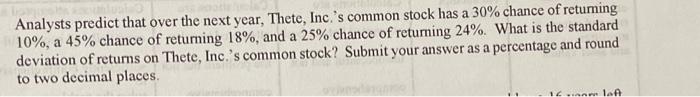

Question: Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of retuming 10%, a 45% chance of returning 18%, and

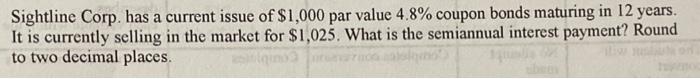

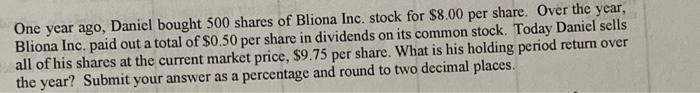

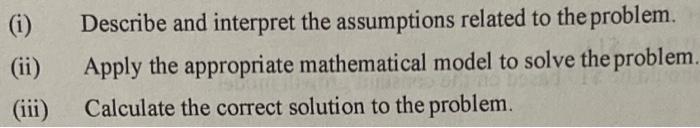

Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of retuming 10%, a 45% chance of returning 18%, and a 25% chance of returning 24%. What is the standard deviation of returns on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places a la Sightline Corp. has a current issue of $1,000 par value 4.8% coupon bonds maturing in 12 years. It is currently selling in the market for $1,025. What is the semiannual interest payment? Round to two decimal places. One year ago, Daniel bought 500 shares of Bliona Inc. stock for $8.00 per share. Over the year, Bliona Inc. paid out a total of $0.50 per share in dividends on its common stock. Today Daniel sells all of his shares at the current market price, $9.75 per share. What is his holding period return over the year? Submit your answer as a percentage and round to two decimal places. (i) (ii) (iii) Describe and interpret the assumptions related to the problem. Apply the appropriate mathematical model to solve the problem Calculate the correct solution to the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts