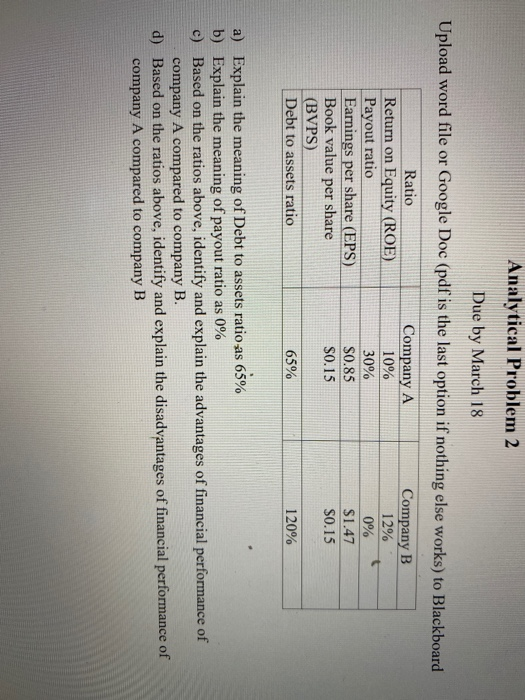

Question: Analytical Problem 2 Due by March 18 Upload word file or Google Doc (pdf is the last option if nothing else works) to Blackboard Ratio

Analytical Problem 2 Due by March 18 Upload word file or Google Doc (pdf is the last option if nothing else works) to Blackboard Ratio Return on Equity (ROE) Payout ratio Earnings per share (EPS) Book value per share (BVPS) Debt to assets ratio Company A 10% 30% $0.85 $0.15 Company B 12% 0% $1.47 $0.15 65% 120% a) Explain the meaning of Debt to assets ratio as 65% b) Explain the meaning of payout ratio as 0% c) Based on the ratios above, identify and explain the advantages of financial performance of company A compared to company B. d) Based on the ratios above, identify and explain the disadvantages of financial performance of company A compared to company B Analytical Problem 2 Due by March 18 Upload word file or Google Doc (pdf is the last option if nothing else works) to Blackboard Ratio Return on Equity (ROE) Payout ratio Earnings per share (EPS) Book value per share (BVPS) Debt to assets ratio Company A 10% 30% $0.85 $0.15 Company B 12% 0% $1.47 $0.15 65% 120% a) Explain the meaning of Debt to assets ratio as 65% b) Explain the meaning of payout ratio as 0% c) Based on the ratios above, identify and explain the advantages of financial performance of company A compared to company B. d) Based on the ratios above, identify and explain the disadvantages of financial performance of company A compared to company B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts