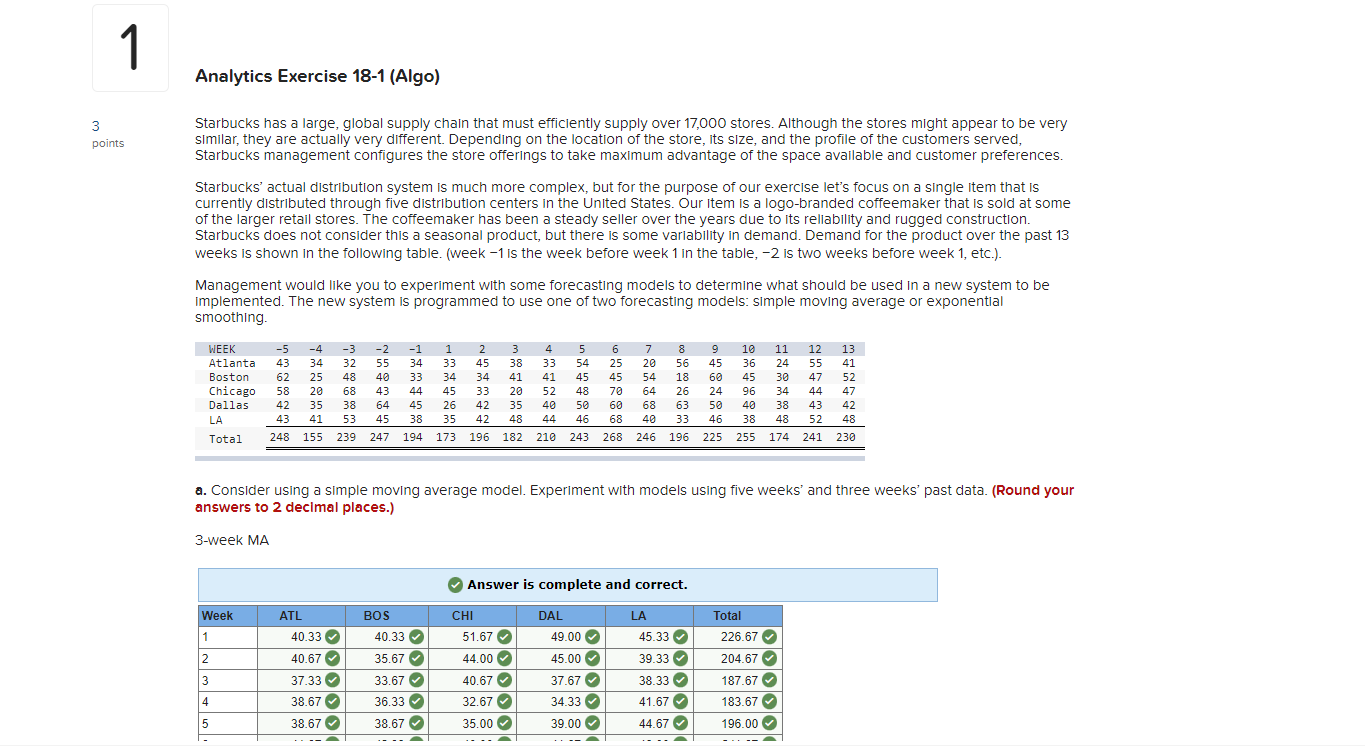

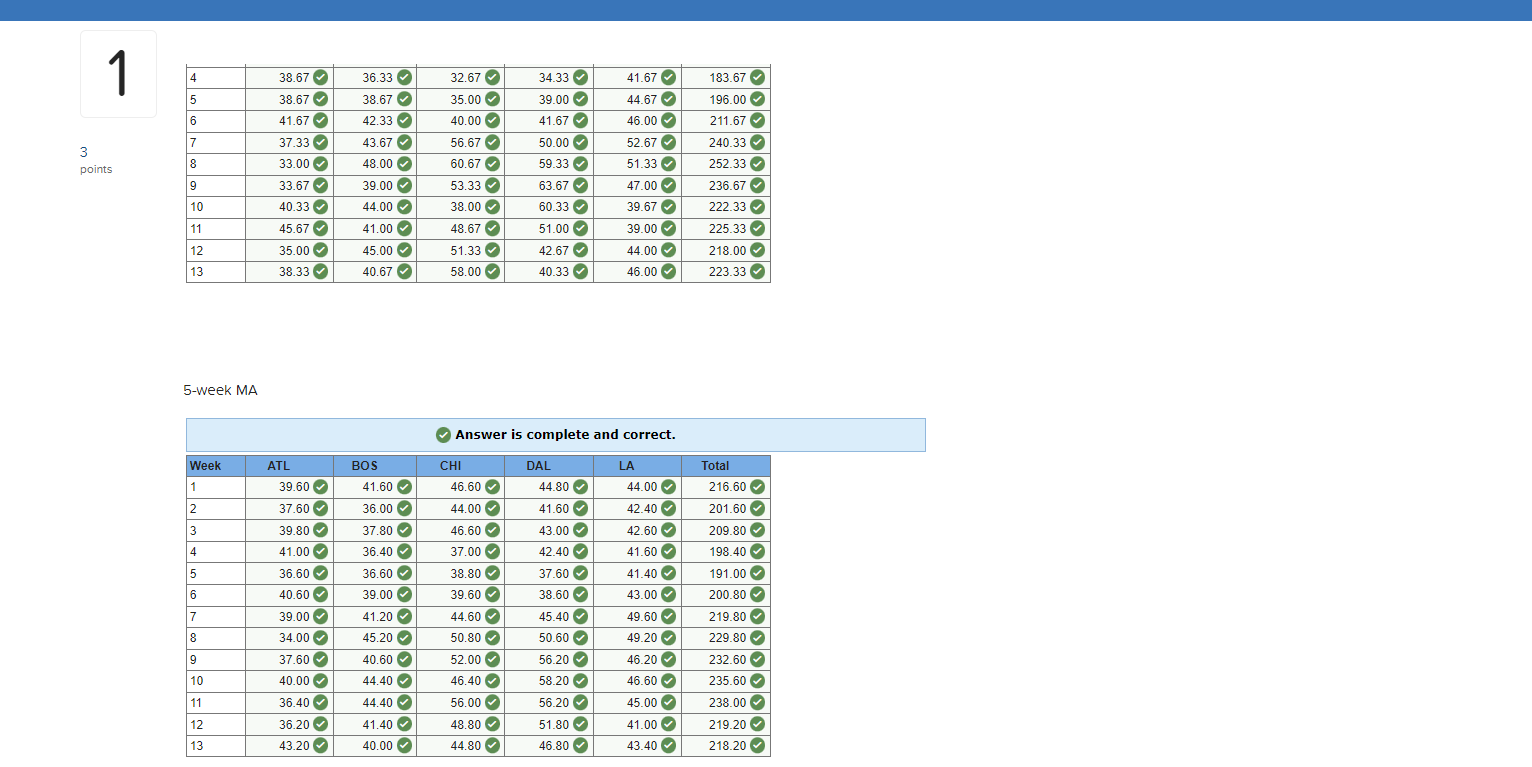

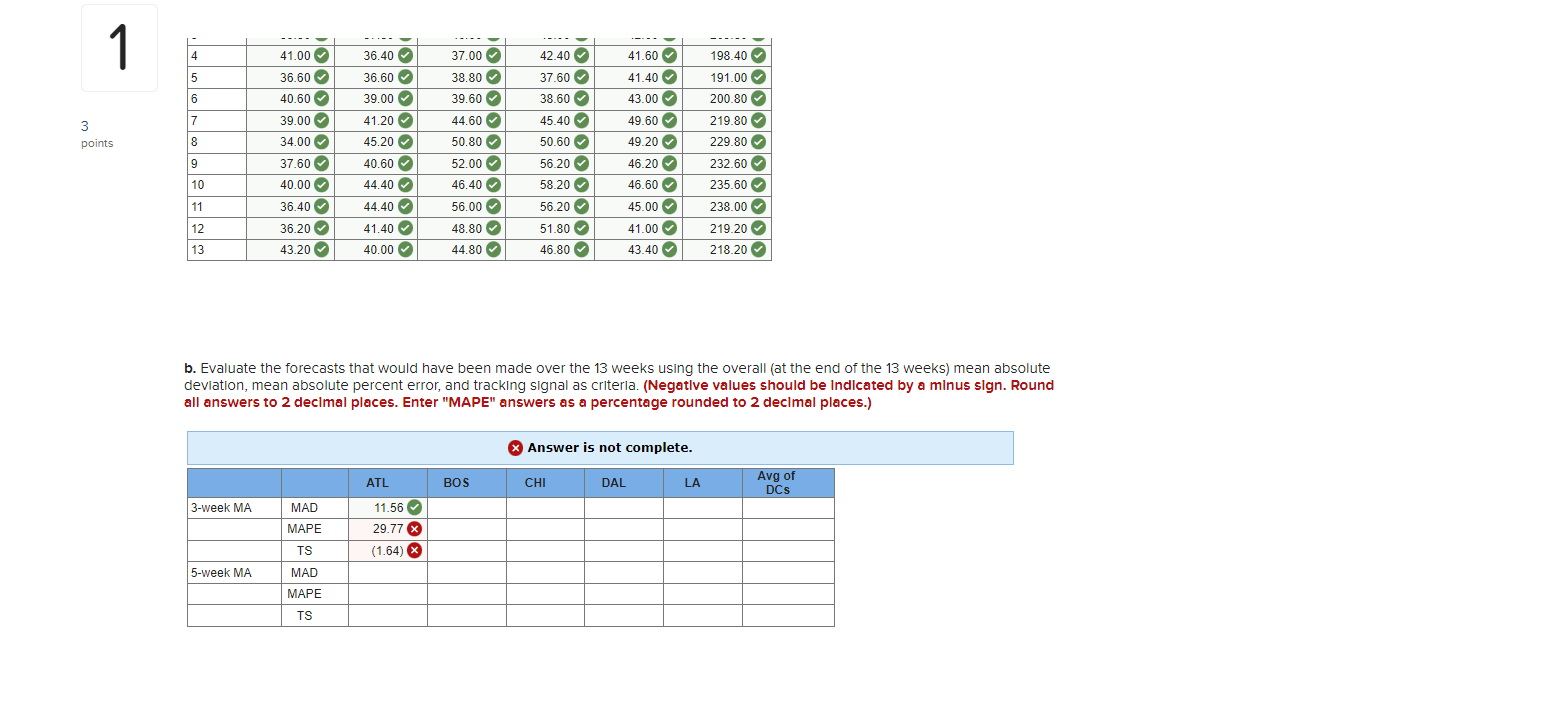

Question: Analytics Exercise 18-1 (Algo) Starbucks has a large, global supply chain that must efficiently supply over 17,000 stores. Although the stores might appear to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts