Question: Analyze and journalize these transactions. This is the first step of the accounting cycle and a perpetual inventory system is used for this. P5. November

Analyze and journalize these transactions. This is the first step of the accounting cycle and a perpetual inventory system is used for this.

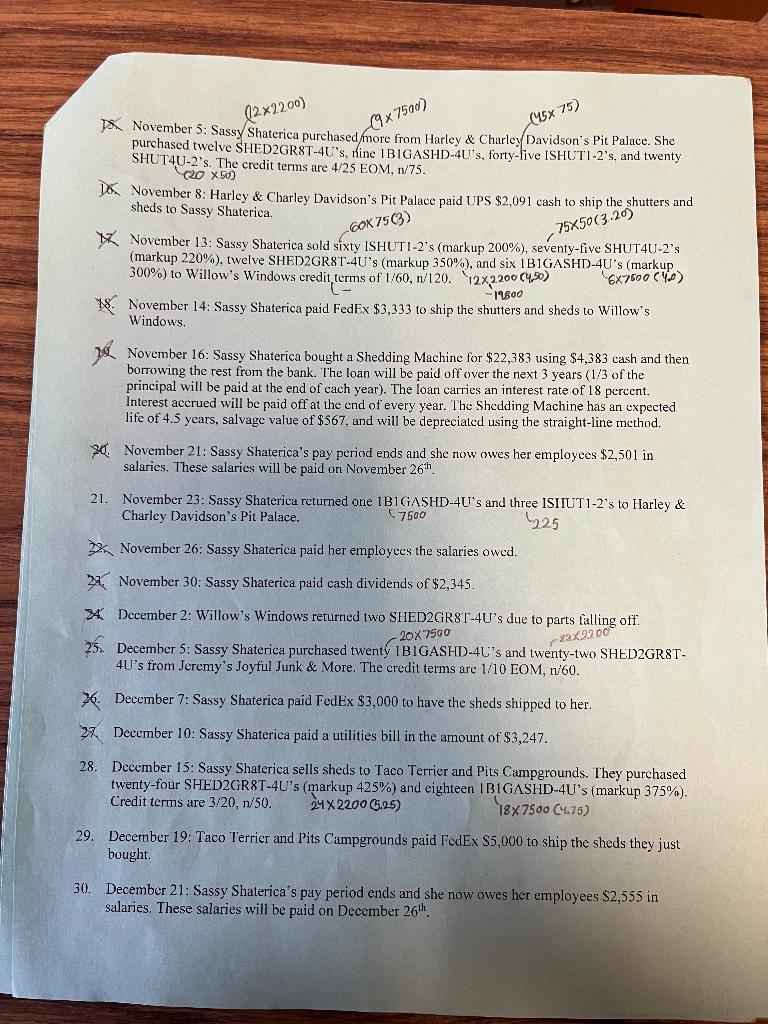

P5. November 5: Sassy Shaterica purchased/more from Harley \& Charley Davidson's Pit Palace. She purchased twelve SHED2GR8T-4U's, nine IB1GASHD-4U's, forty-five ISHUTI-2's, and twenty SHUT4U-2's. The credit terms are 4/25EOM,n/75. (2050) D6. November 8: Harley \& Charley Davidson's Pit Palace paid UPS $2,091 cash to ship the shutters and sheds to Sassy Shaterica. 17. November 13: Sassy Shaterica sold sixty ISHUT1-2's (markup 200\%), seventy-five SHUT4U-2's (markup 220\%), twelve SHED2GR8T-4U's (markup 350\%), and six 1B1GASHD-4U's (markup 78. November 14: Sassy Shaterica paid FedEx $3,333 to ship the shutters and sheds to Willow's Windows. 19 November 16: Sassy Shaterica bought a Shedding Machine for $22,383 using $4,383 cash and then borrowing the rest from the bank. The loan will be paid off over the next 3 years (1/3 of the principal will be paid at the end of cach year). The loan carries an interest rate of 18 percent. Interest accrued will be paid off at the end of every year. The Shedding Machine has an expected life of 4.5 years, salvage value of $567, and will be depreciated using the straight-line method. >0. November 21: Sassy Shaterica's pay period ends and she now owes her employees $2,501 in salaries. These salaries will be paid on November 26th. 21. November 23: Sassy Shaterica returned one 1B1GASHD4U 's and three ISIIUT1-2's to Harley \& Charley Davidson's Pit Palace. 75001225 32. November 26: Sassy Shaterica paid her employees the salaries owed. 20. November 30: Sassy Shaterica paid cash dividends of $2,345. 24. December 2: Willow's Windows returned two SHED2GR8T-4U's due to parts falling off: 25. December 5: Sassy Shaterica purchased twenty 1B1GASHI-4L's and twenty-two SHED2GR8T4 U's from Jeremy's Joyful Junk \& More. The credit terms are 1/10 EOM, n/60. 26. December 7: Sassy Shaterica paid FedEx $3,000 to have the sheds shipped to her. 27. December 10: Sassy Shaterica paid a utilities bill in the amount of $3,247. 28. December 15: Sassy Shaterica sells sheds to Taco Terrier and Pits Campgrounds. They purchased twenty-four SHED2GR8T-4U's (markup 425\%) and eighteen I B1 GASHD-4U's (markup 375\%). Credittermsare3/20,n/50.242200(5.25)187500(4.75) 29. December 19: Taco Terrier and Pits Campgrounds paid FedEx $5,000 to ship the sheds they just bought. 30. December 21: Sassy Shaterica's pay period ends and she now owes her employees $2,555 in salaries. These salaries will be paid on December 26th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts