Question: Analyze Johnson & Johnson stock https://finance.yahoo.com/quote/JNJ/history/ e. Determine the terminal enterprise value at the end of year 5 (EV's) using following equation and a long-run

Analyze Johnson & Johnson stock https://finance.yahoo.com/quote/JNJ/history/

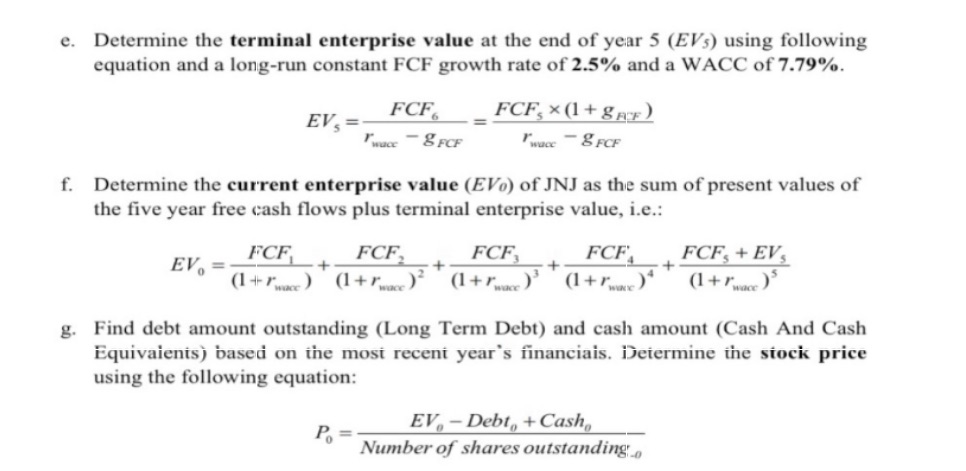

e. Determine the terminal enterprise value at the end of year 5 (EV's) using following equation and a long-run constant FCF growth rate of 2.5% and a WACC of 7.79%. FCF FCF, x (1+g AF ) EV , wace - & FCF wave - & FCF f. Determine the current enterprise value (EVo) of JNJ as the sum of present values of the five year free cash flows plus terminal enterprise value, i.e.: FCF FCF, FCF, FCF FCF, + EV EVO + (1 + [ wace ) (1 + [wee ) 2 (1 + [ ware ) (1 + [wax) (1 + [ware ) g. Find debt amount outstanding (Long Term Debt) and cash amount (Cash And Cash Equivalents) based on the most recent year's financials. Determine the stock price using the following equation: EV - Debt, + Cash, Po Number of shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts