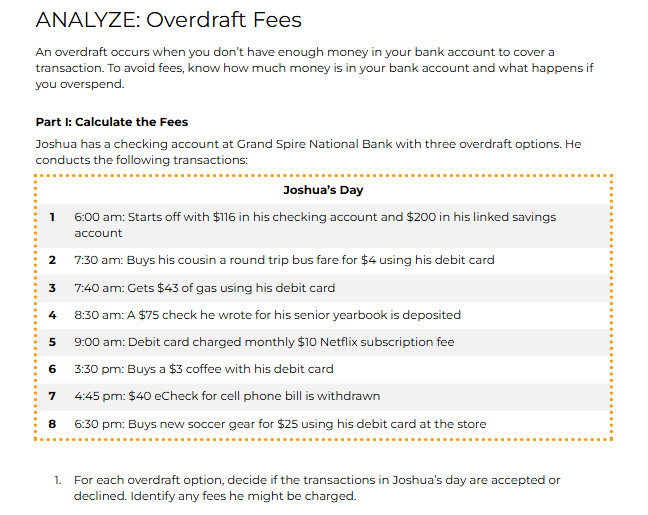

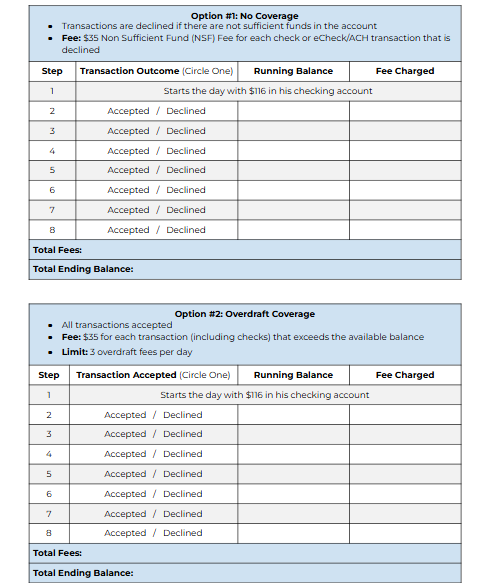

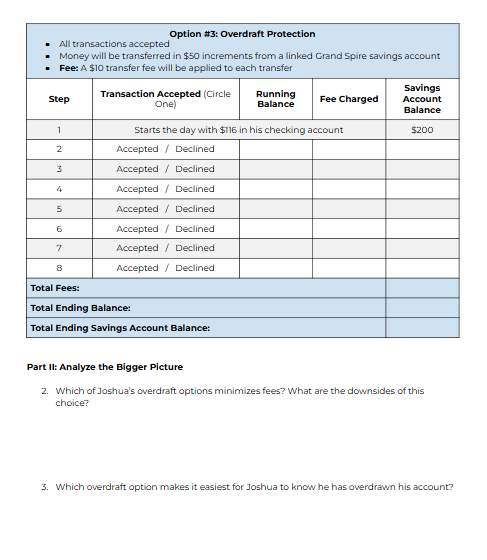

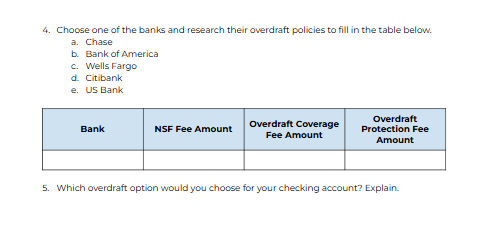

Question: ANALYZE: Overdraft Fees An overdraft occurs when you don't have enough money in your bank account to cover a transaction. To avoid fees, know how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts