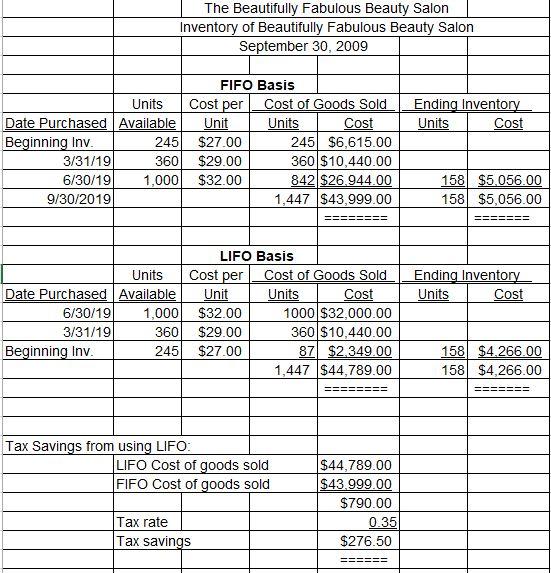

Question: Analyze the above data using the LIFO and FIFO methods: Units Date Purchased Available Beginning Inv. 3/31/19 6/30/19 9/30/2019 6/30/19 3/31/19 The Beautifully Fabulous Beauty

Analyze the above data using the LIFO and FIFO methods:

Units Date Purchased Available Beginning Inv. 3/31/19 6/30/19 9/30/2019 6/30/19 3/31/19 The Beautifully Fabulous Beauty Salon Inventory of Beautifully Fabulous Beauty Salon September 30, 2009 Beginning Inv. 245 360 Cost per Unit $27.00 $29.00 1,000 $32.00 FIFO Basis Units Cost per Date Purchased Available Unit 1,000 $32.00 360 $29.00 245 $27.00 Tax Savings from using LIFO: Tax rate Tax savings Cost of Goods Sold Cost Units 245 $6,615.00 360 $10,440.00 LIFO Basis 842 $26.944.00 1,447 $43,999.00 LIFO Cost of goods sold FIFO Cost of goods sold Cost of Goods Sold Cost Units 1000 $32,000.00 360 $10,440.00 87 $2,349.00 1,447 $44,789.00 == $44,789.00 $43.999.00 $790.00 0.35 $276.50 ====== Ending Inventory Units Cost 158 $5,056.00 158 $5,056.00 ======= Ending Inventory Units Cost 158 $4.266.00 158 $4,266.00

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Using the LIFO method the total cost of goods sold i... View full answer

Get step-by-step solutions from verified subject matter experts