Question: analyze the case presented and develop a financial model in an excel spreadsheet .: a. Refer to the cash flows, discuss the reasons why 3P

analyze the case presented and develop a financial model in an excel spreadsheet .: a. Refer to the cash flows, discuss the reasons why 3P Turbo should consider investing in Brazil, how attractive is the project to 3P Turbo? Brazils inflation rate being volatile, perform sensitivity analyses on the inflation rate and discuss the viability of the investment based on the NPV.

| 5 year case return | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Projected Volume (000) | 28 | 30 | 38 | 44 | 50 | |

| Price per unit (R$) | 2400 | 2616 | 2851.4 | 3108.1 | 3387.8 | |

| Production cost per unit (R$) | 1050 | 1144.5 | 1247.5 | 1359.8 | 1482.2 | |

| Selling cost per unit (R$) | 300 | 327 | 356.4 | 388.5 | 423.5 | |

| Administrative cost per unit (R$) | 100 | 109 | 118.8 | 129.5 | 141.2 | |

| Revenue | 67200 | 78480 | 108355 | 136755 | 169390 | |

| Production cost per unit (R$) | -29400 | -34335 | -47405 | -59830 | -74108 | |

| Gross Profit | 37800 | 44145 | 60950 | 76925 | 95282 | |

| selling cost | -8400 | -9810 | -13544 | -17094 | -21174 | |

| Administrative cost | -2800 | -3270 | -4515 | -5698 | -7058 | |

| Depreciation | -24000 | -24000 | -24000 | -24000 | -24000 | |

| EBIT | 2600 | 7065 | 18890 | 30132 | 43050 | |

| Taxes on Profits (34%) | -884 | -2402 | -6423 | -10245 | -14637 | |

| After-Tax Profit | 1716 | 4663 | 12468 | 19887 | 28413 | |

| Add back depreciation | 24000 | 24000 | 24000 | 24000 | 24000 | |

| Total operating cash flows | 25716 | 28663 | 36468 | 43887 | 52413 | |

| Cost of building and equipment | -120000 | |||||

| Cost of training after tax | -6600 | |||||

| salvage value | 30000 |

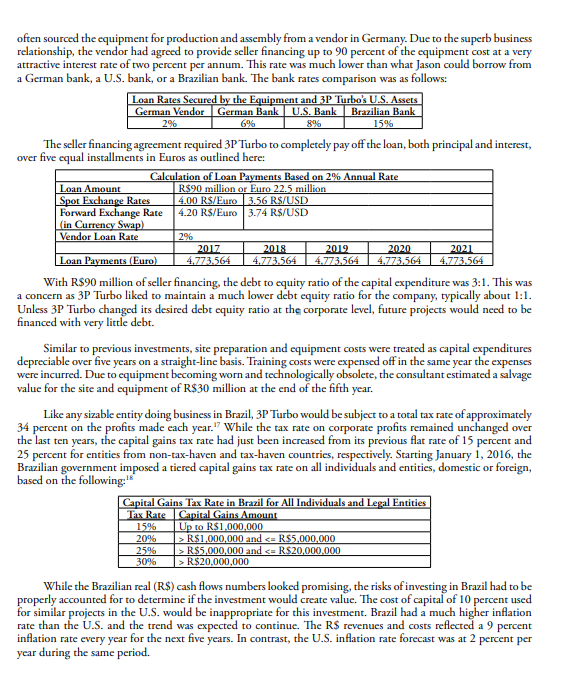

often sourced the equipment for production and assembly from a vendor in Germany. Due to the superb business relationship, the vendor had agreed to provide seller financing up to 90 percent of the equipment cost at a very attractive interest rate of two percent per annum. This rate was much lower than what Jason could borrow from a German bank, a U.S. bank, or a Brazilian bank. The bank rates comparison was as follows: Loan Rates Secured by the Equipment and 3P Turbo's U.S. Assets German Vendor German Bank U.S. Bank Brazilian Bank 6% 8% 15% 2% The seller financing agreement required 3P Turbo to completely pay off the loan, both principal and interest, over five equal installments in Euros as outlined here: Calculation of Loan Payments Based on 2% Annual Rate Loan Amount R$90 million or Euro 22.5 million Spot Exchange Rates 4.00 R$/Euro 3.56 R$/USD Forward Exchange Rate 4.20 R$/Euro 3.74 R$/USD in Currency Swap) Vendor Loan Rate 2% 2017 2018 2019 2020 2021 Loan Payments (Euro) 4.773,564 4.773.564 4.773.564 4.773,564 4.773.564 With R$90 million of seller financing, the debt to equity ratio of the capital expenditure was 3:1. This was a concern as 3P Turbo liked to maintain a much lower debt equity ratio for the company, typically about 1:1. Unless 3P Turbo changed its desired debt equity ratio at the corporate level, future projects would need to be financed with very little debt. Similar to previous investments, site preparation and equipment costs were treated as capital expenditures depreciable over five years on a straight-line basis. Training costs were expensed off in the same year the expenses were incurred. Due to equipment becoming worn and technologically obsolete, the consultant estimated a salvage value for the site and equipment of R$30 million at the end of the fifth year. Like any sizable entity doing business in Brazil, 3P Turbo would be subject to a total tax rate of approximately 34 percent on the profits made each year." While the tax rate on corporate profits remained unchanged over the last ten years, the capital gains tax rate had just been increased from its previous flat rate of 15 percent and 25 percent for entities from non-tax-haven and tax-haven countries, respectively. Starting January 1, 2016, the Brazilian government imposed a tiered capital gains tax rate on all individuals and entities, domestic or foreign, based on the following: Capital Gains Tax Rate in Brazil for All Individuals and Legal Entities Tax Rate Capital Gains Amount 15% Up to R$1,000,000 20% > R$1,000,000 and R$5.000.000 and R$20,000,000 While the Brazilian real (R$) cash flows numbers looked promising, the risks of investing in Brazil had to be properly accounted for to determine if the investment would create value. The cost of capital of 10 percent used for similar projects in the U.S. would be inappropriate for this investment. Brazil had a much higher inflation rate than the U.S. and the trend was expected to continue. The RS revenues and costs reflected a 9 percent inflation rate every year for the next five years. In contrast, the U.S. inflation rate forecast was at 2 percent per year during the same period. often sourced the equipment for production and assembly from a vendor in Germany. Due to the superb business relationship, the vendor had agreed to provide seller financing up to 90 percent of the equipment cost at a very attractive interest rate of two percent per annum. This rate was much lower than what Jason could borrow from a German bank, a U.S. bank, or a Brazilian bank. The bank rates comparison was as follows: Loan Rates Secured by the Equipment and 3P Turbo's U.S. Assets German Vendor German Bank U.S. Bank Brazilian Bank 6% 8% 15% 2% The seller financing agreement required 3P Turbo to completely pay off the loan, both principal and interest, over five equal installments in Euros as outlined here: Calculation of Loan Payments Based on 2% Annual Rate Loan Amount R$90 million or Euro 22.5 million Spot Exchange Rates 4.00 R$/Euro 3.56 R$/USD Forward Exchange Rate 4.20 R$/Euro 3.74 R$/USD in Currency Swap) Vendor Loan Rate 2% 2017 2018 2019 2020 2021 Loan Payments (Euro) 4.773,564 4.773.564 4.773.564 4.773,564 4.773.564 With R$90 million of seller financing, the debt to equity ratio of the capital expenditure was 3:1. This was a concern as 3P Turbo liked to maintain a much lower debt equity ratio for the company, typically about 1:1. Unless 3P Turbo changed its desired debt equity ratio at the corporate level, future projects would need to be financed with very little debt. Similar to previous investments, site preparation and equipment costs were treated as capital expenditures depreciable over five years on a straight-line basis. Training costs were expensed off in the same year the expenses were incurred. Due to equipment becoming worn and technologically obsolete, the consultant estimated a salvage value for the site and equipment of R$30 million at the end of the fifth year. Like any sizable entity doing business in Brazil, 3P Turbo would be subject to a total tax rate of approximately 34 percent on the profits made each year." While the tax rate on corporate profits remained unchanged over the last ten years, the capital gains tax rate had just been increased from its previous flat rate of 15 percent and 25 percent for entities from non-tax-haven and tax-haven countries, respectively. Starting January 1, 2016, the Brazilian government imposed a tiered capital gains tax rate on all individuals and entities, domestic or foreign, based on the following: Capital Gains Tax Rate in Brazil for All Individuals and Legal Entities Tax Rate Capital Gains Amount 15% Up to R$1,000,000 20% > R$1,000,000 and R$5.000.000 and R$20,000,000 While the Brazilian real (R$) cash flows numbers looked promising, the risks of investing in Brazil had to be properly accounted for to determine if the investment would create value. The cost of capital of 10 percent used for similar projects in the U.S. would be inappropriate for this investment. Brazil had a much higher inflation rate than the U.S. and the trend was expected to continue. The RS revenues and costs reflected a 9 percent inflation rate every year for the next five years. In contrast, the U.S. inflation rate forecast was at 2 percent per year during the same period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts