Question: Analyze the data you calculated in problem#4 and discuss the companiesyou chose, Western Tech or Lativa, that (1) havethe better short-term position, and which company

Analyze the data you calculated in problem#4 and discuss the companiesyou chose, Western Tech or Lativa, that (1) havethe better short-term position, and which company (2) would be the better investment. consider the following items noted on the grading rubric in D2L.

Content & Development:Essay is comprehensive anddiscusses the importance for eachmeasure of profitability.Major points are clearly stated andfully developed.Comparisons of calculated resultsbetween companies are noted.

Data Included:Essay includes the data calculated from problem #4(%, not $$).Data is included for bothcompanies as support forstatements made.

Format Length:The required length of essay.The essay should discuss theresults for both companies.

Organization & Structure:Structure is clear and easy tofollow, expressed in a professional manneras if presented to management or a peer group in a work setting.Paragraph transitions are logicaland maintain the flow throughoutthecomments.Introduction and conclusion arepresent and logical. Comments are free from spelling and/or grammar errors, with complete sentences and correct punctuation.

You are not expected to know why the changes happened, just what has changed and how those changes affected different elements in the statements. See the example analysis in D2L.

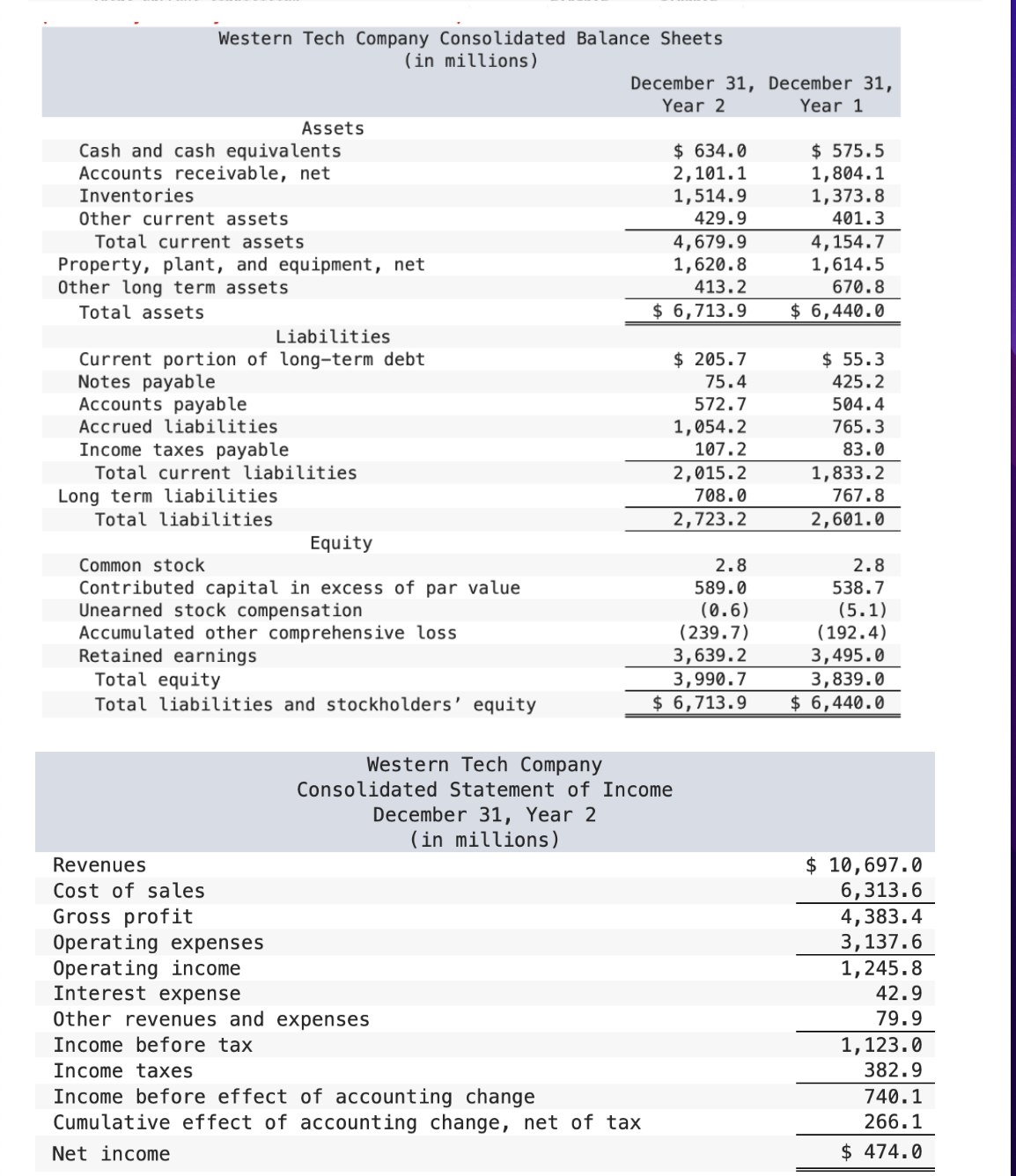

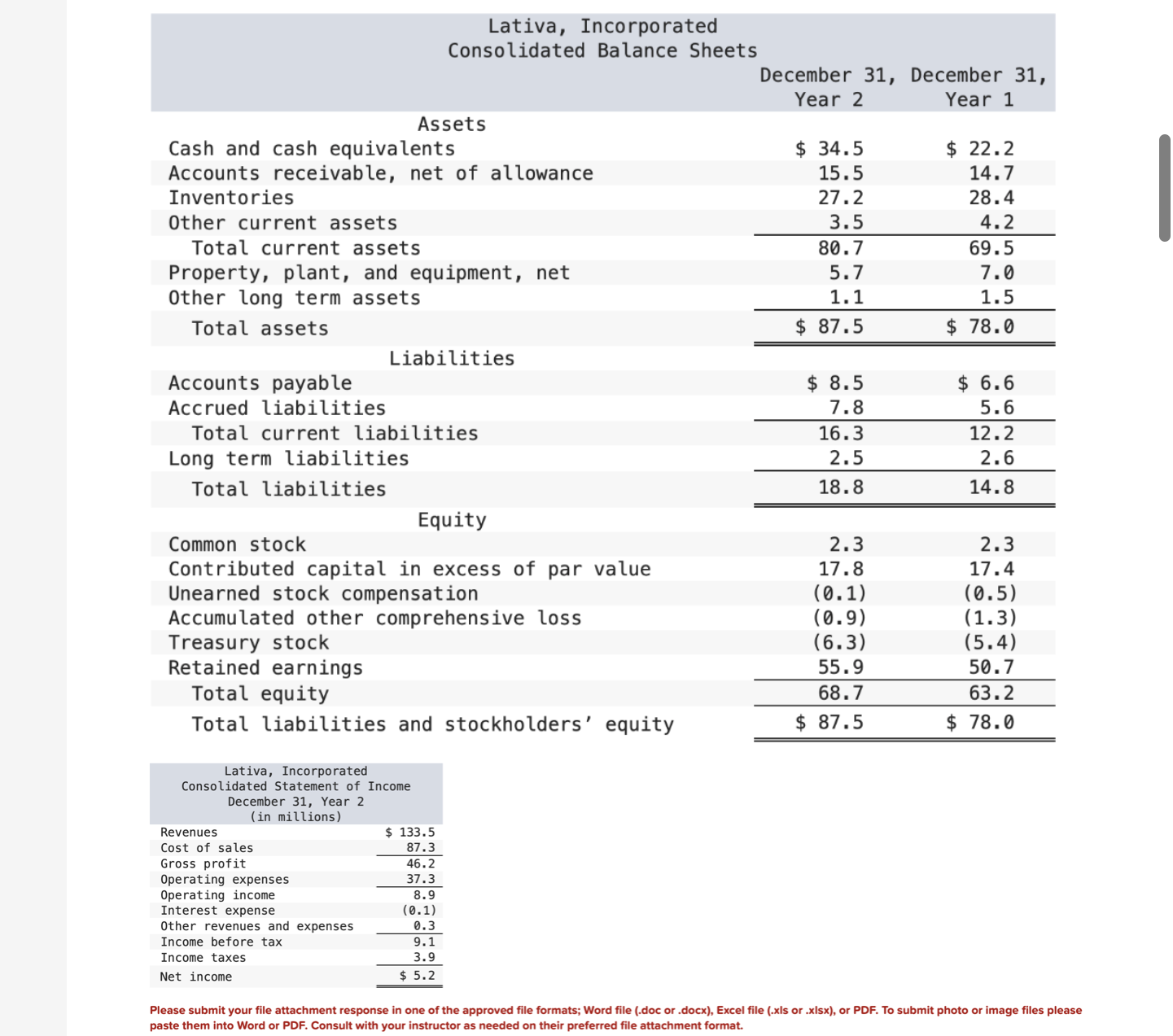

-HEStern Tech Company Consolidated Balance Sheets (in millions) December 31, December 31, Year 2 Year 1 Assets Cash and cash equivalents $ 634.0 5 575.5 Accounts receivable, net 2,101.1 1,804.1 Inventories 1,514.9 1,373.8 Other current assets 429.9 401.3 Total current assets 4,679.9 4,154.7 Property, plant, and equipment, net 1,620.8 1,614.5 Other long term assets 413.2 670.8 Total assets $ 5.713-9 $ 5.440-0 Liabilities Current portion of long-term debt $ 205.7 $ 55.3 Notes payable 75.4 425.2 Accounts payable 572.7 504.4 Accrued liabilities 1,054.2 765.3 Income taxes payable 107.2 83.0 Total current liabilities 2,015.2 1,833.2 Long tenm liabilities 708.0 767.8 Total liabilities 2,723.2 2,601.0 Equity Common stock 2.8 2.8 Contributed capital in excess of par value 589.0 538.7 Unearned stock compensation (0.6) (5.1) Accumulated other comprehensive loss (239.7) (192.4) Retained earnings 3,639.2 3,495.0 Total equity 3,990.7 3,839.0 Total liabilities and stockholders' equity $ 6,713.9 $ 67440-0 Western Tech Company Consolidated Statement of Income December 31, Year 2 (in millions} Revenues $ 10,697.0 Cost of sales 6,313.6 Gross profit 4,383.4 Operating expenses 3,137.6 Operating income 1,245.8 Interest expense 42.9 Other revenues and expenses 79.9 Income before tax 1,123.0 Income taxes 382.9 Income before effect of accounting change 740.1 Cumulative effect of accounting change, net of tax 266.1 Net income $ 474.0 Lativa, Incorporated Consolidated Balance Sheets December 31, December 31, Year 2 Year 1 Assets Cash and cash equivalents $ 34.5 $ 22.2 Accounts receivable, net of allowance 15.5 14.7 Inventories 27.2 28.4 Other current assets 3.5 4. 2 Total current assets 80.7 69.5 Property, plant, and equipment, net 5.7 7. 0 Other long term assets 1. 1 1.5 Total assets $ 87.5 $ 78.0 Liabilities Accounts payable $ 8.5 $ 6.6 Accrued liabilities 7.8 5. 6 Total current liabilities 16.3 12.2 Long term liabilities 2.5 2.6 Total liabilities 18.8 14.8 Equity Common stock 2.3 2.3 Contributed capital in excess of par value 17.8 17.4 Unearned stock compensation (0.1) (0.5) Accumulated other comprehensive loss (0.9) (1.3) Treasury stock (6.3) (5.4) Retained earnings 55.9 50.7 Total equity 68.7 63.2 Total liabilities and stockholders' equity $ 87.5 $ 78.0 Lativa, Incorporated Consolidated Statement of Income December 31, Year 2 (in millions) Revenues $ 133.5 Cost of sales 87.3 Gross profit 46.2 Operating expenses 37.3 Operating income 8.9 Interest expense (0.1) Other revenues and expenses 0.3 Income before tax 9. 1 Income taxes 3.9 Net income $ 5.2 Please submit your file attachment response in one of the approved file formats; Word file (.doc or .docx), Excel file (.xis or .xIsx), or PDF. To submit photo or image files please paste them into Word or PDF. Consult with your instructor as needed on their preferred file attachment format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts