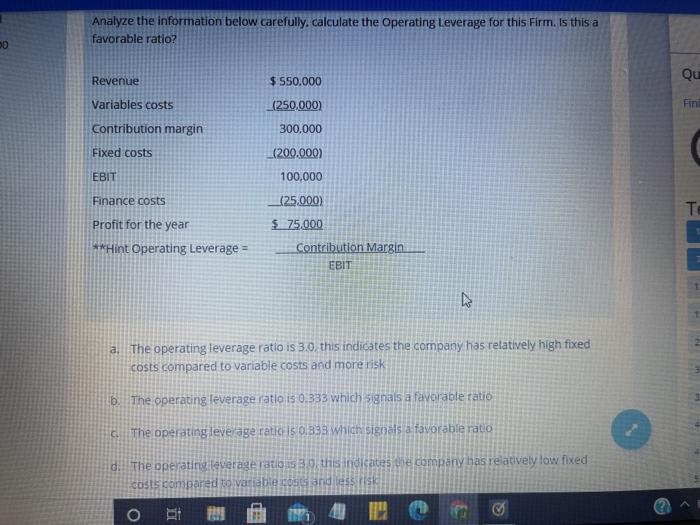

Question: Analyze the information below carefully. calculate the Operating Leverage for this Firm. Is this a favorable ratio? 0 Qu Revenue $550.000 Variables costs (250.000) Fin

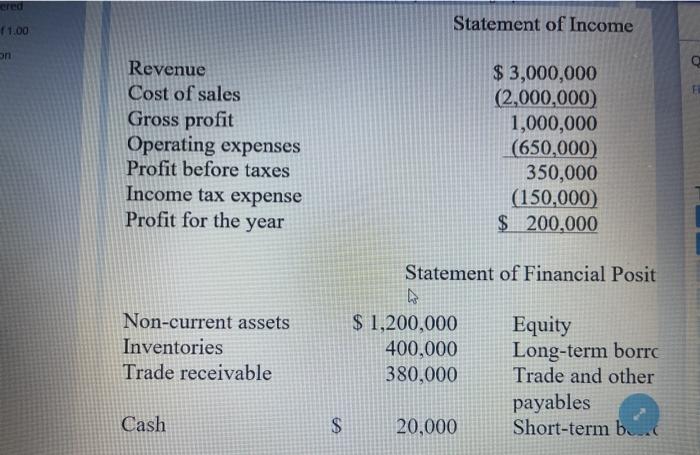

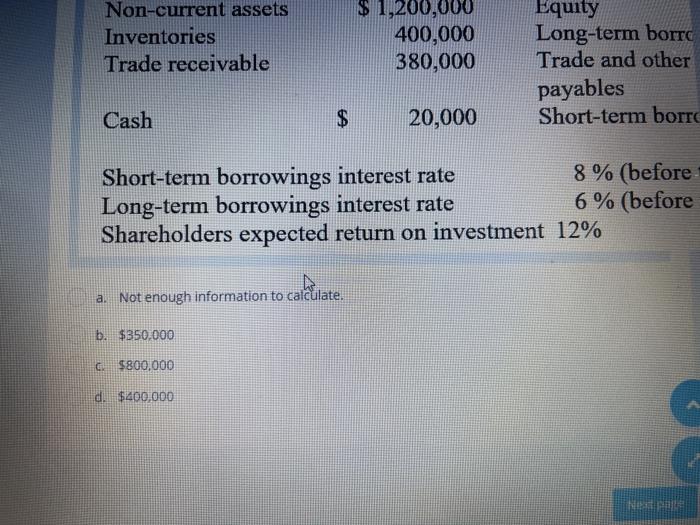

Analyze the information below carefully. calculate the Operating Leverage for this Firm. Is this a favorable ratio? 0 Qu Revenue $550.000 Variables costs (250.000) Fin Contribution margin 300,000 Fixed costs (200.000) EBIT 100,000 Finance costs (25,000) Profit for the year $ 75,000 **Hint Operating Leverage = Contribution Margin EBIT a. The operating leverage ratio is 3.0. this indicates the company has relatively high fixed costs compared to variable costs and more risk b. The operating leverage ratio is 0.333 which signals a favorable ratio The operating leverage rates 0.333 which signals a favorable ratio d. The operating everage ratio is this indicates a company has relatively low fixed costs compared to variable costs and testis o i mi 4 ered (1.00 Statement of Income on Revenue Cost of sales Gross profit Operating expenses Profit before taxes Income tax expense Profit for the year $ 3,000,000 (2,000,000) 1,000,000 (650,000) 350,000 (150,000) $ 200,000 Non-current assets Inventories Trade receivable Statement of Financial Posit N $ 1,200,000 Equity 400,000 Long-term borro 380,000 Trade and other payables 20,000 Short-term bu. Cash $ Non-current assets Inventories Trade receivable $ 1,200,000 400,000 380,000 Equity Long-term borro Trade and other payables Short-term borro Cash $ 20,000 Short-term borrowings interest rate 8% (before Long-term borrowings interest rate 6% (before Shareholders expected return on investment 12% a. Not enough information to calculate. b. $350.000 C. $800,000 d. $400,000 IN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts