Question: analyze the long August 160/170 box spread 6. Using the information provided below, create, and analyze the long August 160/170 box spread. Determine whether a

analyze the long August 160/170 box spread

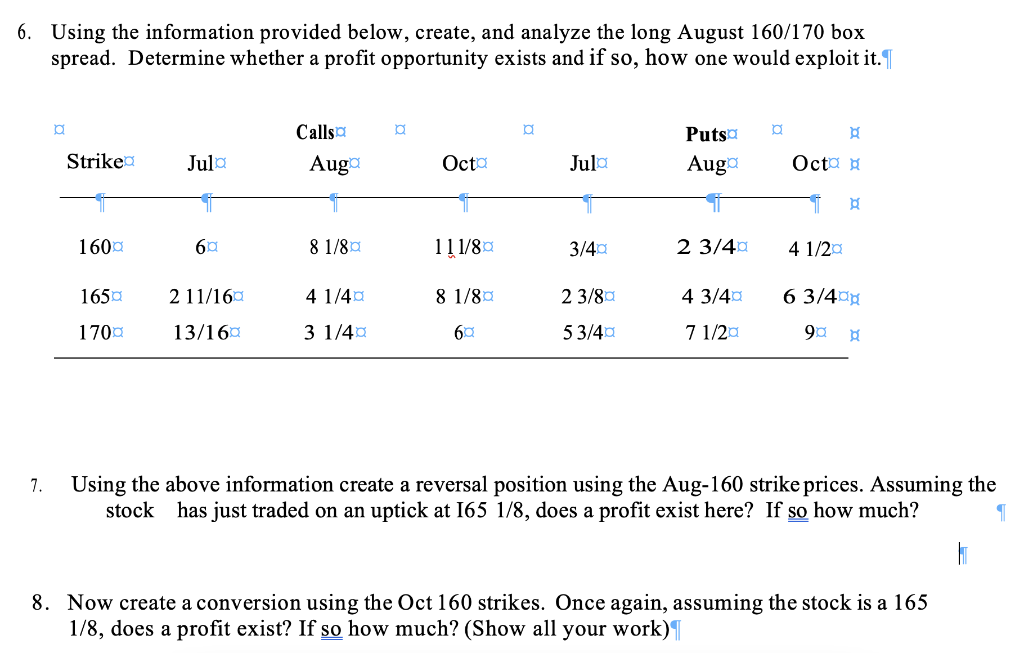

6. Using the information provided below, create, and analyze the long August 160/170 box spread. Determine whether a profit opportunity exists and if so, how one would exploit it.[ Calls Puts 8 Strike Jula Augo Octo Julo Augo Octo 1600 60 8 1/8 111/80 3/40 2 3/40 4 1/20 1650 2 11/160 4 1/40 8 1/80 2 3/80 4 3/40 6 3/400 1700 13/160 3 1/40 60 53/40 7 1/20 908 7. Using the above information create a reversal position using the Aug-160 strike prices. Assuming the stock has just traded on an uptick at 165 1/8, does a profit exist here? If so how much? 8. Now create a conversion using the Oct 160 strikes. Once again, assuming the stock is a 165 1/8, does a profit exist? If so how much? (Show all your work) 6. Using the information provided below, create, and analyze the long August 160/170 box spread. Determine whether a profit opportunity exists and if so, how one would exploit it.[ Calls Puts 8 Strike Jula Augo Octo Julo Augo Octo 1600 60 8 1/8 111/80 3/40 2 3/40 4 1/20 1650 2 11/160 4 1/40 8 1/80 2 3/80 4 3/40 6 3/400 1700 13/160 3 1/40 60 53/40 7 1/20 908 7. Using the above information create a reversal position using the Aug-160 strike prices. Assuming the stock has just traded on an uptick at 165 1/8, does a profit exist here? If so how much? 8. Now create a conversion using the Oct 160 strikes. Once again, assuming the stock is a 165 1/8, does a profit exist? If so how much? (Show all your work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts