Question: Analyze the three cases presented using finance ratios. In your analysis, answer the following questions for each case, INDIVIDUALLY - the ratios used are provided

Analyze the three cases presented using finance ratios. In your analysis, answer the following questions for each case, INDIVIDUALLY - the ratios used are provided in the left column for each scenario. They need to be used to compare to the industry standards and then have the following questions answered based on that analysis - all the data needed for analysis is listed in three images below.

1. Are the companies doing well?

2. What types of firms are these?

3. Is seasonality in existence?

4. What is happening at the company using the ratios given and an evaluation over time and industry?

5. What type of industry is this likely to be?

6. What is the financial condition?

7. What ratios need to improve and how? Which ones are solid and why?

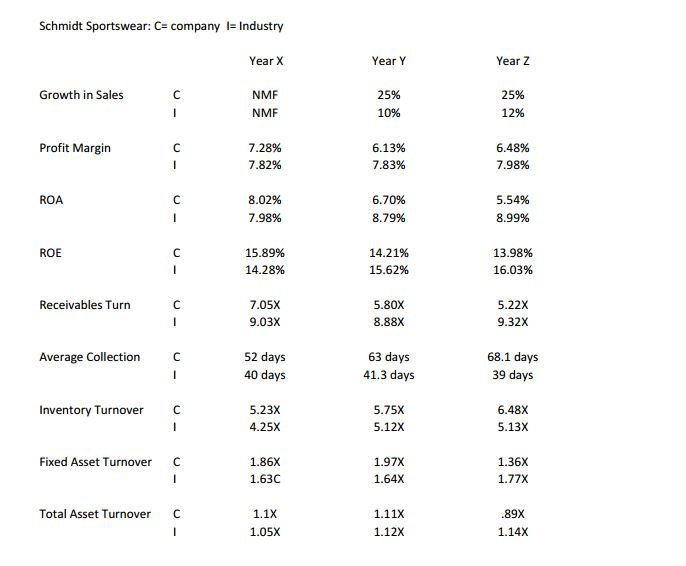

Schmidt Sportswear: C- company ndustry Year X Growth in Sales NMF NMF 7.28% Profit Margin 7.82% ROA 8.02% 7.98% 15.89% ROE 14.28% Receivables Turn 7.05X 9.03X 52 days Average Collection C 40 days Inventory Turnover C 5.23X 4.25X Fixed Asset Turnover C 1.86X 1.63C Total Asset Turnover C 1.1X 1.05X Year Y 25% 10% 6.13% 7.83% 6.70% 8.79% 14.21% 15.62% 5.80X 8.88X 63 days 41.3 days 5.75X 5.12X 1.97X 1.64X 1.11X 1.12X Year Z 25%. 12% 6.48% 7.98% 5.54% 8.99% 13.98% 16.03% 5.22X 9.32X 68.1 days 39 days 6.48X 5.13X 1.36X 1.77X 89X 1.14X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts