Question: Analyzing an Inventory Note Disclosure The inventory note from Deere & Company's recent 1 0 - K follows. basis, or net realizable value. If

Analyzing an Inventory Note Disclosure

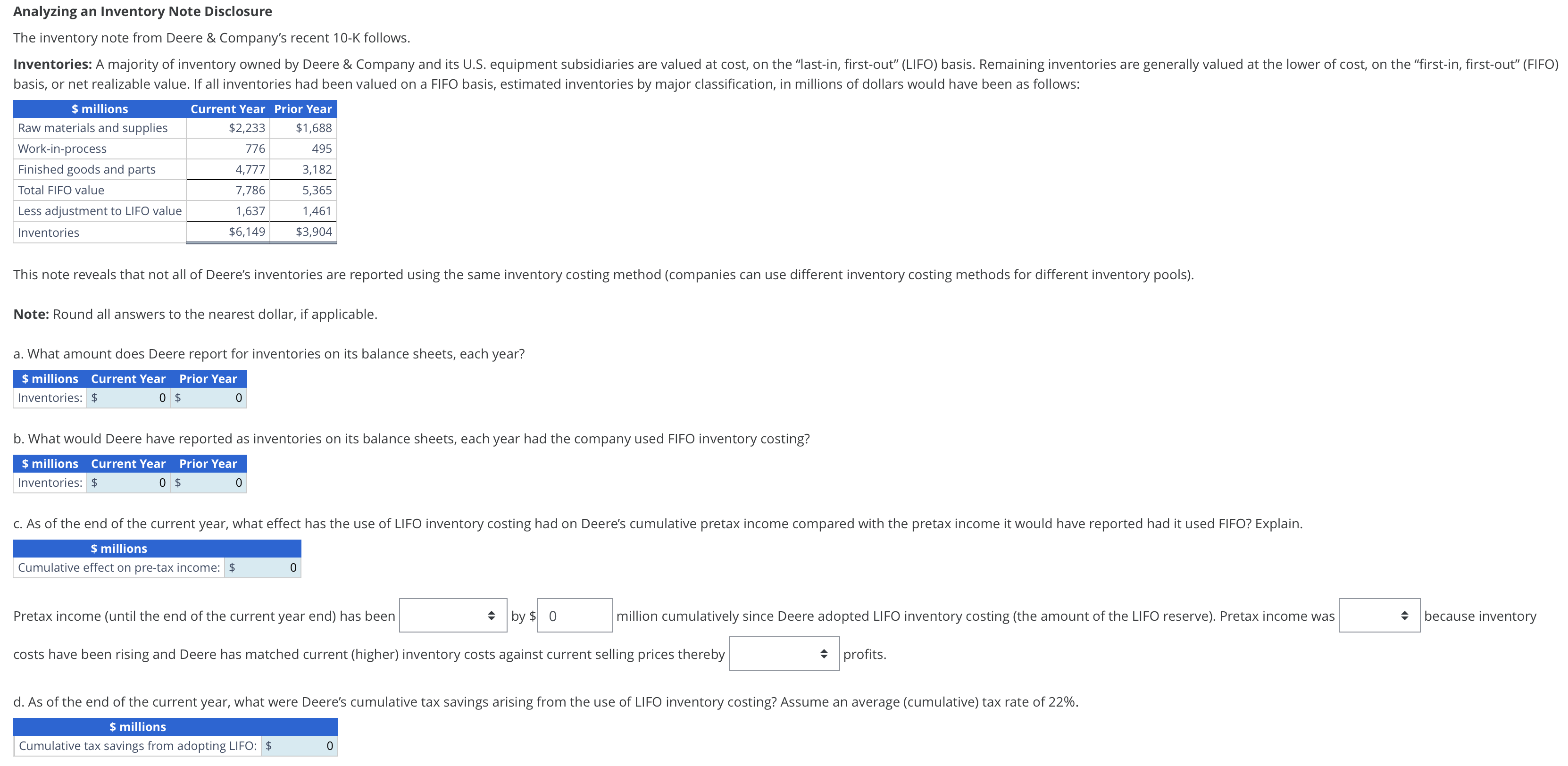

The inventory note from Deere & Company's recent K follows. basis, or net realizable value. If all inventories had been valued on a FIFO basis, estimated inventories by major classification, in millions of dollars would have been as follows:

This note reveals that not all of Deere's inventories are reported using the same inventory costing method companies can use different inventory costing methods for different inventory pools

Note: Round all answers to the nearest dollar, if applicable.

a What amount does Deere report for inventories on its balance sheets, each year?

$ millions Current Year Prior Year

b What would Deere have reported as inventories on its balance sheets, each year had the company used FIFO inventory costing?

c As of the end of the current year, what effect has the use of LIFO inventory costing had on Deere's cumulative pretax income compared with the pretax income it would have reported had it used FIFO? Explain.

$ millions

Cumulative effect on pretax income:

Pretax income until the end of the current year end has been

by $ million cumulatively since Deere adopted LIFO inventory costing the amount of the LIFO reserve Pretax income was because inventory costs have been rising and Deere has matched current higher inventory costs against current selling prices thereby profits.

d As of the end of the current year, what were Deere's cumulative tax savings arising from the use of LIFO inventory costing? Assume an average cumulative tax rate of

$ millions

Cumulative tax savings from adopting LIFO:

$ e What effect has the use of LIFO inventory costing had on Deere's pretax income and tax expense for the current year only assume a income tax rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock