Question: Analyzing and Computing Accrued Wages Liability and Expense Analyzing and Computing Accrued Wages Liability and Expense Demski Company pays its employees on the 1st and

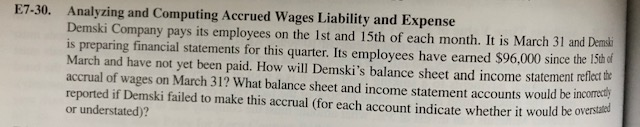

Analyzing and Computing Accrued Wages Liability and Expense

Analyzing and Computing Accrued Wages Liability and Expense Demski Company pays its employees on the 1st and 15th of each month. It is March 31 and Demsli is preparing financial statements for this quarter. Its employees have earned $96,000 since the I5th df March and have not yet been paid. How will Demski's balance sheet and income statement refict accrual of wages on March 31? What balance sheet and income statement accounts would be incomec reported if Demski failed to make this accrual (for each account indicate whether it would be ove or understated)? E7-30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts