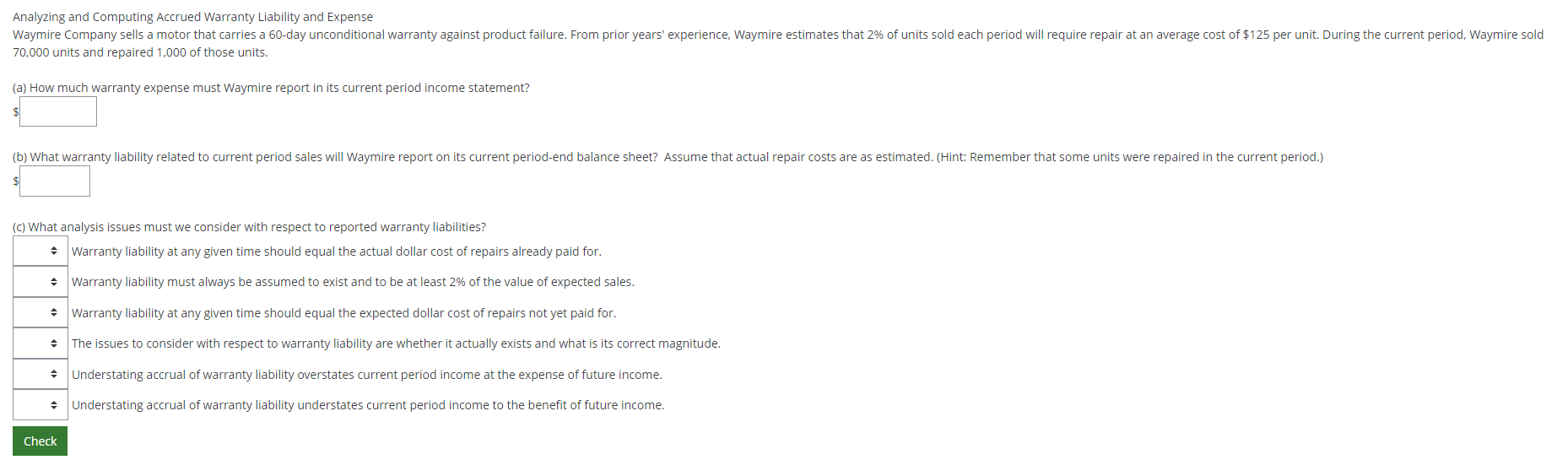

Question: Analyzing and Computing Accrued Warranty Liability and Expense 7 0 , 0 0 0 units and repaired 1 , 0 0 0 of those units.

Analyzing and Computing Accrued Warranty Liability and Expense units and repaired of those units.

a How much warranty expense must Waymire report in its current period income statement?

b What warranty liability related to current period sales will Waymire report on its current periodend balance sheet? Assume that actual repair costs are as estimated. Hint: Remember that some units were repaired in the current period.

c What analysis issues must we consider with respect to reported warranty liabilities? Yes or No Warranty liability at any given time should equal the actual dollar cost of repairs already paid for. Warranty liability must always be assumed to exist and to be at least of the value of expected sales. Warranty liability at any given time should equal the expected dollar cost of repairs not yet paid for. The issues to consider with respect to warranty liability are whether it actually exists and what is its correct magnitude. Understating accrual of warranty liability overstates current period income at the expense of future income. Understating accrual of warranty liability understates current period income to the benefit of future income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock