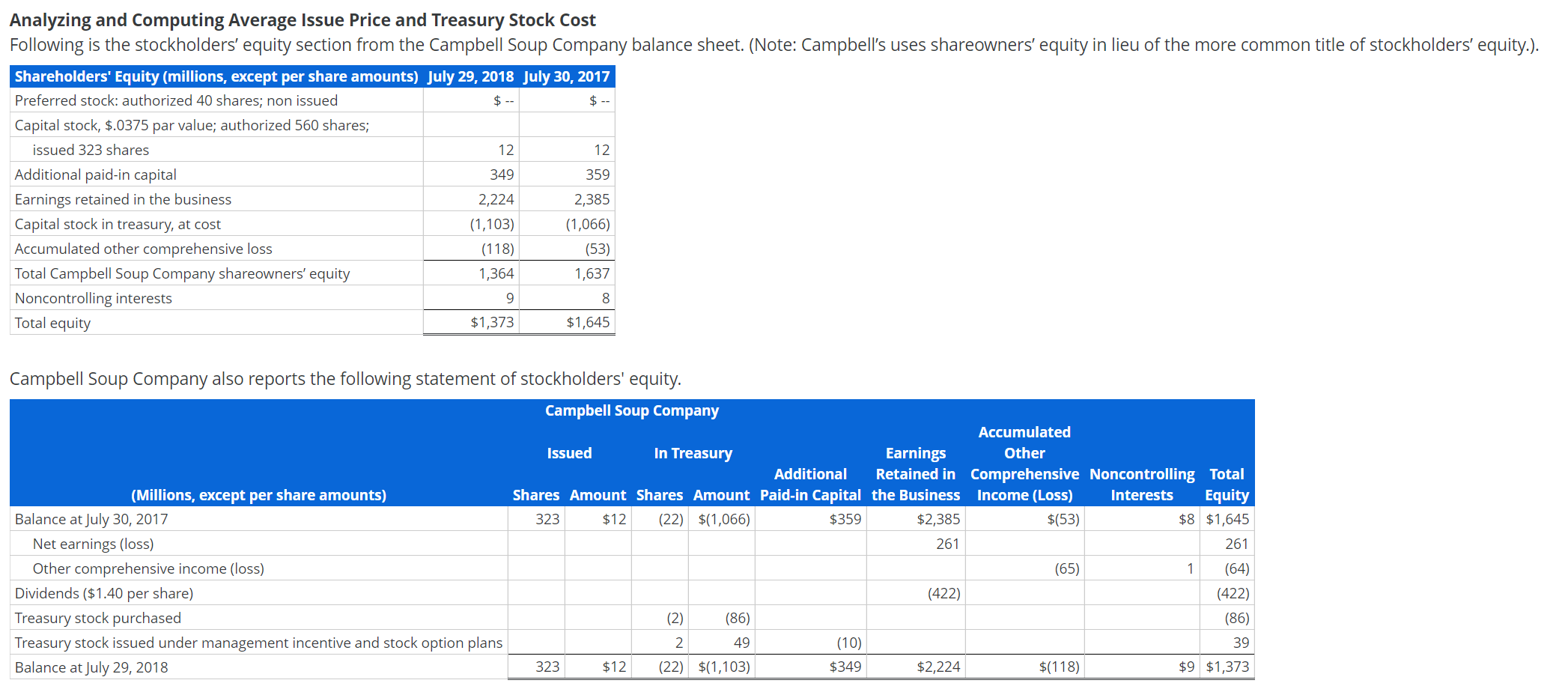

Question: $ -- Analyzing and Computing Average Issue Price and Treasury Stock Cost Following is the stockholders' equity section from the Campbell Soup Company balance sheet.

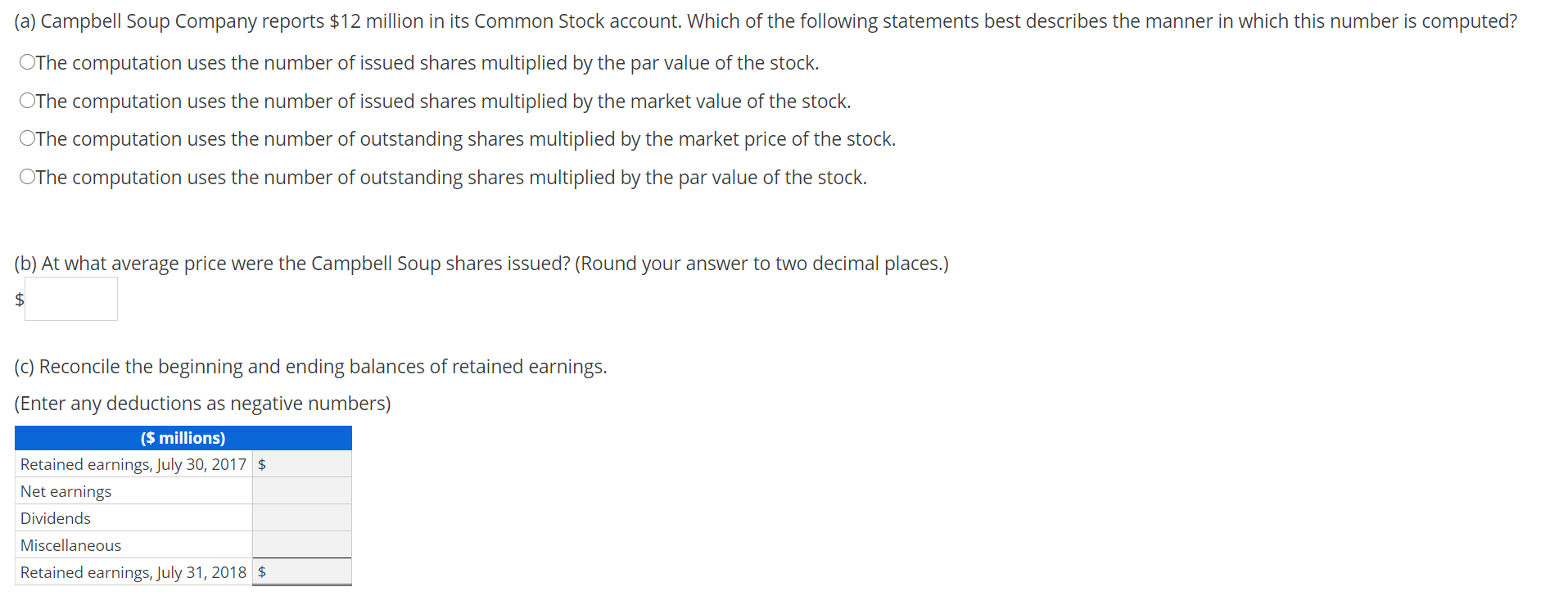

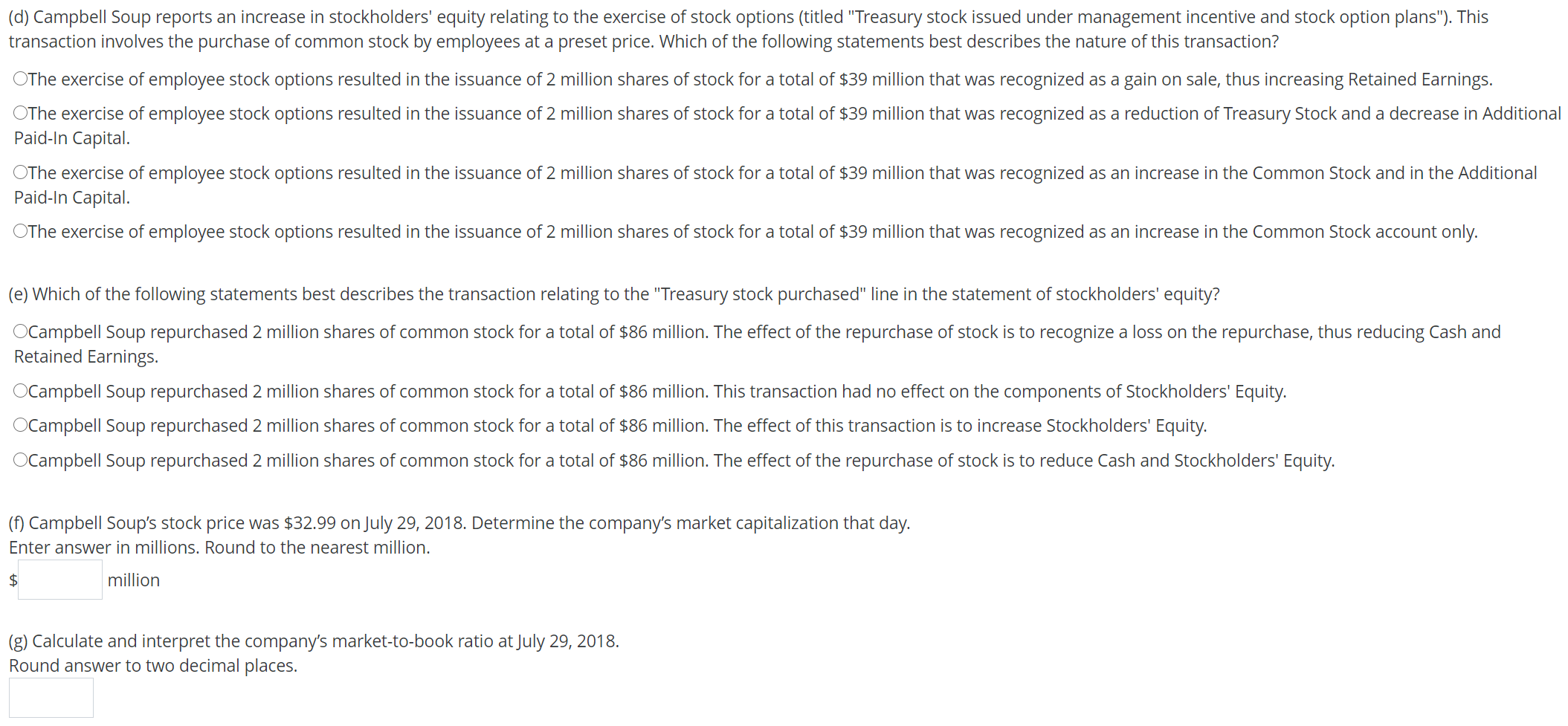

$ -- Analyzing and Computing Average Issue Price and Treasury Stock Cost Following is the stockholders' equity section from the Campbell Soup Company balance sheet. (Note: Campbell's uses shareowners' equity in lieu of the more common title of stockholders' equity.). Shareholders' Equity (millions, except per share amounts) July 29, 2018 July 30, 2017 Preferred stock: authorized 40 shares; non issued $ -- Capital stock, $.0375 par value; authorized 560 shares; issued 323 shares 12 12 Additional paid-in capital 349 359 Earnings retained in the business 2,224 2,385 Capital stock in treasury, at cost (1,103) (1,066) Accumulated other comprehensive loss (118) (53) Total Campbell Soup Company shareowners' equity 1,364 1,637 Noncontrolling interests $1,373 $1,645 9 8 Total equity Campbell Soup Company also reports the following statement of stockholders' equity. Campbell Soup Company Accumulated Issued In Treasury Earnings Other Additional Retained in Comprehensive Noncontrolling Total (Millions, except per share amounts) Shares Amount Shares Amount Paid-in Capital the Business Income (Loss) Interests Equity Balance at July 30, 2017 323 $12 (22) $(1,066) $359 $2,385 $(53) $8 $1,645 Net earnings (loss) 261 261 Other comprehensive income (loss) (65) 1 (64) Dividends ($1.40 per share) (422) (422) Treasury stock purchased (2) (86) (86) Treasury stock issued under management incentive and stock option plans 2 49 (10) 39 Balance at July 29, 2018 323 $12 (22) $(1,103) $349 $2,224 $(118) $9 $1,373 (a) Campbell Soup Company reports $12 million in its Common Stock account. Which of the following statements best describes the manner in which this number is computed? OThe computation uses the number of issued shares multiplied by the par value of the stock. OThe computation uses the number of issued shares multiplied by the market value of the stock. OThe computation uses the number of outstanding shares multiplied by the market price of the stock. OThe computation uses the number of outstanding shares multiplied by the par value of the stock. (b) At what average price were the Campbell Soup shares issued? (Round your answer to two decimal places.) (C) Reconcile the beginning and ending balances of retained earnings. (Enter any deductions as negative numbers) ($ millions) Retained earnings, July 30, 2017 $ Net earnings Dividends Miscellaneous Retained earnings, July 31, 2018 $ (d) Campbell Soup reports an increase in stockholders' equity relating to the exercise of stock options (titled "Treasury stock issued under management incentive and stock option plans"). This transaction involves the purchase of common stock by employees at a preset price. Which of the following statements best describes the nature of this transaction? OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as a gain on sale, thus increasing Retained Earnings. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as a reduction of Treasury Stock and a decrease in Additional Paid-In Capital. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as an increase in the Common Stock and in the Additional Paid-In Capital. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as an increase in the Common Stock account only. (e) Which of the following statements best describes the transaction relating to the "Treasury stock purchased" line in the statement of stockholders' equity? OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of the repurchase of stock is to recognize a loss on the repurchase, thus reducing Cash and Retained Earnings. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. This transaction had no effect on the components of Stockholders' Equity. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of this transaction is to increase Stockholders' Equity. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of the repurchase of stock is to reduce Cash and Stockholders' Equity. (f) Campbell Soup's stock price was $32.99 on July 29, 2018. Determine the company's market capitalization that day. Enter answer in millions. Round to the nearest million. $ million (g) Calculate and interpret the company's market-to-book ratio at July 29, 2018. Round answer to two decimal places. $ -- Analyzing and Computing Average Issue Price and Treasury Stock Cost Following is the stockholders' equity section from the Campbell Soup Company balance sheet. (Note: Campbell's uses shareowners' equity in lieu of the more common title of stockholders' equity.). Shareholders' Equity (millions, except per share amounts) July 29, 2018 July 30, 2017 Preferred stock: authorized 40 shares; non issued $ -- Capital stock, $.0375 par value; authorized 560 shares; issued 323 shares 12 12 Additional paid-in capital 349 359 Earnings retained in the business 2,224 2,385 Capital stock in treasury, at cost (1,103) (1,066) Accumulated other comprehensive loss (118) (53) Total Campbell Soup Company shareowners' equity 1,364 1,637 Noncontrolling interests $1,373 $1,645 9 8 Total equity Campbell Soup Company also reports the following statement of stockholders' equity. Campbell Soup Company Accumulated Issued In Treasury Earnings Other Additional Retained in Comprehensive Noncontrolling Total (Millions, except per share amounts) Shares Amount Shares Amount Paid-in Capital the Business Income (Loss) Interests Equity Balance at July 30, 2017 323 $12 (22) $(1,066) $359 $2,385 $(53) $8 $1,645 Net earnings (loss) 261 261 Other comprehensive income (loss) (65) 1 (64) Dividends ($1.40 per share) (422) (422) Treasury stock purchased (2) (86) (86) Treasury stock issued under management incentive and stock option plans 2 49 (10) 39 Balance at July 29, 2018 323 $12 (22) $(1,103) $349 $2,224 $(118) $9 $1,373 (a) Campbell Soup Company reports $12 million in its Common Stock account. Which of the following statements best describes the manner in which this number is computed? OThe computation uses the number of issued shares multiplied by the par value of the stock. OThe computation uses the number of issued shares multiplied by the market value of the stock. OThe computation uses the number of outstanding shares multiplied by the market price of the stock. OThe computation uses the number of outstanding shares multiplied by the par value of the stock. (b) At what average price were the Campbell Soup shares issued? (Round your answer to two decimal places.) (C) Reconcile the beginning and ending balances of retained earnings. (Enter any deductions as negative numbers) ($ millions) Retained earnings, July 30, 2017 $ Net earnings Dividends Miscellaneous Retained earnings, July 31, 2018 $ (d) Campbell Soup reports an increase in stockholders' equity relating to the exercise of stock options (titled "Treasury stock issued under management incentive and stock option plans"). This transaction involves the purchase of common stock by employees at a preset price. Which of the following statements best describes the nature of this transaction? OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as a gain on sale, thus increasing Retained Earnings. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as a reduction of Treasury Stock and a decrease in Additional Paid-In Capital. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as an increase in the Common Stock and in the Additional Paid-In Capital. OThe exercise of employee stock options resulted in the issuance of 2 million shares of stock for a total of $39 million that was recognized as an increase in the Common Stock account only. (e) Which of the following statements best describes the transaction relating to the "Treasury stock purchased" line in the statement of stockholders' equity? OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of the repurchase of stock is to recognize a loss on the repurchase, thus reducing Cash and Retained Earnings. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. This transaction had no effect on the components of Stockholders' Equity. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of this transaction is to increase Stockholders' Equity. OCampbell Soup repurchased 2 million shares of common stock for a total of $86 million. The effect of the repurchase of stock is to reduce Cash and Stockholders' Equity. (f) Campbell Soup's stock price was $32.99 on July 29, 2018. Determine the company's market capitalization that day. Enter answer in millions. Round to the nearest million. $ million (g) Calculate and interpret the company's market-to-book ratio at July 29, 2018. Round answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts