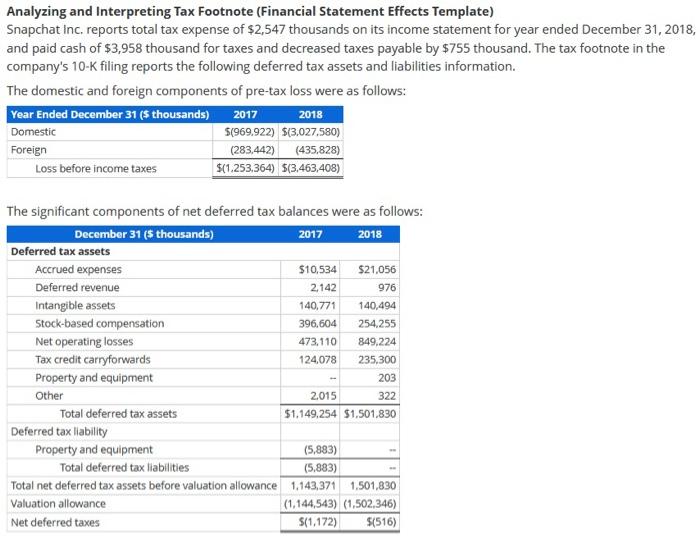

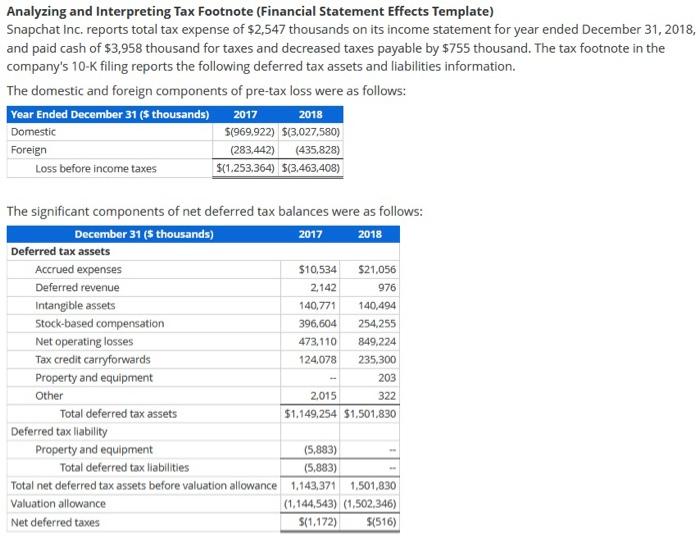

Question: Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Snapchat Inc, reports total tax expense of $2,547 thousands on its income statement for year ended

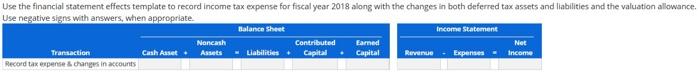

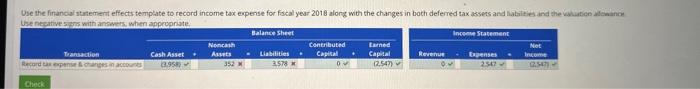

Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Snapchat Inc, reports total tax expense of $2,547 thousands on its income statement for year ended December 31,2018 , and paid cash of $3,958 thousand for taxes and decreased taxes payable by $755 thousand. The tax footnote in the company's 10-K filing reports the following deferred tax assets and liabilities information. The domestic and foreign components of pre-tax loss were as follows: The significant components of net deferred tax balances were as follows: Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Snapchat Inc, reports total tax expense of $2,547 thousands on its income statement for year ended December 31,2018 , and paid cash of $3,958 thousand for taxes and decreased taxes payable by $755 thousand. The tax footnote in the company's 10-K filing reports the following deferred tax assets and liabilities information. The domestic and foreign components of pre-tax loss were as follows: The significant components of net deferred tax balances were as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts