Question: Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Under Armour, Inc. reports total tax expense on its income statement for year ended December 31,

Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template)

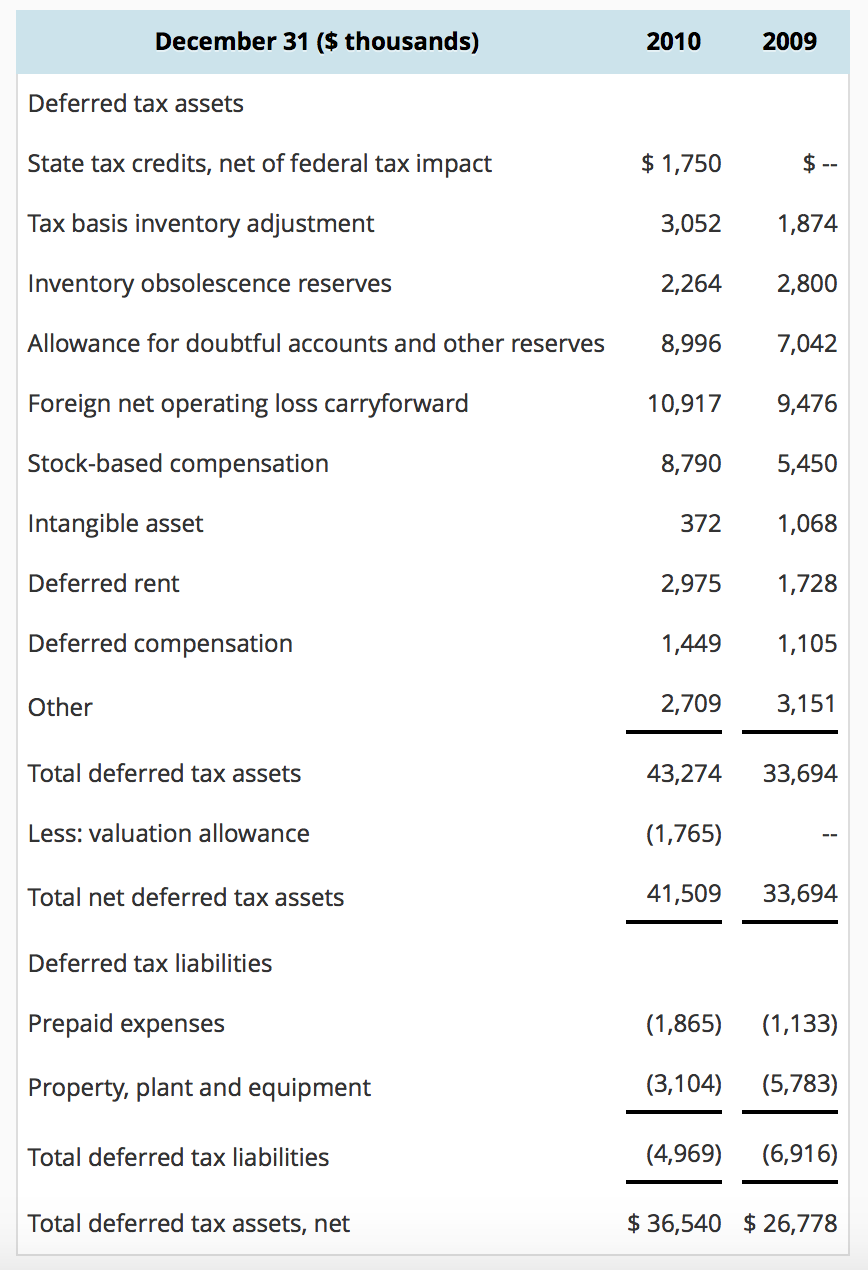

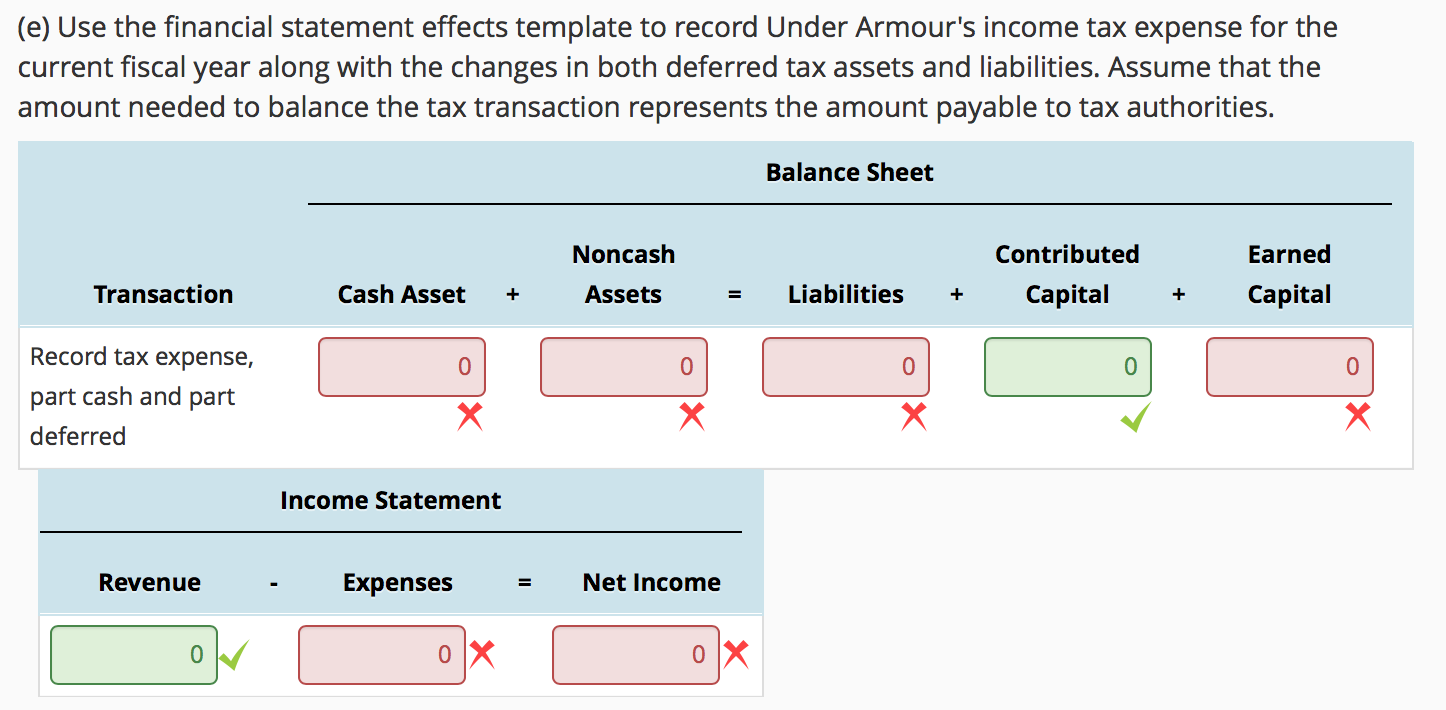

Under Armour, Inc. reports total tax expense on its income statement for year ended December 31, 2010 of $40,442 and cash paid for taxes of $38,773. The tax footnote in the company's 10-K filing, reports the following deferred tax information. Deferred tax assets and liabilities consisted of the following (in thousands):

(a) Did Under Armour's deferred tax assets increase or decrease during the most recent fiscal year? By $?

(b) Did Under Armour's deferred tax liabilities increase or decrease during the most recent fiscal year?

(d) What proportion of the foreign net operating losses does the company believe will likely expire unused? (Round your answer to the nearest whole number)

Thank you!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts