Question: Analyzing Asset Management Effectiveness Presented below are selected financial data from the Coca-Cola Enterprises, Inc., annual report. Using the ratio definitions from Exhibit 4.6, calculate

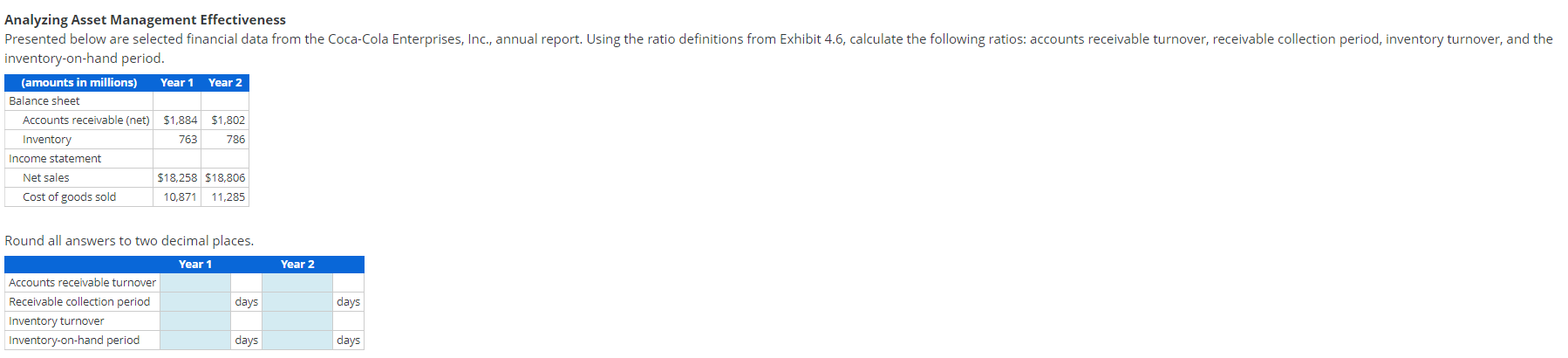

Analyzing Asset Management Effectiveness Presented below are selected financial data from the Coca-Cola Enterprises, Inc., annual report. Using the ratio definitions from Exhibit 4.6, calculate the following ratios: accounts receivable turnover, receivable collection period, inventory turnover, and the inventory-on-hand period. (amounts in millions) Year 1 Year 2 Balance sheet Accounts receivable (net) $1,884 $1,802 Inventory 763 786 Income statement Net sales $18,258 $18,806 Cost of goods sold 10,871 11,285 Round all answers to two decimal places. Year 1 Year 2 days days Accounts receivable turnover Receivable collection period Inventory turnover Inventory-on-hand period days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts