Question: Analyzing Asset Management Effectiveness Presented below are selected financial data from the The Coca-Cola Company 2018 annual report. Using the ratio definitions from Exhibit 4.6,

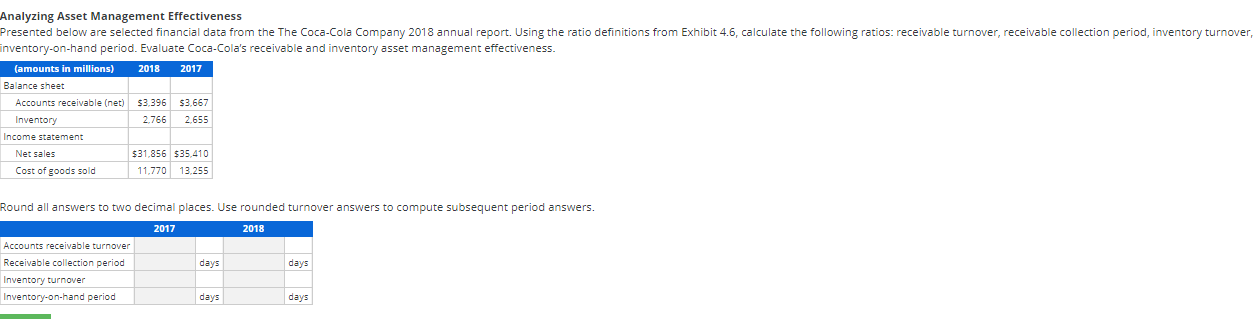

Analyzing Asset Management Effectiveness Presented below are selected financial data from the The Coca-Cola Company 2018 annual report. Using the ratio definitions from Exhibit 4.6, calculate the following ratios: receivable turnover, receivable collection period, inventory turnover, inventory-on-hand period. Evaluate Coca-Cola's receivable and inventory asset management effectiveness. (amounts in millions) 2018 2017 Balance sheet Accounts receivable (net) $3.396 $3.667 Inventory 2.766 2.655 Income statement $31.856 $35.410 Cost of goods sold 11.770 13.255 Net sales Round all answers to two decimal places. Use rounded turnover answers to compute subsequent period answers. 2017 2018 Accounts receivable turnover Receivable collection period days days Inventory turnover Inventory-on-hand period days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts