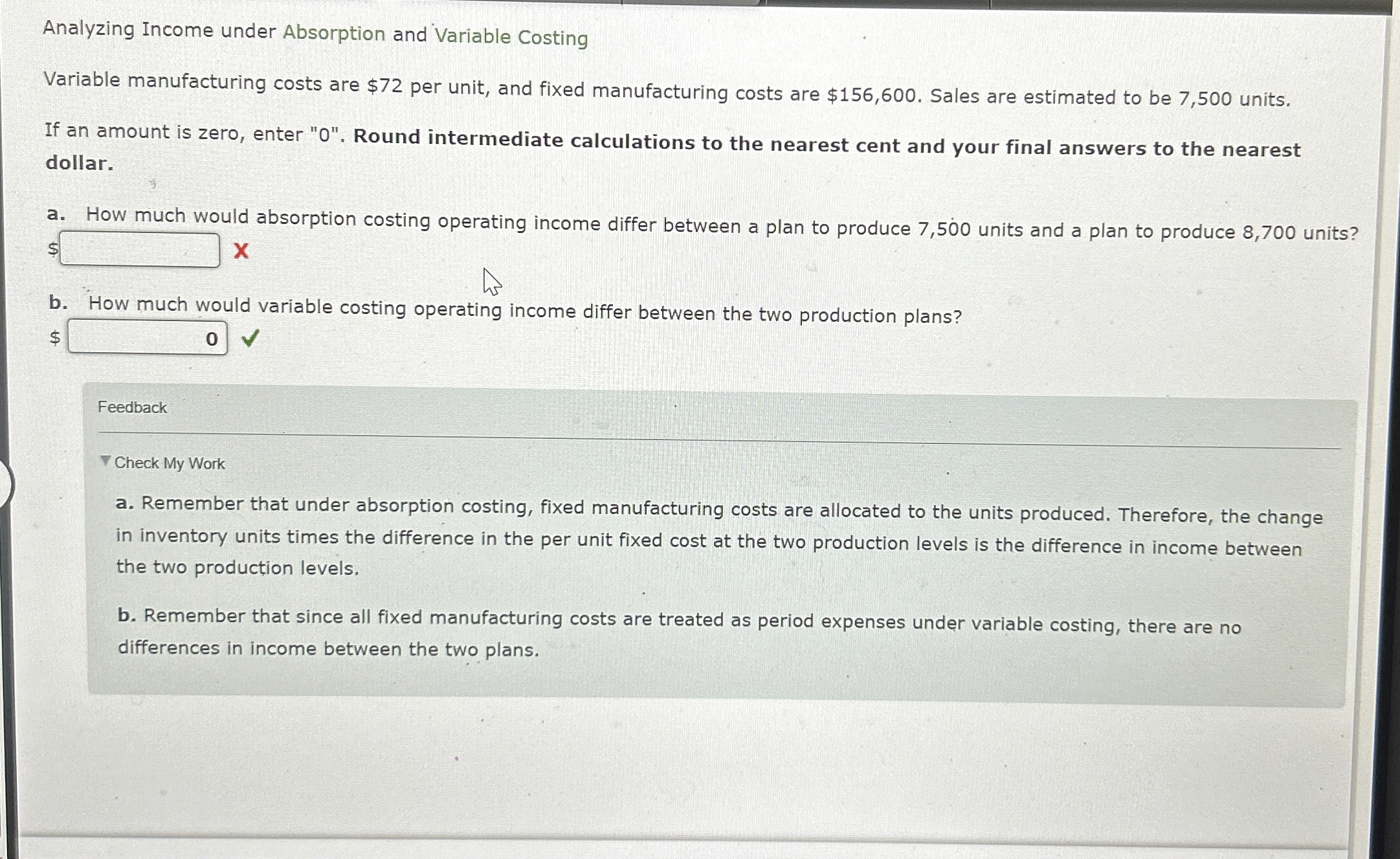

Question: Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $ 7 2 per unit, and fixed manufacturing costs are $ 1 5 6

Analyzing Income under Absorption and Variable Costing

Variable manufacturing costs are $ per unit, and fixed manufacturing costs are $ Sales are estimated to be units. If an amount is zero, enter Round intermediate calculations to the nearest cent and your final answers to the nearest dollar.

a How much would absorption costing operating income differ between a plan to produce units and a plan to produce units?

b How much would variable costing operating income differ between the two production plans?

$

Feedback

Check My Work

a Remember that under absorption costing, fixed manufacturing costs are allocated to the units produced. Therefore, the change in inventory units times the difference in the per unit fixed cost at the two production levels is the difference in income between the two production levels.

b Remember that since all fixed manufacturing costs are treated as period expenses under variable costing, there are no differences in income between the two plans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock