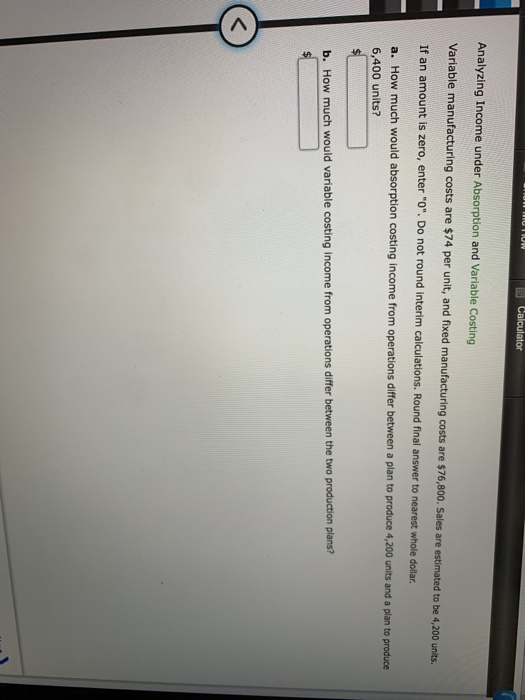

Question: Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $74 per unit, and fixed manufacturing costs are $76,800. Sales are estimated to be

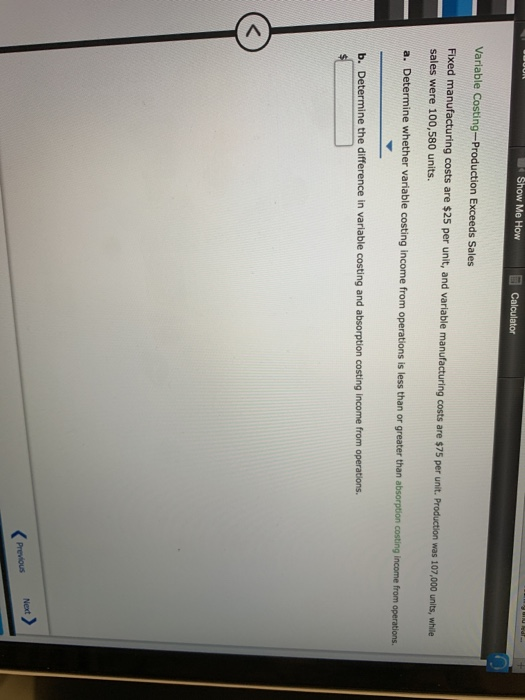

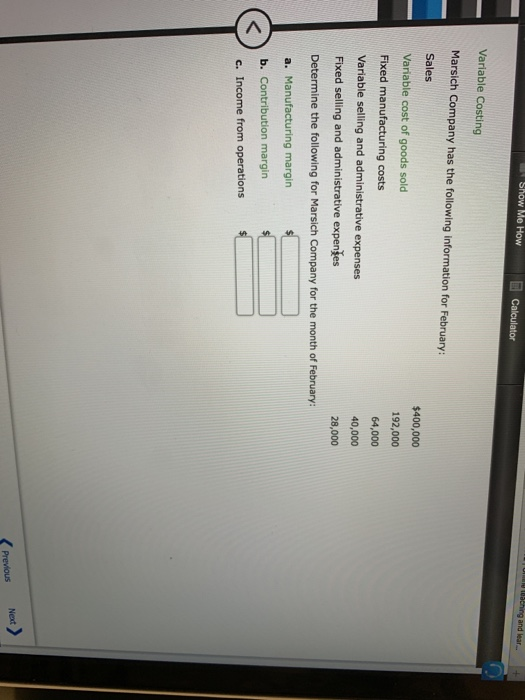

Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $74 per unit, and fixed manufacturing costs are $76,800. Sales are estimated to be 4,200 units. If an amount is zero, enter "O". Do not round interim calculations. Round f a. How much would absorption costing income from operations differ between a plan to produce 4,200 units and a plan to produce 6,400 units? final answer to nearest whole dollar b. How much would variable costing income from operations differ between the two production plans? Show Me How Calculator Variable Costing-Production Exceeds Sales Fixed manufacturing costs are $25 per unit, and variable manufacturing costs are $75 per unit. Production was 107,000 units, while sales were 100,580 units. a. Determine whether variable costing income from operations is less than or greater than absorption costing income from operations b. Determine the difference in variable costing and absorption costing income from operations Next lBaching and lear Variable Costing Marsich Company has the following information for February: Sales Variable cost of goods sold Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenjes Determine the following for Marsich Company for the month of February: a. Manufacturing margin b. Contribution margin c. Income from operations $400,000 192,000 64,000 40,000 28,000 PreviousNext

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts