Question: Analyzing Inventories Using LIFO Inventory Disclosure Note The disclosure note below is from the 2 0 2 0 1 0 - K report of Casey's

Analyzing Inventories Using LIFO Inventory Disclosure Note

The disclosure note below is from the K report of Casey's General Stores, Inc., an

operator of convenience stores $ thousands

Inventories

Inventories, which consist of merchandise and fuel, are stated at the lower of cost or market. For

fuel, cost is determined through the use of the firstin firstout FIFO method. For merchandise

inventories, cost is determined through the use of the lastin firstout LIFO method. The excess of

replacement cost over the stated LIFO value was $ and $ at April and

respectively. There were no material LIFO liquidations during the period presented. Below is a

summary of the inventory values at April and

In Casey's General Stores reported sales revenue of $ million and cost of goods sold of

$ million.

a Calculate the amount of inventories purchased by Casey's General Stores in Round

intermediate calculations and answers to one decimal place.

& million.

b What amount of gross profit would Casey's General Stores have reported if the FIFO method had

been used to value all inventories in Round intermediate calculations and answer to one

decimal place.

q

million

c Calculate the gross profit margin GPM as reported and assuming that the FIFO method had

been used to value all inventories. Round answers to two decimal places ie

As reported

Under FIFO

A majority of inventory owned by Deere & Company and its US equipment subsidiaries are valued at cost on the "lastin firstout" LIFO basis. Remaining

inventories are generally valued at the lower of cost on the "firstin firstout" FIFO basis, or net realizable value. The value of gross inventories on the LIFO basis

at November and November represented percent and percent, respectively, of worldwide gross inventories at FIFO value. The pretax

favorable income effect from the liquidation of LIFO inventory during was $ million. If all inventories had been valued on a FIFO basis, estimated

inventories by major classification at November and November in millions of dollars would have been as follows:

We note that not all of Deere's inventories are reported using the same inventory costing method companies can use different inventory costing methods for

different inventory pools

a At what dollar amount are Deere's inventories reported on its balance sheet?

$ million

b At what dollar amount would inventories have been reported on Deere's balance sheet had it used FIFO inventory costing?

q million

c What cumulative effect has the use of LIFO inventory costing had, as of yearend on its pretax income compared with the pretax income it would have

reported had it used FIFO inventory costing?

Show an increase as a positive number and a decrease as a negative number.

$ million

d Assuming a income tax rate, by what cumulative dollar amount has Deere's tax liability been affected by use of LIFO inventory costing as of yearend

Show an increase as a positive number and a decrease as a negative number. Round your answer to one decimal place.

$ million

e What effect has the use of LIFO inventory costing had on Deere's pretax income and tax liability for assume a income tax rate

Show an increase as a positive number and a decrease as a negative number. Round your answers to one decimal place.

Pretax income: $ million

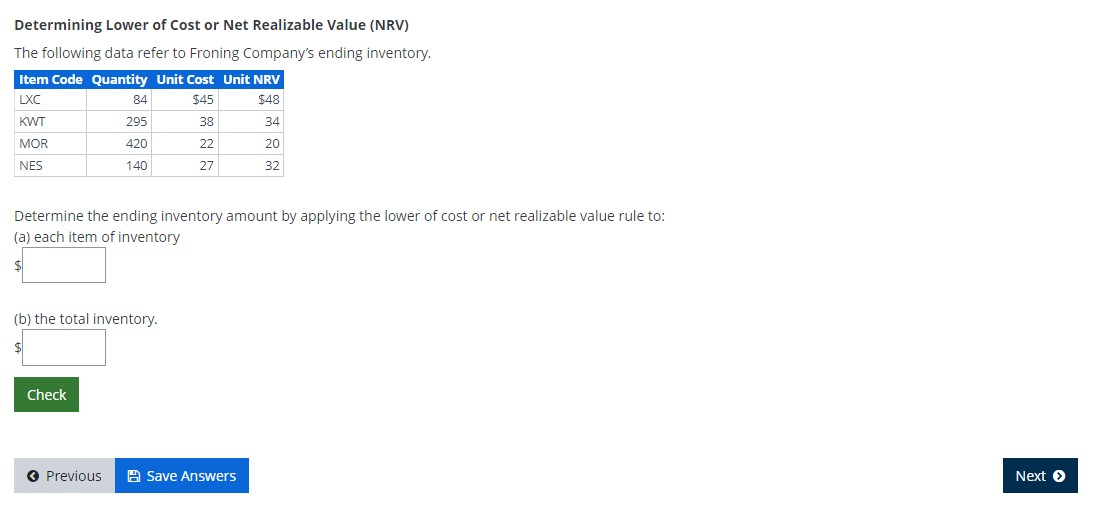

Determining Lower of Cost or Net Realizable Value NRV

The following data refer to Froning Company's ending inventory.

Determine the ending inventory amount by applying the lower of cost or net realizable value rule to:

a each item of inventory

b the total inventory.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock