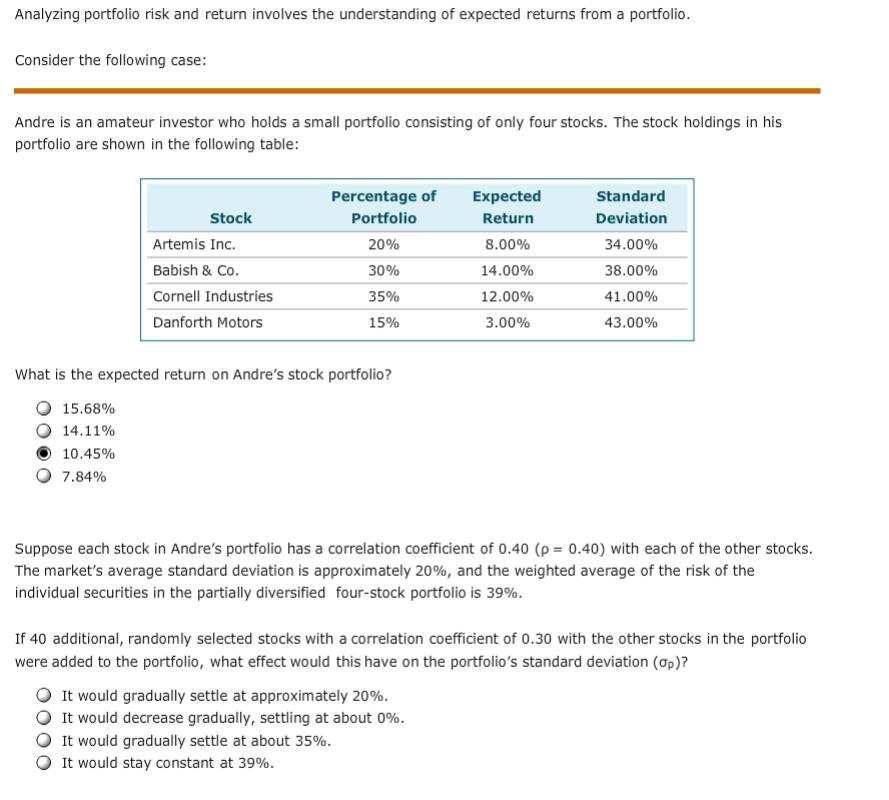

Question: Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio Consider the following case Andre is an amateur investor who holds

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio Consider the following case Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table Percentage of Expected Standard Deviation 34.00% 38.00% 41.00% 43.00% Stock Artemis Inc. Babish & Co Cornell Industries Danforth Motors Portfolio 20% 30% 35% 15% Return 8.00% 14.00% 12.00% 3.00% What is the expected return on Andre's stock portfolio? 15.68% 14.11% 10.45% 7.84% Suppose each stock in Andre's portfolio has a correlation coefficient of 0.40 ( = 0.40) with each of the other stocks The market's average standard deviation is approximately 20%, and the weighted average of the risk of the individual securities in the partially diversified four-stock portfolio is 39% If 40 additional, randomly selected stocks with a correlation coefficient of 0.30 with the other stocks in the portfolic were added to the portfolio, what effect would this have on the portfolio's standard deviation (ap)? It would gradually settle at approximately 20% It would decrease gradually, settling at about 0% It would gradually settle at about 35% It would stay constant at 39%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts