Question: (Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc. spanning the period 20132016 are found here: Answer the following questions

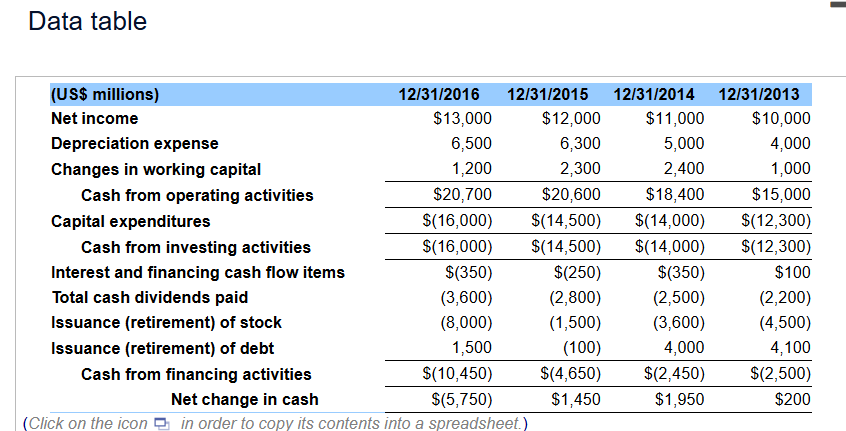

(Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc. spanning the period 20132016 are found here: Answer the following questions using the information found in these statements: a. Did BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over the period? c. Describe BigBox's sources of financing in the financial markets over the period. d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over the period. a. Did BigBox generate positive cash flow from its operations? (Select the best choice below.) A. BigBox has generated positive cash flow from its operations during the years 2013, 2015, and 2016. B. BigBox has generated positive cash flow from its operations during the years 2013, 2014, and 2016. C. BigBox has generated positive cash flow from its operations during the years 2013, 2014, 2015, and 2016. D. BigBox has generated positive cash flow from its operations during the years 2014, 2015, and 2016. b. How much did BigBox invest in new capital expenditures over the period? The amount that BigBox invested in new capital expenditures over the period is $ million. (Round to the nearest integer.) c. Describe BigBox's sources of financing in the financial markets over the period. (Select the best choice below.) A. BigBox's main source of financing in the financial markets over the period was the issuance of debt for the amount of $9,500 million. B. BigBox's main source of financing in the financial markets over the period was the issuance of common stock for the amount of $850 million. C. BigBox's main source of financing in the financial markets over the period was the issuance of debt for the amount of $850 million. D. BigBox's main source of financing in the financial markets over the period was the issuance of common stock for the amount of $17,600 million. (Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc. spanning the period 20132016 are found here: Answer the following questions using the information found in these statements: a. Did BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over the period? c. Describe BigBox's sources of financing in the financial markets over the period. d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over the period. The amount that BigBox invested in new capital expenditures over the period is 9 million. (Round to the nearest integer.) c. Describe BigBox's sources of financing in the financial markets over the period. (Select the best choice below.) A. BigBox's main source of financing in the financial markets over the period was the issuance of debt for the amount of $9,500 million. B. BigBox's main source of financing in the financial markets over the period was the issuance of common stock for the amount of $850 million. C. BigBox's main source of financing in the financial markets over the period was the issuance of debt for the amount of $850 million. D. BigBox's main source of financing in the financial markets over the period was the issuance of common stock for the amount of $17,600 million. internally generated funds. funds. Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts