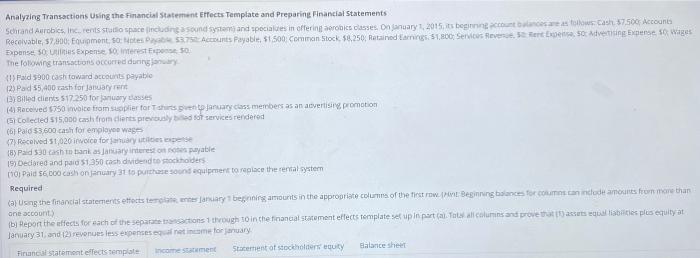

Question: Analyzing Transactions Using the Financial Statement Effects Template and preparing Financial Statements Schand Aurobies, Inc. rents studio space including a sound systems and speciales in

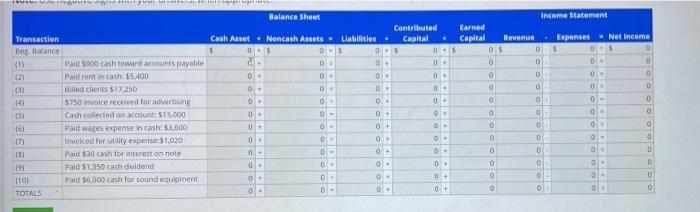

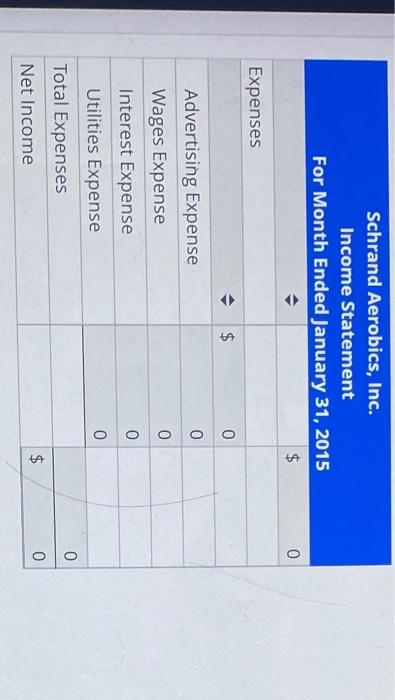

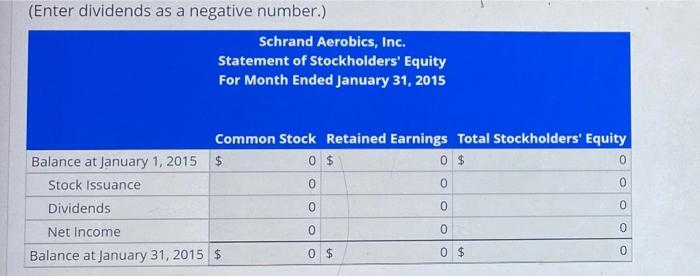

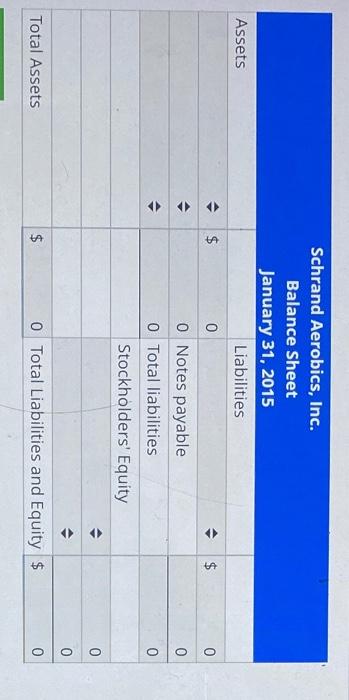

Analyzing Transactions Using the Financial Statement Effects Template and preparing Financial Statements Schand Aurobies, Inc. rents studio space including a sound systems and speciales in offering Serobics classes on january 1, 2015 begining contestellows Cash 57500 Accounts Receivable, 57,800 Eimont sortes 53.75 Accounts Payable, 51 500 Coin Stock 58.250, Ratained in 1,800 Services Reverse en ese se Advertising Eerse sowiges Expenses Us Expense sont Esponse: 50 The following transactions occurred during (1) Paid 5900 cash toward accounts payable 2)Pad 55,400 cash for Januaryrent By Billed clients 517.250 forary asses (4) Receved 5750 invoice from supplier for sign to January class members as an advertise promotion El Colected 515.000 cash from dients preuse of services rendered (6 Paid 53600 cash for employee wag Received 51,020 invoice formuary to desse 18) Pad 530 cash tank as january interest on es payable 191 Dedored and paid $1250 cash divided to stockholders 10Paid Sebo Cash on January 31 to purchase sound equipment to replace the rental system Required (aj Using the financial statements effects termines January beginning amounts in the appropriate colors of the first row. It Beginning ancestor.com.cn indlede amounts for more than one account) (b) Report the effects for each of the separate transactions through 10 in the financial statement effects template set up in part al. Totes all columns and prove that tassuts egta tibicles plus equity at January 31, and 2) revenues less expenses are income for January Firuncal statement effects Template income stament Stacement of stockholes outy Balance sheet Income Statement Earned Capital Revenue Expenses. Net Income 0$ 5 0 0 01- g 0 0 0 0 0- D Balance sheet Contributed Transaction Cash Asset . Noncash Assets - Labilities Capital Bee Balance 1 01 0+ (1) Paco cash toward accounts payable 0 0 (2) Paid rent in cash: $5,400 0 0- 0- 0 (3) illed clients 517.250 D- 0 143 3750 invoice received for advertising 0 0+ 0 15) Cash collected on count: $15.000 0+ 0- 0 + O. 16 Paid wages expense in cost $3,600 0 + 01 0 123 invoiced for utility expense:51,020 0 0 0 18) Paid 530 cash for interest on note 0- 0- 0 + 0+ Paid $1,350 cash dividend 0 0 0+ 0+ 1101 Paid $6,000 cash for sound equipment 0 0 - 0+ TOTALS 0- O + 0 . 0 0 0- D 0 0 0 = D 0 0 D 0 0 - 0 0 0 Schrand Aerobics, Inc. Income Statement For Month Ended January 31, 2015 $ 0 Expenses tA 0 > 0 0 0 Advertising Expense Wages Expense Interest Expense Utilities Expense Total Expenses Net Income 0 0 $ 0 (Enter dividends as a negative number.) Schrand Aerobics, Inc. Statement of Stockholders' Equity For Month Ended January 31, 2015 0 Common Stock Retained Earnings Total Stockholders' Equity Balance at January 1, 2015 $ 0$ 0 $ 0 Stock Issuance 0 0 Dividends 0 0 Net Income 0 0 Balance at January 31, 2015 $ 0 $ 0 $ 0 0 0 Assets Schrand Aerobics, Inc. Balance Sheet January 31, 2015 Liabilities $ 0 o Notes payable 0 Total liabilities Stockholders' Equity $ $ 0 0 0 0 0 Total Assets $ 0 Total Liabilities and Equity $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts