Question: Analyzing Transactions Using the Financial Statement Effects Template and Preparing Financial Statements Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in

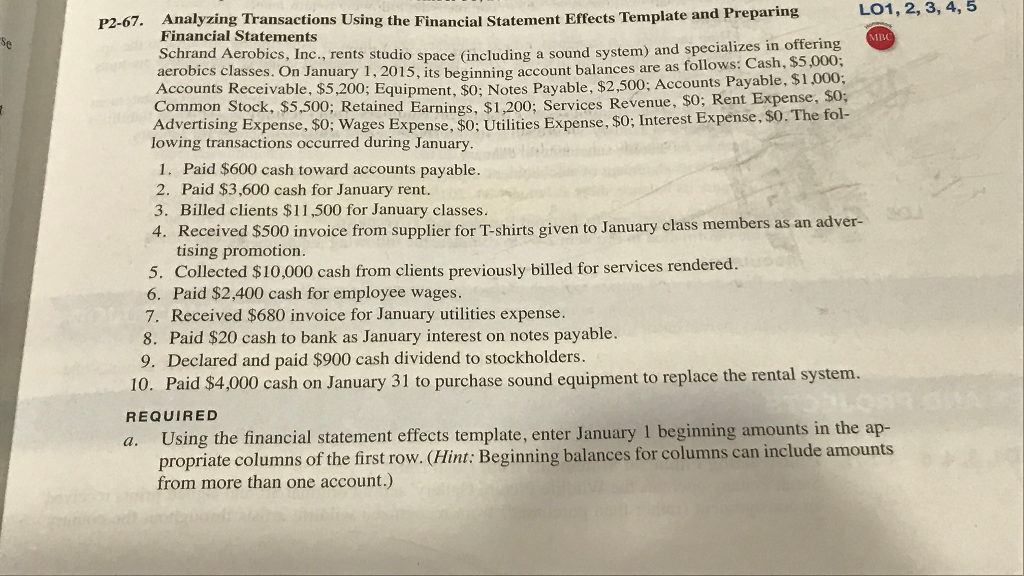

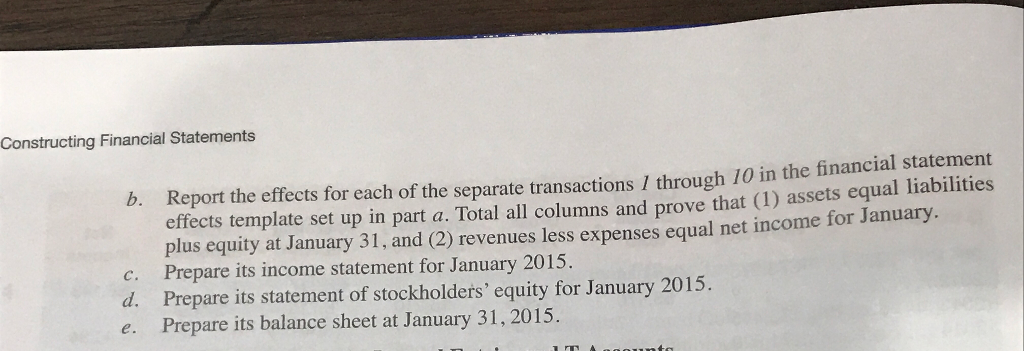

Analyzing Transactions Using the Financial Statement Effects Template and Preparing Financial Statements Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in offering aerobics classes. On January 1, 2015, its beginning account balances are as follows: Cash, $5,000: Accounts Receivable, $5, 200: Equipment, $0: Notes Payable, $2, 500: Accounts Payable, $1,000: Common Stock, $5, 500: Retained Earnings, $1, 200: Services Revenue, $0: Rent Expense, $0: Advertising Expense, $0: Wages Expense, $0: Utilities Expense, $0: Interest Expense, $0. The following transactions occurred during January. 1. Paid $600 cash toward accounts payable. 2. Paid $3, 600 cash for January rent. 3. Billed clients $11, 500 for January classes. 4. Received $500 invoice from supplier for T-shirts given to January class members as an advertising promotion. 5. Collected $10,000 cash from clients previously billed for services rendered. 6. Paid $2, 400 cash for employee wages. 7. Received $680 invoice for January utilities expense. 8. Paid $20 cash to bank as January interest on notes payable. 9. Declared and paid $900 cash dividend to stockholders. 10. Paid $4,000 cash on January 31 to purchase sound equipment to replace the rental system. a. Using the financial statement effects template, enter January 1 beginning amounts in the appropriate columns of the first row

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts